Silver Bullion Market – “Still The Most Bullish Story Ever Told?”

Interview with Ted Butler from SilverSeek.com

Cook: What’s happening in the silver market is hard to understand right now. Can you simplify it for us?

Butler: First you must understand the price of silver is set on the COMEX by two large opposing forces. On the short side are the big banks or traders led by JPMorgan. Four of these big traders are short 72% of the total commercial short position.

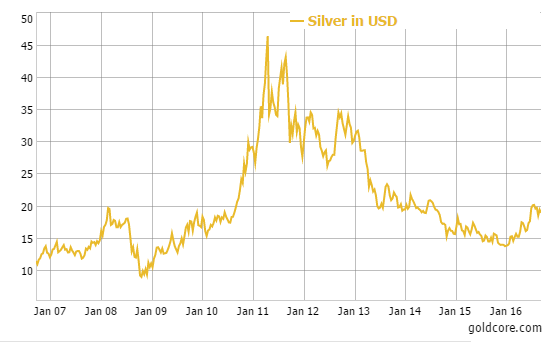

Silver in USD – 10 Years (GoldCore)

Silver in USD – 10 Years (GoldCore)

Cook: Isn’t that highly manipulative?

Butler: Of course, I think it’s grossly illegal, but the regulators sit on their hands.

Cook: Let’s leave that story for another day. Who is on the long side of the silver futures market?

Butler: The technical hedge funds known as the managed-money traders. They are pretty much computer-driven and react to technical trading signs.

Cook: Such as?

Butler: The most important are the 50-day and the 200-day moving averages. When the averages are penetrated by a price move to the upside, they buy. When they are penetrated to the downside, they sell.

Cook: Didn’t we just penetrate the 50-day to the downside?

Butler: Yes, and for the first time ever the tech funds didn’t sell as many contracts as they have sold in the past

Cook: Why not?