Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan? Looting, pillage, rapacious, exploitive, only saved from collapse by massive intervention by the Federal Reserve, the source of rising wealth inequality, crony capitalism, privatized profits-socialized losses, low interest rates = gift from savers to banks, bloviating overpaid C.E.O., propaganda favoring the financial elite, tool of the top .01%, destroyer of democracy, financial fraud goes unpunished, free money for financiers, debt-serfdom, produces nothing of value to society or the bottom 99.5%.

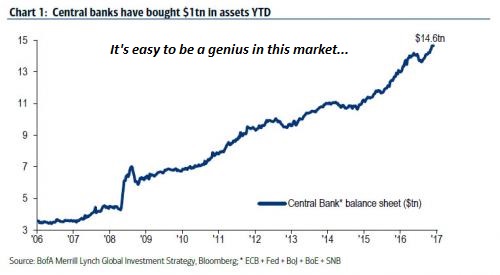

Jamie, if you answered “all of them,” you’re correct. The only reason you have a soapbox from which you can bloviate is the central bank (Federal Reserve) saved you and your neofeudal looting machine (bank) from well-deserved oblivion in 2008-09, and the unprecedented, co-ordinated campaign by global central banks to buy trillions of dollars of bonds and stocks.

Central Banks Have Purchased $2 Trillion In Assets In 2017

This 8-year long central bank intervention has:

1) transferred billions in what were once interest payments earned by savers and pension funds to banks such as J.P. Morgan

2) boosted your sales by flooding the financial system with low-cost credit

3) lifted your stock far above its value in an unmanipulated market and thus

4) awarded you immense stock-option and bonus-based wealth for doing nothing but letting the central banks enrich J.P. Morgan and its peers.

In other words, your claim of “financial genius” is based solely on central bank intervention. J.P Morgan would have done very well in the past eight years if they’d replaced you with a crash-test dummy. In fact, the shareholders would have done much, much better if the crash-test dummy had a Post-It note on its chest reading “buy bitcoin.”

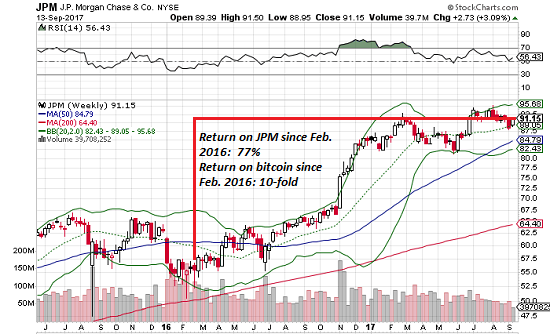

Compare the return for an investor who believed your shuck-and-jive claim to “financial genius” and “bought the dip” in J.P. Morgan stock (JPM) at $57 in early February 2016 and the investor who bought bitcoin (BTC) at $376 at the same time.

The buyer of JPM has certainly done well, earning a return of around 77% over the 19 months (JPM has risen from $57 to $91, a gain of $44, not counting dividends), but the buyer of bitcoin has earned a more than 10-fold increase, gaining $3,525 per bitcoin at the current price around $3,900. (A few weeks ago, the owner of BTC could have skimmed an additional $1,000 per coin.)

The buyer of 1,000 shares of JPM for $57,000 gained $44,000 plus dividends, yielding a total of around $93,000, while the buyer of $57,000 worth of bitcoin at $376 (roughly 150 BTC) gained $528,000 and has a total of $585,000.

The buyer of JPM could sell his shares, pay the capital gains tax and buy a modest mid-sized car with the gains. The buyer of bitcoin could sell his bitcoins, pay the capital gains tax and buy a very nice house or flat in all but the most over-valued markets with his gain, and buy a brand-new vehicle with whatever cash is left.

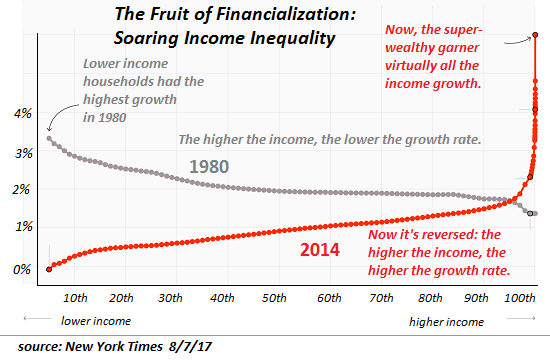

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%: an economy undermined by a vast and widening gulf between the Jamie Dimons (crony-capitalist toadies) and everyone else.

Dear Jamie: if you want us to listen to your incoherent ranting about bitcoin as “financial genius,” first predict the timing of the crash that takes down your parasitic bank. If you pull that off with amazing accuracy, then maybe we’ll pay attention to your “prediction” about bitcoin.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.