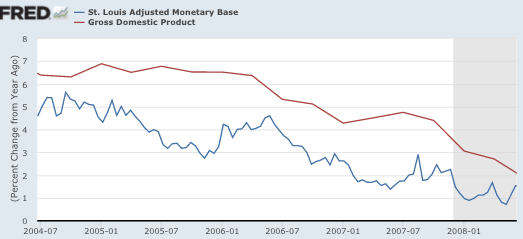

On some days that’s my impression of the economics profession. They’ve made up their minds that the financial crisis (not tight money) caused the recession. When I point to the huge decline in NGDP growth, they insist that’s not monetary policy. They say, “It was a fall in velocity, not tight money.” And yet that’s not true, base velocity was actually rising as the Fed drove the economy into recession. As you can see from the following graph, the Fed gradually squeezed growth in the monetary base, until by early 2008 the year-over-year percentage growth rate of the base had fallen to about 1%. This gradually squeezed year over year NGDP growth, which slowed to 2% by mid-2008 (and much worse later on.)

Just to be clear, I’m not suggesting the monetary base is a good way of thinking about the stance of monetary policy, it’s not. I’m just pointing out that the “concrete steppes” people who insist it’s not the Fed’s fault if V falls, only if the Fed does something concrete with the base, themselves never bother to look for concrete steps. If you tell them that the onset of the recession can easily be accounted for by this concrete action, they’ll still deny the Fed caused the recession. They’ve already made up their minds. Facts simply don’t matter.

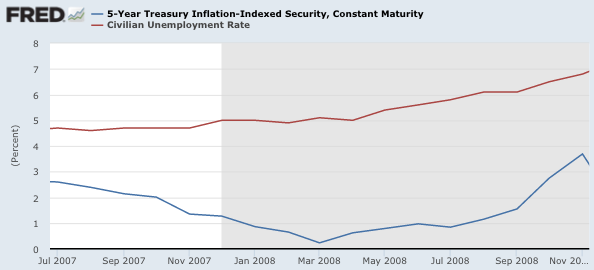

Others will insist that monetary policy is all about interest rates. If you ask “real or nominal” they’ll say real rates. Real rates did fall in the early stages of the recession, as is often the case, but then something really weird happened. Real yields on 5 year TIPS soared between the spring and fall of 2008, as unemployment began to rise sharply. If you point this out, they’ll still deny there was any tight money, because they’ve made up their minds that tight money could not possibly be to blame.

The economics profession considers the Fed to be sort of like the Pope, basically infallible, except for tiny errors induced by data lags. Any shock to AD can’t possible be caused by the Fed, because they fix problems, they don’t cause problems. Here’s James Alexander, posing a question to Tony Yates:

I think Yates’ course might be interesting but would it really help me with my questions.. The blogsphere is alive with debate on them and sometimes academic papers are referred to, but most seem unsatisfactory in one way or another.

Anyway, would they help answer this question: Would you ever create a model that included occasional, but deeply random tightening and loosening of monetary policy by central banks?

To this one he [Yates] answered: “Yes, if you thought central banks faced measurement error in real time, or changes in committee membership that meant changes in the preferences of the median committee voter. Have a look. Large literature on just that.”

I think Yates is expressing the mainstream view. We can draw an AS/AD diagram, and ask our students what would happen to AD if there were an expansionary or contractionary monetary shock. But deep down the profession doesn’t believe those shocks are important. Rather they think there are non-monetary AD shocks, which central banks offset with more or less skill. But surely central banks wouldn’t just create a negative AD shock out of thin air? The ECB wouldn’t just suddenly raise interest rates in July 2008, or April 2011, would they? Bueller, are you paying attention?

This faith in central bankers is what I reject. I see no reason at all to assume that 2007-09 was not a massive negative AD shock, caused by a series of central bank errors of commission and omission. These occur due to a complex mixture of data lag problems (correctly identified by Yates), ignoring market signals, and a deeply flawed model of monetary economics that focuses on growth rates, not levels. All three flaws came together in 2008. First the economy began to slump. That’s the data lag. Then the markets recognized the problem, but the Fed still did not. That’s ignoring market signals (i.e. Sept. 2008). Then when even the Fed realized the problem, they refused to commit to bring NGDP (or even the price level) back up to the previous 5% (or 2%) trend line. Put these three together and you get a massive negative monetary shock and the Great Recession.

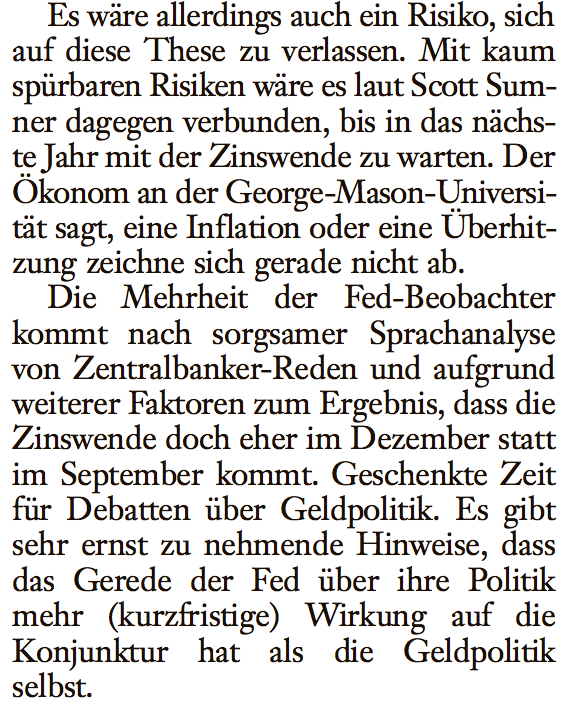

PS. I was recently interviewed by the Frankfurter Allgemeine. Here is an excerpt:

The article is gated, and costs 2 euros. (Most of the article discusses Larry Summers, not me.)