Real shocks are far, far more important that nominal shocks, for long run growth in living standards. But for the business cycle, and especially for fluctuations in the unemployment rate . . . well, it’s all about the musical chairs model. Here are two more recent examples.

Let’s start with Australia, which has been hammered by a global commodity downturn; especially by falling Chinese imports of iron and coal. In the past when I praised the RBA of Australia for keeping a rising trend of NGDP during the global crisis (after a small blip), people scoffed that the Aussie’s were just lucky. Even then that argument made no sense. Australia has no had a recession since 1991, but in theory a country susceptible to commodity shocks should have more recessions than the US.

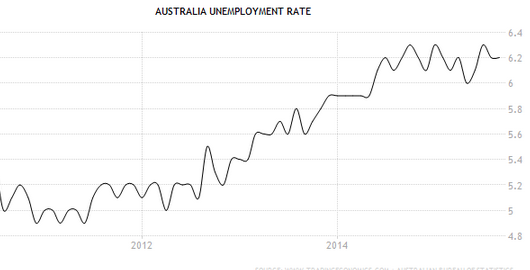

And now the evidence is even weaker. Look at the unemployment rate in Australia since the commodity bust began:

It bounces around, but I see no significant trend. Ironically, Aussie unemployment had a mild upward trend before the commodity bust:

It bounces around, but I see no significant trend. Ironically, Aussie unemployment had a mild upward trend before the commodity bust:

That was probably due to the slower than trend rate of NGDP growth.

That was probably due to the slower than trend rate of NGDP growth.

And then there is Texas. Recall that progressives keep telling us that the Texas miracle is due to oil. Obviously there’s a grain of truth in that. Texas does have lots of shale oil. But so does Europe, and so does California. The difference is that Texas actually believes in producing it. I said a “grain” of truth, because most of the Texas growth is due to other factors. It’s not oil, and it’s not weather (which is actually far worse than many other slower growing states.) It’s good economic policies.

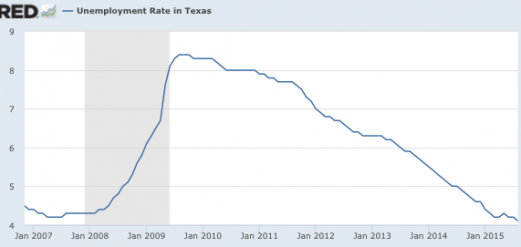

Now that we have had a big oil bust, the progressives were probably expecting a recession to hit Texas. And yet the unemployment figures keep getting better and better:

Notice that between February 2008 and June 2008, Texas unemployment actually rose from 4.3% to 4.7%, despite soaring oil prices. The reason? US NGDP growth was slowing sharply. Then in the second half of 2008, unemployment soared much higher, as NGDP fell (as did oil prices.) Over the past year, the unemployment rate has continued to decline, and is now at 4.1%, just above the all-time record low of 4.0% of late 2000.

Notice that between February 2008 and June 2008, Texas unemployment actually rose from 4.3% to 4.7%, despite soaring oil prices. The reason? US NGDP growth was slowing sharply. Then in the second half of 2008, unemployment soared much higher, as NGDP fell (as did oil prices.) Over the past year, the unemployment rate has continued to decline, and is now at 4.1%, just above the all-time record low of 4.0% of late 2000.

Bottom line: Real shocks, and “reallocations” resulting from real shocks, generally don’t significantly impact the overall unemployment rate. It’s changes in NGDP (monetary policy) that drive the business cycle. On the other hand, real shocks can have a modestly larger impact on Texas RGDP, as the drop in oil output affects RGDP more than employment. It’s a capital intensive industry.