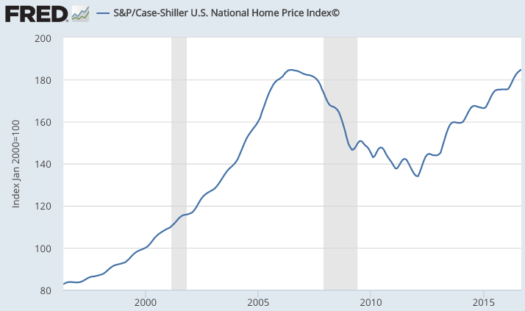

Real house prices are still well below the peak, but nominal prices hit a record high in September:

The 2006 period may have been a bubble, but as of today is seems far less irrational than it seemed in 2012. (This recovery also makes Kevin Erdmann’s arguments look even stronger.)

The world’s full of uncertainty and markets are volatile. Get used to it.

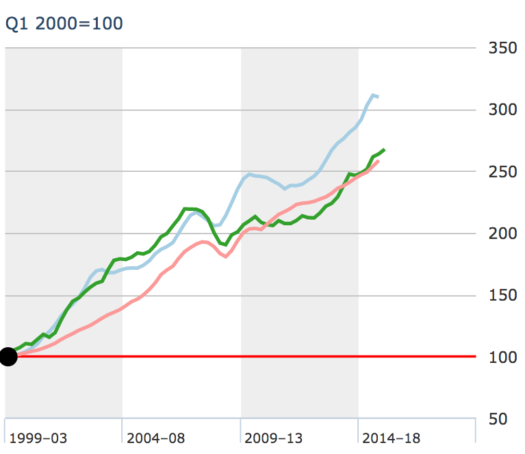

PS. UK house prices (green) took a dip after 2006, but are now well above 2006 levels (and equal to 2006 prices in real terms). Australia (blue) and Canada (pink) are much higher in both real and nominal terms.

What goes up must eventually . . . go up even more!

So the US is down in real terms, the UK is even, and Canada and Australia are up in real terms. Isn’t that sort of consistent with the EMH?

Sure, those prices will dip at some point in the future. That’s what efficient markets do, they go up and down.