Lars has a great new post on the euro disaster:

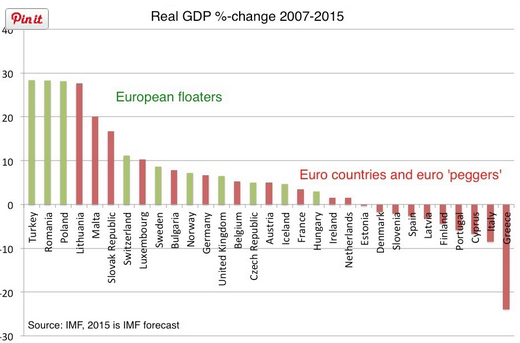

The graph below shows the growth performance for these two groups of European countries in the period from 2007 (the year prior to the crisis hit) to 2015.

The difference is striking – among the 21 euro countries (including the two euro peggers) nearly half (10) of the countries today have lower real GDP levels than in 2007, while all of the floaters today have higher real GDP levels than in 2007.

Even Iceland, which had a major banking collapse in 2008 and the always politically dysfunctionally and highly indebted Hungary (both with floating exchange rates) have outgrown the majority of euro countries (and euro peggers).

In fact these two countries – the two slowest growing floaters – have outgrown the Netherlands, Denmark and Finland – countries which are always seen as examples of reform-oriented countries with über prudent policies and strong external balances and healthy public finances.

When some of the best managed countries in the eurozone can’t even outgrow Iceland, you know that something is very, very wrong.