Turkey, Gold and US Dollar Hegemony

Introduction

Buy Gold and Lira, Sell Dollars To End “Economic Sabotage” – PM of Turkey

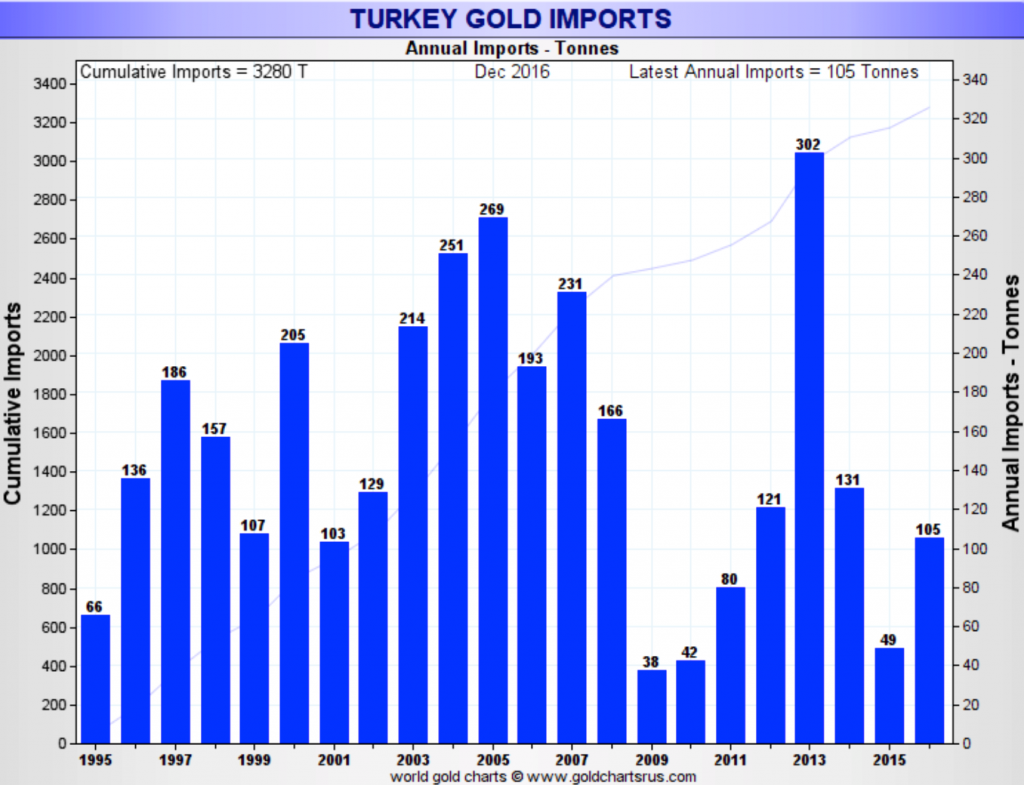

Gold Imports to Turkey Surge 688% In December

‘Tough Turkey’ today

Affinity for gold to save the day?

Central bank gold demand

Personal accumulation

Country’s gold reserves

Turkey Iran gold conduit

Axis of Evil to Axis of Gold

Conclusion: Gold as an insurance policy

Introduction

With a ‘Hard Brexit’ looking more likely and Trump’s inauguration this week, 2017 is well and truly under way.

What we expect the year to hold is probably not even half of what it really will. But from what we know, the upcoming French and German elections, referendums, geopolitical crises, steps towards reverse globalisation and a third of global government debt yielding negative interest rates, governments are already prompting central banks and investors to turn to the one asset that has survived millennia of financial and monetary crises.

One that is highly liquid and convertible into other currencies – gold.

Whilst mining output remains relatively flat and we are at peak gold, Western central banks have stopped gold sales, large emerging market economies continue to increase their gold reserves. China, Russia (both top gold purchasers in 2016) and now Turkey, are the notable players.

Turkey’s President Recep Tayyip Erdogan reminded us of this when he called on his citizens to buy gold:

“Those who keep dollar or Euro currency under their mattresses should come and turn them into Liras or gold.”

This has been met by such support that, not only did Turkish gold imports surge 688% in December, to reach their highest monthly level in two years but, according to Reuters, “fervent supporters have offered free haircuts, fish and even tombstones to those who can prove they have done so.”

As a result, in December 2016 imports reached 36.7 tonnes, significantly more than the 4.65 tonnes seen in the same month in 2015. This accounted for more than one-third of the country’s annual imports of 106.2 tonnes, more than double 48.7 tonnes in 2015.