The world’s two largest economies are facing a similar problem, a gradual loss of credibility in monetary policy. In China, the exchange rate is artificially fixed at too high a level for macroeconomic stability. The public recognizes this fact, and expects the Chinese government will eventually devalue. Not surprisingly, people are trying to get their money out of China before the devaluation occurs.

The problem in the US is different. Our government does not fix asset prices at non-equilibrium values. The Fed does peg the fed funds rate, but they do so by adjusting monetary policy tools, until the desired fed funds rate becomes the actual fed funds rate. So there is no disequilibrium in the sense of a shortage of fed funds, or a surplus.

But there can ben macroeconomic disequilibrium, if the fed funds rate is pegged at an inappropriate value. In recent weeks, Fed policy has lost credibility. In America this doesn’t show up as capital flight, but rather in terms of asset price movements:

1. The market is increasingly skeptical that the Fed will raise rates 4 times this year.

2. More importantly, the market is increasingly skeptical that the Fed will hit its long-term inflation objective.

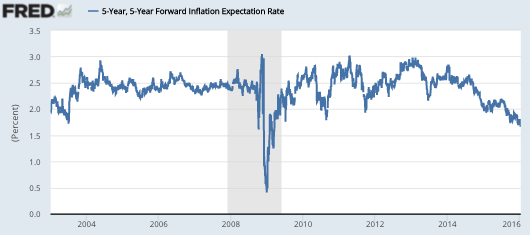

In the past I’ve often discounted the usefulness of TIPS spreads from the 5-year, 5-year forward market. This is the expected inflation rate from 2021 to 2026. The reason I tended to discount this data is that it was being used to claim there was no problem with inflation expectations. But a 2.3% 5-year, 5-year forward TIPS spread is a necessary condition for credibility, not a sufficient condition. Even if the public thinks CPI inflation will eventually return to 2.3% (or 2% PCE inflation), there may be problems with monetary policy over the next 5 years. So my past objections to the 5-year, 5-year forward data was that it ignored the short-term problem of “lowflation” and high unemployment. It was not a sufficient condition for sound policy.

But now the Fed is not even meeting the minimal objective of market confidence that CPI inflation will run about 2.3% in the very long run. Here’s the graph:

It’s even worse than it looks, as the spread has fallen to about 1.58% today, which is consistent with roughly 1.3% PCE inflation. That’s a very low number for 5 to 10 years out, by which time the current problems (strong dollar, falling oil, etc.) should no longer be impacting the inflation rate.

It’s even worse than it looks, as the spread has fallen to about 1.58% today, which is consistent with roughly 1.3% PCE inflation. That’s a very low number for 5 to 10 years out, by which time the current problems (strong dollar, falling oil, etc.) should no longer be impacting the inflation rate.

Now admittedly there is some evidence that TIPS spreads can be distorted at times (as in late 2008), when there is an inflation risk premium in the bond yield. But as Narayana Kocherlakota points out, that doesn’t mean there’s no loss of Fed credibility, just that the loss is spread between growth and inflation:

Let me turn then to the inflation risk premium (which is generally thought to move around a lot more than inflation forecasts). A decline in the inflation risk premium means that investors are demanding less compensation (in terms of yield) for bearing inflation risk. In other words, they increasingly see standard Treasuries as being a better hedge against macroeconomic risks than TIPs.

But Treasuries are only a better hedge than TIPs against macroeconomic risk if inflation turns out to be low when economic activity turns out to be low. This observation is why a decline in the inflation risk premium has information about FOMC credibility. The decline reflects investors’ assigning increasing probability to a scenario in which inflation is low over an extended period at the same time that employment is low – that is, increasing probability to a scenario in which both employment and prices are too low relative to the FOMC’s goals.

. . .

To sum up: we’ve seen a marked decline in the five year-five year forward inflation breakevens since mid-2014. This decline is likely attributable to a simultaneous fall in investors’ forecasts of future inflation and to a fall in the inflation risk premium. My main point is that both of these changes suggest that there has been a decline in the FOMC’s credibility.

Marcus Nunes pointed out that this decline began at roughly the time NGDP growth began slowing, probably linked to tightening monetary policy. I should say that Marcus, James Alexander, Lars Christensen and some other market monetarists have been ahead of me on this issue.

I’m well aware that asset prices bounce around, and that the markets may well recover from this. But what scares me is that current asset prices already reflect the expected Fed response. That 1.3% expected PCE inflation 5 to 10 years out is already pricing in the fact that the Fed will probably respond to this bearish news by raising rates by less than 4 times. To boost PCE inflation up to the target, the Fed would have to do considerably more than the markets currently expect.

Perhaps in the end all will be well, but as of today the Fed has lost credibility on inflation. The case for further Fed rate increases is much, much weaker than even 4 weeks ago.

HT: Julius Probst

PS. TravisV sent me an alternative view, from the Atlanta Fed.