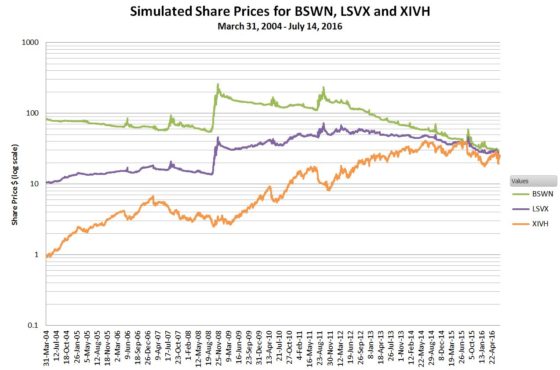

I have generated simulated end-of-day close indicative share values (4:15 PM ET) for VelocityShares’ BSWN, LSVX, and XIVH Exchange Traded Notes (ETNs) from March 31st, 2004 through July 14th, 2016.

- BSWN VelocityShares VIX Tail Risk ETN

- LSVX VelocityShares VIX Variable Long/Short ETN

- XIVH VelocityShares VIX Short Volatility Hedged ETN

These simulated ETN histories are useful if you want to backtest various volatility strategies using these funds starting in 2004. The chart below show the simulated values with a logarithmic vertical axis so that you can see a reasonable amount of information for each fund.

For a description of how these funds work, see this post.

The algorithms for generating these ETN’s values are documented in their combined prospectus and the underlying S&P 500 VIX Futures Long/Short Strategy Index methodology. The short term VIX futures index SPVXSP is used as the base index and all the specific fund indexes are calculated using it. The respective fund underlying indexes are:

| ETN Ticker | Underlying Index |

| BSWN | SPVXTRST |

| LSVX | SPVXVST |

| XIVH | SPVXVHST |

I calculate my version of SPVXSP directly from historic VIX futures settlement data. This futures data is available on this CBOE website—in the form of 100+ separate spreadsheets. To make the calculation of this index tractable I created a master spreadsheet that integrates the futures settlement data into a single sheet. See this post for more information about that spreadsheet.

My simulated values very closely track the published values of the underlying indexes (less than +-0.01% error) from the December 20, 2005 index inception date through the present, so I have very high confidence in the accuracy of these simulations.

These ETN prices reflect the contribution of 91-day treasury bills on their overall performance. Thirteen-week Treasuries annualized yields are running around 0.30% in 2016, but in February 2007 they yielded over 5%— things have changed a bit…

I am making these 3 simulation spreadsheets available for purchase, individually, or as a single spreadsheet with all three funds. These spreadsheets do not include the index calculations themselves. The only formulas included are the ones required to go from the underlying index of each fund (e.g. SPVXVHST for XIVH) to the final ETN values including fees.

In addition to the 1.3% annual fee, these funds charge a “Futures Spread Fee” that can change on a daily basis. There is no historical data available for the fee before the funds’ inception and I have not provided for changing the fee on a daily basis in the spreadsheet. I have made a guess that this fee will effectively add 0.3% to the overall annual fees. This guess can be changed for each fund at an overall level in the spreadsheet, however changing it will require regenerating a “seed” value to re calibrate the simulation to the actual IV levels. Details on how to do that will be included in the readme sheet.

For more information on the spreadsheets see this readme.

If you purchase the spreadsheet you will be directed to PayPal where you can pay via your PayPal account or a credit card. When you successfully complete the PayPal portion you will be shown a “Return to Six Figure Investing” link. Click on this link to reach the page where can download the spreadsheet. Please email me at vh2solutions@gmail.com if you have problems, questions, or requests. It’s easy to miss the “Return to Six Figure Investing” link. If you don’t get it / can’t find it please email me and I will reply with the spreadsheets you purchased attached.