Lars Christensen has a new newsletter called the Global Monetary Conditions Monitor, which I highly recommend for people interested in international monetary policy. It is by subscription at this link, but Lars is allowing me to quote from the newsletter. (There is a discount for academic users and think tanks.)

Lars has constructed a monetary conditions index for a wide range of currencies. This basically measures whether the current stance of monetary policy is too easy or too tight to hit the target. (A value of zero means right on target.)

On pages 8 and 9 of the May issue there is a discussion of policy credibility:

The approach here is to evaluate a central bank’s credibility based on our monetary conditions indicators.

We consider a central bank to be credible if it succeeds over time in keeping the monetary indicator close to zero. This can be measured by how long each central bank keeps the indicator within a range between -0.25 and 0.25 over a rolling five year period. This also means a central bank’s credibility can and will change over time.

By this criterion, the central bank of New Zealand has the highest credibility:

This can be illustrated by looking at developments in New Zealand over the past five years.

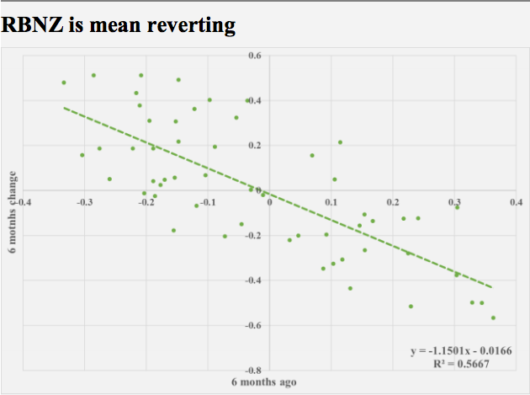

If monetary policy is (highly) credible, we would expect monetary conditions to be ‘mean-reverting’ – meaning that if the monetary conditions indicator is above (below) zero, we should expect it to decline (increase) in the subsequent period.

This is precisely the case for New Zealand. The graph below shows monetary conditions in New Zealand six months ago and how they changed over the following six months.

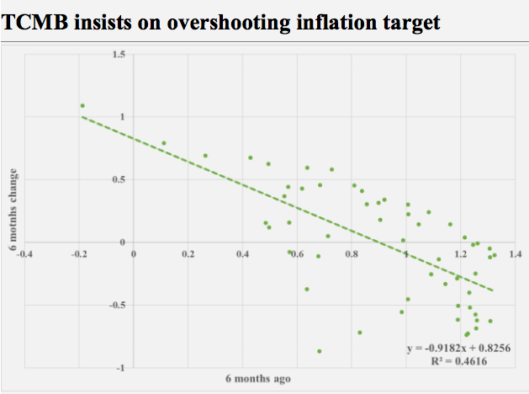

The line should go through zero, with most of the points being in the upper left and lower right quadrants. To give you a sense of what a lack of credibility looks like—consider Turkey, one of the least credible central banks:

The line should go through zero, with most of the points being in the upper left and lower right quadrants. To give you a sense of what a lack of credibility looks like—consider Turkey, one of the least credible central banks:

Maybe Lars will eventually incorporate the Hypermind NGDP forecast into his analysis.

Maybe Lars will eventually incorporate the Hypermind NGDP forecast into his analysis.