In the early years of the Great Recession, I pointed to Australia as an example of enlightened monetary policy. It hadn’t had a recession in 20 years. NGDP grew at a 6.5% annual rate between 1996 and 2006, and then continued growing at a 6.5% annual rate from 2006 to 2012. Since then Australian NGDP growth has slowed substantially, for a variety of reasons:

1. Population growth has slowed to 1.2%, from a peak of 2.2% in 2008. (It’s actually per capita NGDP that matters)

2. Commodity prices have plunged, leading to a fall in the GDP deflator. (Total labor compensation per capita is probably superior to NGDP in commodity-intensive economies.)

Back in 2009-10, my critics said that Australia was just a lucky country, benefiting from booming commodity exports to China. OK, let’s test that theory. How has Australia done in 2015? Recall that in late 2014 and throughout 2015, global commodity markets plunged due to falling Chinese demand for Australia’s key exports (coal and iron ore), pushing Canada into a sharp slowdown and places like Venezuela into deep depression. Here’s a news report from December 2015:

Australia’s unemployment rate has fallen to 5.8%, the lowest level in 20 months, following the strongest two-month period of jobs growth in 28 years.

Now admittedly the two month data is very noisy, but over the past 12 months the Australian unemployment rate has fallen from 6.4% to 6.0%. So much for the theory that Australia was bailed out by China in 2008-09. What’s the new excuse going to be? If it wasn’t commodities, why did Australia avoid recession in 2008-09?

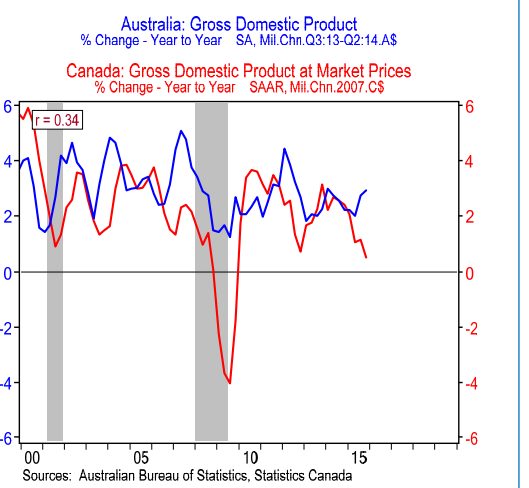

If you don’t like unemployment data, JP Koning sent me a nice graph comparing Australia with its most similar rival—Canada:

Aussie RGDP is up 3% over the past 12 months, whereas Canada is up just 0.5%. And keep in mind that Canada is one of the best run developed economies, with one of the best run central banks—and the Aussies still blew them away. Also recall that Canada’s economy has a larger manufacturing sector than Australia, and is thus less dependent on commodities.

Aussie RGDP is up 3% over the past 12 months, whereas Canada is up just 0.5%. And keep in mind that Canada is one of the best run developed economies, with one of the best run central banks—and the Aussies still blew them away. Also recall that Canada’s economy has a larger manufacturing sector than Australia, and is thus less dependent on commodities.

Recall this anecdote:

Historical rumor has it that a subordinate once asked Napoleon, “What kind of generals do you want?” “I want lucky ones,” he replied.

I say, “Give me a ‘lucky country’s’ central bankers.”

PS. Austrian readers may be interested in knowing that Australia’s monetary policy was much more expansionary than Fed policy during the years leading up to the Great Recession. When will Australia pay the price for all that misallocation? And Australia’s housing bubble was even bigger, but still hasn’t burst. When will the inevitable collapse occur?

And for all you protectionists out there, Australia’s run massive current account deficits for many decades. When I taught there in 1991, the Very Serious People told me that Australia’s day of reckoning was approaching. That was 25 years ago. So just how long can Australia keep selling condos to Chinese investors in exchange for manufactured goods? And why do we call that sort of trade a “deficit”? And just how many empty beaches do they have, where more condos can be built?