A media mini-industry touts Scandinavia’s “happiness” as the result of its high-tax, generous welfare state-capitalism. This mini-industry conveniently fails to report the soft underbelly of Scandinavia’s “High-Tax Happy-Capitalism”: The high-tax, generous welfare model is just as dependent on unsustainable credit bubbles as every other version of state-capitalism.

The glossy surface story goes like this: state-capitalism creates a happy, secure society if taxes are high enough to fund generous social welfare benefits for everyone. People are happy to pay the higher taxes because they value the generous benefits they receive.

The story has an implicit message: every state-capitalist society could become happy if only taxes were raised high enough to fund generous social welfare for all. There are many versions of this narrative, for example, the appealing (but financially impractical) “tax the robots” funded Universal Basic Income (UBI) that I have repeatedly debunked.

Put another way: state-managed capitalism works just great if high earners and companies pay high enough taxes to fund a rebalancing of wealth and income via social welfare transfers.

The reality is quite different from this glossy PR narrative. The Scandinavian economies have pursued the same unsustainable debt-bubble “fix” for their structural insolvency as other state-managed nations.

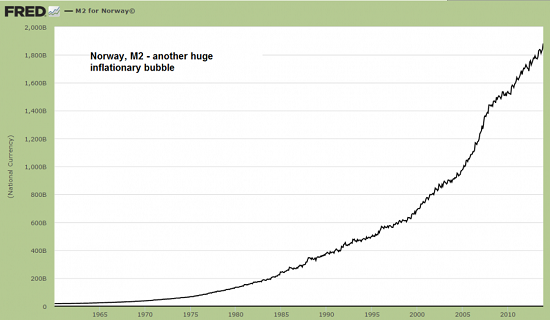

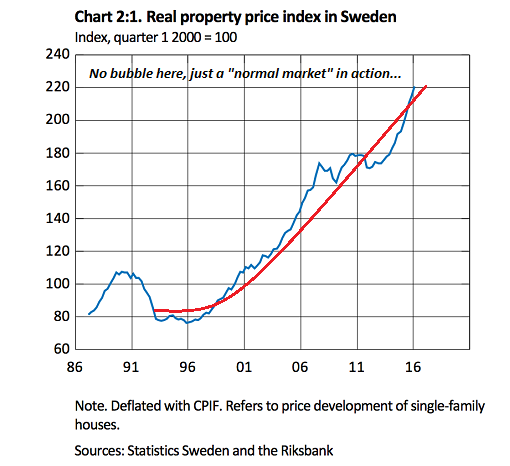

As the charts below reveal, the “happy” Scandinavian nations are now dependent on unprecedented debt/housing bubbles inflated by extreme monetary stimulus. The script is the same as in every other monetary “experiment” intended to create the illusion of solvency in an insolvent system: lower interest rates to zero (or below-zero if you’re really desperate), juice the financial system with liquidity/ easy credit, and base your measures of financial “health” on housing bubbles and other debt-based gimmicks. (Charts courtesy of the Acting Man blog)

Also left unmentioned is the Scandinavian reliance on export sectors for national income. This is of course the German model: make your money exporting to other nations that are over-borrowing to fund consumption.

So what happens when consumption in the importing nations crashes when debt bubbles pop? The economies of the export-dependent nations also implode. This is the inconvenient consequence of having an export-dependent economy.

Also left unsaid is the imperialist wealth amassed by the mini-empires of Denmark and Sweden. Denmark and Sweden had smaller but no less imperialist interests as the larger imperial powers, and ownership of foreign assets remains a hidden mainstay of their national incomes.

Put another way: if you want to be rich, start out rich.

Norway is a special case in two ways. Norway only won its full political independence from Denmark and then Sweden in 1905. Its current wealth is the direct result of a depleting resource: North Sea oil and gas. While Norway has amassed a large sovereign-wealth fund, it has already started to draw upon this fund.

The fund is of course largely invested in the usual debt-bubble-dependent “assets” that are doomed to implode along with the fiat currencies they prop up.

Does this explosion in Norway’s M2 money supply look healthy or sustainable to you? If so–what are you high on?

Does Sweden’s insane real estate bubble look healthy or sustainable to you? If so–what are you high on?

Does Denmark’s unprecedented levels of household debt look healthy or sustainable to you? If so–what are you high on?

Take away these unsustainable bubbles, and how “happy” will these economies (or their suddenly impoverished residents) be? Central planning based on central-bank inflated debt-asset bubbles works until it doesn’t. The day of reckoning draws ever nearer in every economy that’s created the illusion of solvency with debt/asset bubbles and export-dependent economies.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.