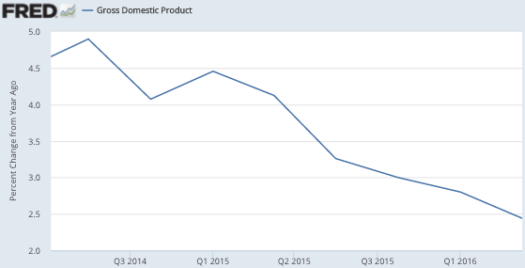

Back in July 2014, I made a prediction that 3% NGDP growth was the new normal, as soon as unemployment fell to the natural rate. At the time, that prediction raised some eyebrows. The 12-month NGDP growth rate was running 4.5% in the second quarter of 2014, and rose to about 4.9% in Q3. The Fed’s estimate of the long-term growth trend was considerably higher than 3%, as were private forecasters. But look what’s happened since:

The NGDP growth rate has fallen below 2.5% over the past 12 months. That’s partly due to the falling oil prices, and I expect inflation to bounce back a bit. But I also expect the unemployment rate to stop falling soon, so I’m sticking with 3%, which looks increasingly likely as a long run NGDP trend.

The NGDP growth rate has fallen below 2.5% over the past 12 months. That’s partly due to the falling oil prices, and I expect inflation to bounce back a bit. But I also expect the unemployment rate to stop falling soon, so I’m sticking with 3%, which looks increasingly likely as a long run NGDP trend.

Here’s what I said in July 2014:

3. The Fed has a big NGDP problem. It’s becoming increasingly clear that when the labor market recovers, RGDP growth will be very slow, maybe 1.2%. Add in about 1.8% on the GDP deflator, and 3% NGDP growth looks like the new normal, assuming the Fed intends to stick with 2% PCE inflation targeting. Bill Woolsey wins!! Here’s the problem. The Fed wants to do both of these things:

a. Continue targeting inflation at 2%.

b. Continuing to use interest rates as the instrument of policy.

But it won’t work. At 3% trend NGDP growth, nominal interest rates will fall to zero in every single recession going forward. The Fed will be spinning their wheels just when monetary stimulus is most needed. At some point they will need a new policy instrument/target. Lars Christensen has a very good post discussing a clever idea by Bennett McCallum, but in my view this idea works better for small countries than for the US, which is likely to follow the global business cycle. NGDP futures anyone? Level targeting?

4. Unemployment is likely to fall to the natural rate (estimated by the Fed at 5.6%) quite quickly. There will be a debate about what to do next. It will be the wrong debate. The debate needs to be about where the Fed wants to go in the long run. First figure out where you want to go in the long run, then adjust your short run policy as needed. Otherwise the blogosphere debate will be like a bunch of drunken frat boys arguing about which street to take, when they can’t even agree on which bar they are going to.

As I expected, unemployment did fall to 5.6% fairly quickly, more rapidly than the Fed predicted. And growth in both nominal and real GDP was slower than the Fed predicted. So how was I able to beat the highly skilled Fed forecasters at their own game?

The answer is simple. Way back in 2011 I noticed that this was a “job-filled non-recovery”, while most pundits were still talking about a jobless recovery. That is, I noticed that RGDP was not recovering as expected, but the unemployment rate was falling rapidly. And this process has continued up until the present. By 2014 I had seen enough to regard this strange pattern as more than a fluke, rather as the new normal. The asset markets (long term bond yields) were clearly signaling more slow NGDP growth ahead. Thus I figured that if the unemployment rate is falling rapidly, and NGDP growth is still only about 4%, you know that when the unemployment rate stops falling, the NGDP growth rate will slow dramatically. And that’s exactly what happened. The trick was to take the data seriously, and not assume we were going to return to some mythical “normal” level of NGDP growth.

Unfortunately, monetary policy remains just as dysfunctional as I feared. The Fed still relies on interest rate adjustments in a world where we are going to be permanently close to zero rates, and at or below zero in every single recession where we need stimulus. They have not adopted any of the new procedures suggested by elite economists (including Bernanke) for such a world, such as a higher inflation target or level targeting. They are very reluctant to admit the obvious; their current policy regime is not working.

And the drunken frat boy metaphor still applies. There are all these meaningless debates about whether to raise interest rates, with no consideration of what sort of NGDP growth rate is appropriate. No debate about level targeting. What are we trying to achieve? As a result, inflation has averaged well below 2% during the period of high unemployment, whereas under the Fed’s dual mandate inflation should average above 2% during slumps, and below 2% during booms. They have things backwards and don’t even seem to realize it.

The Fed has thrown in the towel and admitted that they will not raise rates 4 times this year. (The markets predicted 2 times, which itself may be an overestimate.) How long will it take for the Fed to throw in the towel and admit that under its current operating procedure 3% NGDP growth is the new normal? (Bullard will probably get there first–he has an open mind, and takes the data seriously.) And how long until they realize that this sort of NGDP growth rate makes interest rate targeting almost useless as a monetary policy instrument?

PS. Think about this for a moment—the US real GDP grew about 1.2% over the past year, and the unemployment rate fell. This disconnect between growth and unemployment also explains why I don’t expect the UK unemployment rate to rise very much after Brexit (I predicted a 50 basis point increase.) My hunch is that Brexit will hurt UK GDP more than it hurts their job market.