One of the most interesting things about the long Japanese deflation was the relative stability of the Japanese yen, against the dollar. It’s depreciated about 1% since the end of 1993:

You’d have expected the Japanese yen to have appreciated strongly in recent decades, as the US price level (GDP deflator) has risen from 73 to 100 since early 1994, while the Japanese price level has fallen from 117 to 100. Thus the ratio of US to Japanese prices has risen from 0.91 to 1.62. And that’s not because I cherry-picked the data, as of a month ago the yen was down about 10% against the dollar, since the end of 1993. Thus the deviation from PPP would have been even bigger.

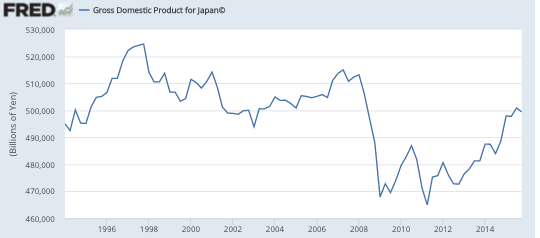

I frequently argue that inflation doesn’t matter, what matters is NGDP growth per capita. Here is the NGDP of Japan since the beginning of 1994:

It’s up about 1%. But Japan’s population is up about 1% or 2%, depending on the source, meaning that NGDP/person is either flat or down 1%.

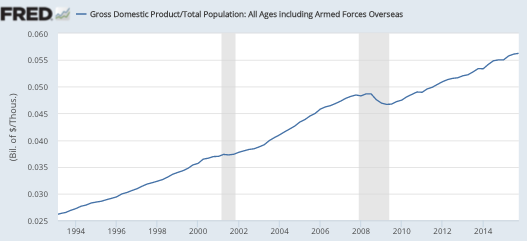

How about in the US? The following graph shows NGDP/person:

So in the US NGDP/person is up about 106.7%, versus at most zero in Japan. You might say that’s comparing apples and oranges, as one is in dollars and the other is in yen. But as we saw the exchange rate is pretty stable since the end of 1993. On the other hand, if PPP does not hold, what difference does that make? RGDP in Japan has been rising, so Japanese living standards are on the way up.

Here’s how I would interpret this data. This is telling us that compared with early 1994, Japanese tourists have become much poorer in a relative sense, every time they visit Hawaii. Relative to American tourists, they have a hard time affording positional goods, like the best hotel rooms.

Just think about the size of this relative impoverishment of Japanese tourists. In PPP terms, Japan’s per capita GDP (World Bank) is $36,412, a normal developed country. What does it mean to lose half your purchasing power? Here are some countries about half as rich as Japan:

Please don’t misunderstand me; I’m not saying that Japan is that poor, the $36,412 figure shows their current PPP income. I’m just trying to give you a sense of how big a drop it is. In fact, at the end of 1993 the yen was quite strong in real terms, so the Japanese seemed rich when they visited Hawaii. But since then, the drop has been precipitous, with Japanese tourists losing over half their purchasing power, relative to Americans.

Please don’t misunderstand me; I’m not saying that Japan is that poor, the $36,412 figure shows their current PPP income. I’m just trying to give you a sense of how big a drop it is. In fact, at the end of 1993 the yen was quite strong in real terms, so the Japanese seemed rich when they visited Hawaii. But since then, the drop has been precipitous, with Japanese tourists losing over half their purchasing power, relative to Americans.

One silver lining is that Japan remains 50% richer than Borat’s home country (Kazakhstan) which has a GDP/person of only $24,228, so I don’t expect to see any Japanese tourists confusing the elevator with their hotel room.

Finally, I get to the point. The PPP theory is pretty elastic, but not infinitely so. The fall in the real value of the yen is probably close to the maximum possible. If Japan were to simply to push the yen back to 125/dollar, and then peg it for several decades, they would likely experience at least as high an inflation rate as the US, probably higher. Because the US is now out of the zero rate trap, I predict our inflation rate will average at least 1.5% over the next few decades. If Japan doesn’t end up with significant inflation, it won’t be because they are unable to do it with monetary policy alone. Rather it would be because they stupidly allowed the yen to appreciate over time. It’s up to them. The US may grouse, but as we showed with the Chinese dollar peg, we are (Thank God!) a paper tiger.

And if I’m wrong, and the real yen exchange rate keeps plunging, then Japanese workers will have Kazakhstani wage by 2040. If those highly productive Japanese workers can’t take market share at Kazakhstani wage levels, then Japan should just fold up shop.