I’ve seen a lot of interpretation of Thursday’s money supply announcement. But it’s important not to overreach, just because we might find a particular theory attractive:

1. The theory needs to be consistent with what we know about past reactions to Fed announcements.

2. The theory needs to be consistent with the timing of the reaction.

3. The theory needs to be consistent with the other market responses.

For instance, some argue that the market responded as if the Fed knew more than they do. But that’s not the reaction we typically observe. Why would that be the case this time, but not other times? On the other hand I see why this theory is attractive, as the secondary (negative) reaction after 2:50 pm. does look like a response to bearish news about the economy—stocks, bond yields and the dollar all fell. But I’m still reluctant to accept that interpretation unless someone can find a plausible explanation as to why the market would believe the Fed knew more this time, but not other times. And also explain what new information about the Fed’s view of the economy came out after 2:50.

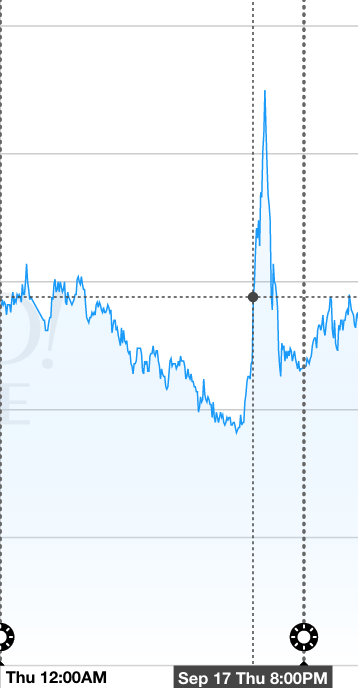

Here’s a graph showing the stock market reaction to the 2pm announcement:

I highlighted 2:35, which is about when the Yellen press conference began. Both the sharp (almost 1%) increase and the even bigger subsequent decline occurred during the press conference. But I have trouble seeing what Yellen said that would have made markets more bullish around 2:40 made more bearish after 2:50. Still, just because I don’t see it, doesn’t mean the market didn’t see something meaningful. Despite my skepticism, I still think Yellen’s comments were the most plausible cause of the market swings.

If you look at the forex markets, you see an interesting pattern. The commodity currencies like the Australian and Canadian dollars rose sharply on the announcement, and then even further when the US stock market rose sharply during the early part of Yellen’s talk. Then both currencies immediately plunged almost all the way back down just a few minutes later, in tandem with the fall in US stocks. Risk on, then off? Here’s the Aussie dollar:

In contrast, currencies like the euro and yen rose sharply and stayed higher for the rest of the day. (Although the euro did fall the next day, but it’s hard to see how that relates to the Fed.)

You might wonder why I don’t just accept:

1. It was already priced in.

But if that were true, why did other markets respond so strongly?

2. The stock market didn’t much care either way.

That’s more plausible. But stocks usually respond strongly to unexpected monetary policy announcements.

3. Yes, the stock market usually cares, but with unemployment at 5.1% the market thought the risks were balanced in this case.

That’s an even better argument (and essentially what Tyler Cowen suggests). But I still have this nagging feeling that stocks would have fallen on a .25% rate increase, partly because in the lead up to the announcement stocks often seemed to swing significantly on news about whether the Fed was going to raise rates—things like statements by key Fed officials.

Here’s an analogy. A few months back US stocks were very volatile during the Greek crisis. Suppose that on Monday the Greek government announced it had printed up currency in secret and was leaving the euro. And suppose the US stock market did not react. Wouldn’t you be surprised, even if you thought there was no valid reason for stocks to respond? Even if you thought the stock market had been foolish to respond to the Greek crisis in July, wouldn’t you expect another response if they actually left the euro?

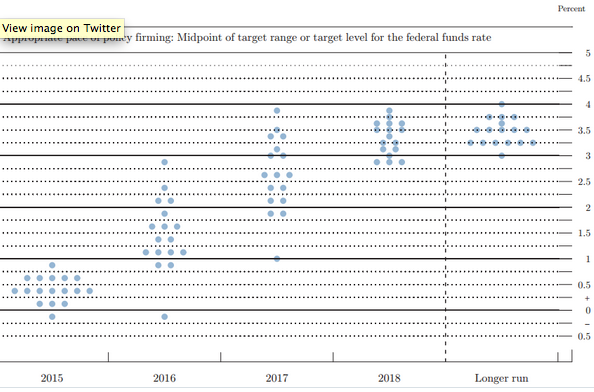

And finally, don’t forget that the other markets did provide useful information. For instance, we know that the TIPS spreads remained quite low, which I believe supports Kocherlakota’s claim that we need a rate cut. People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017. Consider that Japan and probably even the eurozone are still going to be at zero in 2017. How plausible is it that the US has 4% rates when the rest of the developed world is at zero? Especially given that we are growing at just over 2% in a period of rapidly falling unemployment, and the unemployment rate will stop falling by 2017, and hence RGDP growth will slow sharply from the current pathetic levels. We might even have another recession, recall that America has never had an expansion that lasted 10 years.

PS. Frederic Mishkin really hit the nail on the head. I wish he were still on the FOMC.