Last year I made a mental note to do occasional updates of Kocherlakota’s 2015 predictions, when he strayed far, far off the reservation:

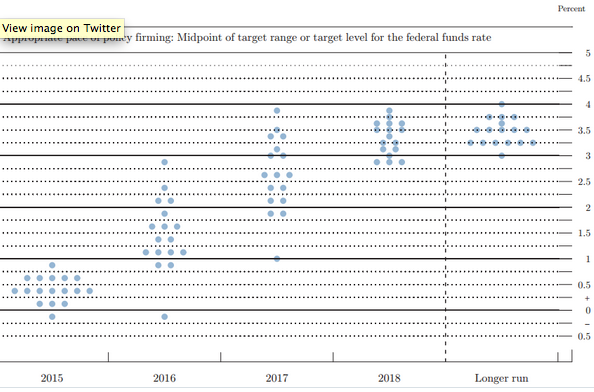

And finally, don’t forget that the other markets did provide useful information. For instance, we know that the TIPS spreads remained quite low, which I believe supports Kocherlakota’s claim that we need a rate cut. People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017.

Here’s the FT today:

A disintegrating oil price, coupled with a round of disappointing data on the US economy on Friday, has pushed back expectations to September of when the Federal Reserve will add to last month’s historic rate rise.

Fed funds futures are on Friday morning pricing a roughly 50-50 chance of US policymakers lifting rates at least once more by the end of September. On Thursday, futures implied even odds of the Fed making its next move as early as June.

Another rate increase would push rates up to 0.625% in September, 2016. The Fed had been forecasting 4 rate increases in 2016, which most MMs thought was unlikely (because the market thought it was unlikely). Kocherlakota was even more bearish than the markets, but they have been moving in his direction so far this year. While it’s much too soon to predict 2017, Kocherlakota must be feeling pretty good about his farewell shot at the Fed establishment.

Oh, and the 10 year yield is back below 2%. Remember all those “experts” that said the Fed’s actions would push up mortgage rates? I guess they don’t read MM blogs.

PS. Kocherlakota reminds me of the little boy at the end of this music video. He realizes that just wishing you can fly, doesn’t make it so.

PPS. Just to be clear, while I predicted things would be worse than the Fed believed, I did not predict they’d be this bad. Some of the other MMs, however, did make this prediction.

PPPS. And how about my claim that raising the policy target rate has the effect of lowering the Wicksellian equilibrium rate, thus giving policymakers less “ammunition”?