Here’s Alexander Humboldt:

First they ignore it, then they laugh at it, then they say they knew it all along.

In late 2008, I wrote op eds saying that tight money was driving the US into recession. No newspaper was willing to publish them. Then in early 2009 I started a blog, and people laughed at my claim that money was very tight. “How can that be, with ultra low rates and all the QE.” It was difficult to find anyone who agreed with me—until today. Now it looks to me like Paul Krugman agrees with me. This is from a recent post entitled, “It’s Getting Tighter.”

When thinking about the market madness and its possible real effects, here’s something you — where by “you” I mean the Fed in particular — really, really need to keep in mind: the markets have already, in effect, tightened monetary conditions quite a lot.

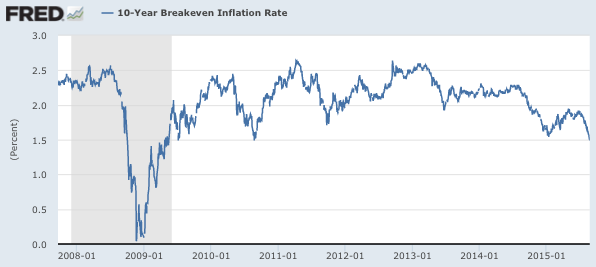

First of all, if break-evens (the difference between interest rates on ordinary bonds and inflation-protected bonds) are any guide, inflation expectations have fallen sharply:

Why only go back to 2011? Let’s see what monetary policy was like in late 2008:

Krugman continues:

Second, while interest rates on Treasuries are down, rates on private securities viewed as even moderately risky are up quite a lot:

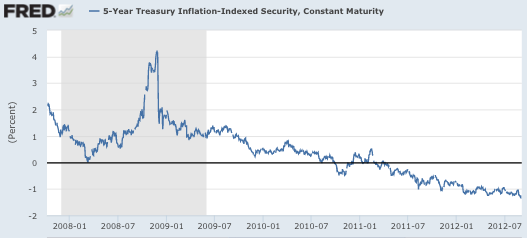

Again, that makes me wonder what real borrowing costs looked like in 2008:

Now you might argue that this isn’t really tight money. Good borrowers could still borrow cheaply in 2008. It was default risk. Nope, good borrowers couldn’t borrow cheaply, as liquidity had dried up. How do we know? While yields on conventional Treasuries fell sharply, the real yield on TIPS soared higher during the second half of 2008. The 5-year TIPS yield soared from 0.57% to over 4%. There is no default risk with TIPS, it was purely a liquidity story. Because of the Fed’s tight money policy, liquidity had dried up:

Just to be clear, real interest rates are not a good indicator of whether money is easy or tight. But the spike in BBB yields was not just a default risk story; it was also a liquidity story.

Just to be clear, real interest rates are not a good indicator of whether money is easy or tight. But the spike in BBB yields was not just a default risk story; it was also a liquidity story.

Over at Econlog I have a post discussing a related issue, could a quarter point interest rate increase later this year do great harm?

I suppose we attach the label ‘crazy’ to people who believe things that are not socially acceptable and seem irrational. Now that a Nobel Prize winner is making similar claims, I guess I can’t claim to be crazy any longer.