Here’s an article discussing Bill Gross’s views on monetary policy:

Bond guru Bill Gross, who has long called for the Federal Reserve to raise interest rates, urged the U.S. central bank on Wednesday to “get off zero and get off quick” as zero-bound levels are harming the real economy and destroying insurance company balance sheets and pension funds.

In his October Investment Outlook report, Gross wrote that the Fed, which did not raise its benchmark interest rates at last week’s high-profile policy meeting, should acknowledge the destructive nature of zero percent interest rates over the intermediate and longer term.

“Zero destroys existing business models such as life insurance company balance sheets and pension funds, which in turn are expected to use the proceeds to pay benefits for an aging boomer society,” Gross said. “These assumed liabilities were based on the assumption that a balanced portfolio of stocks and bonds would return 7-8 percent over the long term.”

But with corporate bonds now at 2-3 percent, Gross said it was obvious that to pay for future health, retirement and insurance related benefits, stocks must appreciate by 10 percent a year to meet the targeted assumption. “That, of course, is a stretch of some accountant’s or actuary’s imagination,” he said.

Not only are Bill Gross’s views wrong, they aren’t even defensible. Let’s look at several perspectives:

1. Money is neutral. In that case the Fed can only impact nominal returns. If it wants higher nominal returns then it needs to adopt a more expansionary monetary policy. That’s the opposite of what Gross is proposing.

2. Money is non-neutral. In that case the Fed can raise nominal returns on debt with a tight money policy, but only in the short run. And Gross says the problem is that long-term returns are too low. However to raise them you need to raise NGDP growth, which means easier money. Even worse, a contractionary monetary policy that raises the return on T-bills will reduce the return on stocks.

Why is there so much confusion on this point? Perhaps because people forget that most central bank decisions are endogenous, on any given day or week the Fed usually follows the market. Here’s a perfect example of why people get confused, look at the first paragraph of a recent Reuters article:

Euro zone government bond yields dropped by more than 10 basis points on Friday after the U.S. Federal Reserve prolonged the era of nearly-free money amid concerns about a weak world economy.

Most readers probably think there is a connection between these two events. And there may be one. But it’s not the connection you might assume at first glance. It’s obviously not that case that the Fed deciding to keep rates steady on Wednesday caused eurozone bond yields to fall on Friday. That makes no sense. Instead both the Fed and the bond market are reacting to the same facts—a weakening global economy. People see short and long-term rates rise and fall at about the same time, and draw the erroneous conclusion that Fed policy is causing those changes.

The Fed can’t magically produce strong long run real returns on investment for insurance companies, especially with tight money. That’s far beyond their powers, according to all models I’m aware of (monetarist, Keynesian, Austrian, etc.) If Bill Gross has a new model, I’d love to see it. In the 21st century, insurance companies will have to learn to live with lower returns. They may have to raise the price of insurance. If they lose business, then . . . well, tough luck!

Off topic, Tyler Cowen recently noted that China’s September PMI fell to 47, and then asked:

How quickly do services have to be expanding for the entire Chinese economy to be growing at anything close to six percent?

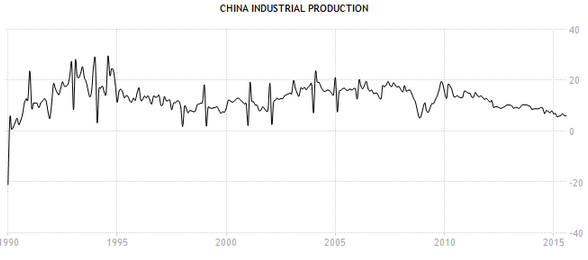

Since I’m on record predicting 6% RGDP growth, I’ll address this question. First we need to determine how fast industrial production is growing. Here’s a graph of the growth rate of IP since 1990:

Other than the post-Tiananmen crash, China’s industrial production has maintained a strong upward trend. However there are three notable slowdowns. The slowdown in the late 1990s was caused by China’s currency being overvalued due to its peg to an appreciating dollar, at the same time the emerging markets were struggling and devaluing, and at the same time the US and Europe were growing. Sound familiar? And notice that the gradually slowdown since 2012 looks a lot like the late 1990s. And then there was a sharp but brief slowdown during the global recession of 2008-09.

The most recent figures show 6.1% growth (YOY) in August, and September may show further deterioration. After than I expect Chinese IP growth to begin recovering, although the YOY figures may worsen for some time.

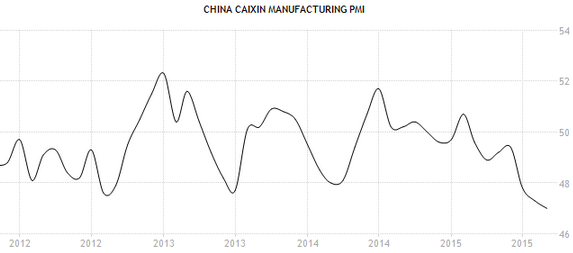

So to answer Tyler’s question, if industry is growing at 6%, then services would also need to be growing at roughly 6%, in order to produce 6% GDP growth. Is it plausible that China’s industrial production could be growing at 6% with such horrible manufacturing PMIs? See for yourself, here’s the PMI index as far back as I could find:

The recent numbers are a bit worse than usual, but as you can see the PMI often dipped to 48, with no obvious ill effects on the China boom. I believe that this time China is slowing a bit more than usual, which explains my bearish forecast of 6% growth in 2016, vs. the consensus of 6.7% by China experts. So like Tyler I’m currently bearish on the Chinese economy, just not as bearish. My bearishness comes from the fact that I believe China experts are underestimating the impact of the strong dollar, which is making China’s currency overvalued.

I’m also more bearish than the Fed on the US economy, for much the same reason.