When oil collapsed, Pengrowth (PGH) and Denbury (DNR) deleveraged their balance sheets to outperform peers following a rebound in the broader commodity market.

Figure 1: PGH & DNR Have Lapped Peers Exponentially Since March

Inovio (INO) and Minerva (NERV) reported compelling data in respective unmet disease settings to counter a biotech rout that depressed industry peers.

Figure 2: NERV & INO Outperformed Broader Biotech Market on Progress of Their Science

What oil & gas and biotech can teach us is that opportunity is often borne out of situations that are seemingly out-of-favor or unpopular. We think these select issuers – Pengrowth et al – demonstrate that point and lead us to another:

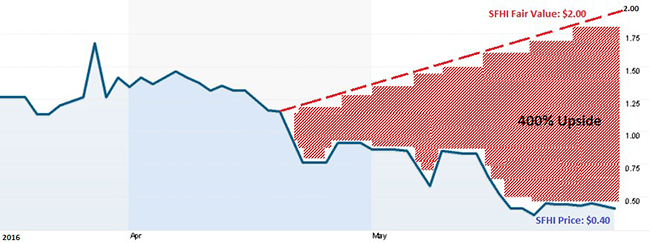

Sports Field Holdings (OTC: SFHI) is building an enviable end-to-end solution for sports stadium design, engineering and construction and have the contracts to prove it. SFHI shares trade at 0.5x forward EV/sales compared to industry peers at 2.2x. We think this makes a clear case for risk-tolerant investors to own SFHI while its shares are ‘out-of-favor’. An adjustment to where its peers are valued would give investors owning SFHI potential upside of 400%.

Investors Miss Forest For The Trees, Creating 400% Arbitrage in SFHI Shares

SFHI is positioned to exceed management’s guidance for $17 Million in sales contracts this fiscal year after contracting for $15.75 Million year-to-date. Underpinning their rapid expansion is a phenomenal win rate suggested by CEO Jeromy Olson on a recent conference call:

“Our win rate of 20% increases to over 40% when [potential] clients visit one of our existing fields.”

The market, however, is missing the forest for the trees with Sports Field’s valuation. SFHI reported Q1 revenues of $0.811 Million due to the company’s revenue recognition accounting policy, in which revenues are recorded when a project is under construction. Projects which have yet to begin construction are not accounted as revenue, even though they are reasonably assured to translate into revenue. The majority of Sports Field’s $15.75 Million contract wins are expected to convert into revenues during the second half of the year, forming a catalyst that could boost top line and buoy SFHI shares.

Figure 3: SFHI Fair Value of $2.00 Presents 400% Upside

Value of SFHI’s $15.75 Million in Sales Contracts Not Reflected in Share Price

Thus far in 2016, Sports Field has been awarded over $15.75 Million in sales contract. This means that over $15.75 Million of business has been won, but due to accounting policies, have not yet been recognized as revenue.

Sales contracts become revenues once construction begins under the percentage-of-completion accounting method. In their quarterly conference call, management stated that summer is the busy period when construction takes place. Due to this, the sales contracts that have been announced so far in 2016 will begin to translate into revenues during the second half of the year, beginning in June. We believe this will boost SFHI’s top line and act as a catalyst.

Figure 4: SFHI Has Fallen Out of Favor Even As Company Announced More Sales Contracts in 2016

SFHI Contracts Sales For 93% of FY 2016 Guidance In Just The First 5 Months. Guidance Beat Looming?

Earlier in the year, Sports Field guided for $17 Million in awarded contracts for Fiscal 2016. The company is well ahead of this guidance as it has announced over $15.75 Million in awarded contracts during the first five months of 2016.

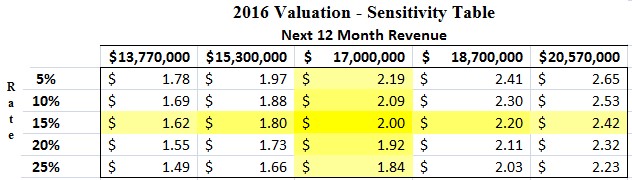

If investors conservatively assume that $17 Million of contracts will convert into revenue during the next 12 months, SFHI shares would be worth $2.00, compared to a recent price of $0.40.

In our model, we assume that $17 Million in contracts are converted into revenue during the next 12 months. We applied a 15% discount rate to account for the risk, eg. execution, and to determine the present value of these future revenues.

A 2.2x EV/sales multiple, derived from construction industry average (described in detail here), was used to compute SFHI’s enterprise value or ‘EV’. Our end result for SFHI fair value was a per share price of $2.00.

Below, a sensitivity table shows fair value for each SFHI share depending on the level of recognized revenue over the next 12 months and discount used to arrive at the present value of those future revenues.

Figure 5: Fair value matrix: recognized revenues over the next twelve months versus discount rate used to arrive at a fair value for SFHI shares, today.

Our assumptions, above, do not incorporate any probability for SFHI significantly exceeding guidance, notwithstanding the fact that the Company has contracted sales for $15.75 Million in less than 5 months after guiding for $17 Million in sales contracts for the full 2016year. We believe Company execution on existing contracts in the busy summer season will give us a reason to revisit this as a probable outcome.

Risks Checked By Signed Contracts

Financing and execution are the two largest risks weighing against potential upside in Sports Field. Execution risk – the possibility that contracts are not executed on – is mitigated by the company’s strategic change to bring their construction management team in-house in order to better handle projects slated for construction. To account for this risk, we applied a 15% discount rate in our valuation model, as discussed above.

Further, Sports Field will be dependent on outside investment until the company reaches profitability to self-sustain operational costs. Although near term dilution is inevitable, the Company has done a stellar job of maintaining the integrity of the capital structure. For instance, the last several million in capital was raised at a price per share significantly above current trading. In their quarterly filing Sports Field said it raised $0.6 Million subsequent to the quarter-end at $1.10/share, 175% higher than current market price. This shows that management has intended to keep existing shareholders’ interests at heart when evaluating terms and pricing on new capital.

2H 2016 Revenues Could Spark SFHI Inflection In Valuation, Share Price

The majority of Sports Field’s $15.75 Million contract wins are expected to convert into revenues during the second half of this year. We believe this will result in a top line surge and form a catalyst that buoys SFHI shares out of their current slump, much like MGT Capital Investments (MGT) experienced in May. Prior to announcing cyber security pioneer John McAfee as their Chairman and CEO, MGT had largely fallen out of favor with investors. Fortunes changed with McAfee’s appointment and the stock rose 7-fold in the last month.

Both biotech and oil & gas issuers, many of whom traded out-of-favor earlier in the year reverted sharply to the upside when demonstrating fundamental execution. Sports Field has captured $15.75 Million in sales contracts, is positioned to capture and perhaps exceed $17 Million in FY2016 and could see upside as those contracts translate to revenues, beginning in June. The upside to execution is SFHI shares trading at or above $2, a potential 400% return from recent market prices.

Key Takeaways:

SFHI is ‘out-of-favor’ with investors notwithstanding $15.75 Million in contracted sales year-to-date compared to Company guidance for $17 Million for 2016

NERV, DNR, MGT clearly demonstrate upside to owning companies that execute notwithstanding out-of-favor circumstances

SFHI is trading at $0.40, but worth $2.00 based on peer EV/sales multiples

Arbitrage opportunity clearly demonstrates 400% in potential upside for SFHI

June 2016 marks a busy revenue-generating period for SFHI, creating a catalyst for ownership

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC (“One Equity”) on behalf of Sports Field Holdings, Inc. (“Company”) as part of research coverage services entered into February 2016. As of the date of this report we have received sixty-two thousand five hundred restricted shares and expect to receive up to twelve thousand dollars per month in addition to sixty-two thousand five hundred restricted shares of the Company on the 180-day, 270-day and 360-day anniversary of our agreement. However, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, One Equity invested into Sports Field Holdings through a 12% convertible note to voice our support and belief in the Company’s growth outlook. The terms of the convertible note are fully described in an 8-K filing with the SEC at https://www.sec.gov/Archives/edgar/data/1539551/000121390016011285/f8k021916_sportfieldhold.htm Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company’s SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/

Related Articles:

Trump to OK TransCanada (TRP) Keystone Pipeline if Elected

This Company Could See Its Valuation Inflect On Hidden Q2 Catalyst

TD Bank (TD), CIBC (CM) Hit 52-week Highs

Royal Bank (RY) Profit Jumps in Q2