Yesterday I described the conditions that render the U.S. ungovernable. Here is a chart of why the U.S. economy will also be ungovernable. Longtime readers are acquainted with the S-curve model of expansion, maturity, stagnation and decline.

This is why the economy will be ungovernable: all the financial gambits that have been played to create the illusion of “prosperity” have reached stagnation/decline.

The key take-away is that the financial gambits–QE, zero interest rates, etc.–did not actually address the economy’s structural problems. All the Federal Reserve and fiscal stimulus policies accomplished was to prop up the corrupt, stagnant engine of debt-serfdom, rising inequality and financial fragility.

All the monetary gambits are versions of trickle-down economics: if we give free money to banks and financiers, this will spur speculation that inflates asset bubbles that generate a wealth effect–households looking at their swelling IRA accounts will feel wealthier and thus more enthused about borrowing and spending money they shouldn’t borrow and spend.

But “trickle down” wealth effects do absolutely nothing to address the structural challenges that are undermining the economy: they do nothing to address the collapse of interest income for the households that save rather than spend, the collapse of low-risk yields for pension funds, the demographic time-bomb of pensions and social welfare programs that are unsustainable, stagnating productivity, the crushing pressure of soaring healthcare costs, and so on.

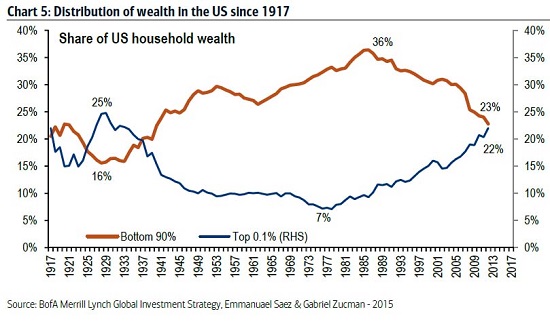

Unfortunately for the Fed, their gambits only benefited the top 5%–the slice of households that owns 70% of the nation’s financial assets. The top .01% that owns 22% of the wealth and most of the political power did even better:

Lowering interest rates to zero simply removed the discipline imposed by interest. With the discipline of interest reduced to near-zero, speculating with leveraged credit make perfect sense–if you’re a financier or corporation with access to the Fed’s free money spigot.

Asset bubbles are no substitute for the expansion of goods, services and wages. Stimulating asset bubbles greatly increases the wealth of those who own the assets, while doing essentially nothing for investment in improving productivity and output of real goods and services.

With productivity stagnant due to under-investment, wages are also stagnant.

The Federal Reserve believes it can govern the economy by tweaking interest rates and bond purchases. The next four years will disabuse us of the illusion that the economy can be governed with monetary policies that have moved from maturity to stagnation and are about to slip into the decline phase: not only will Fed policy not fix what’s broken, it will actively make the structural problems worse.

Join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is #8 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition)For more, please visit the book’s website.