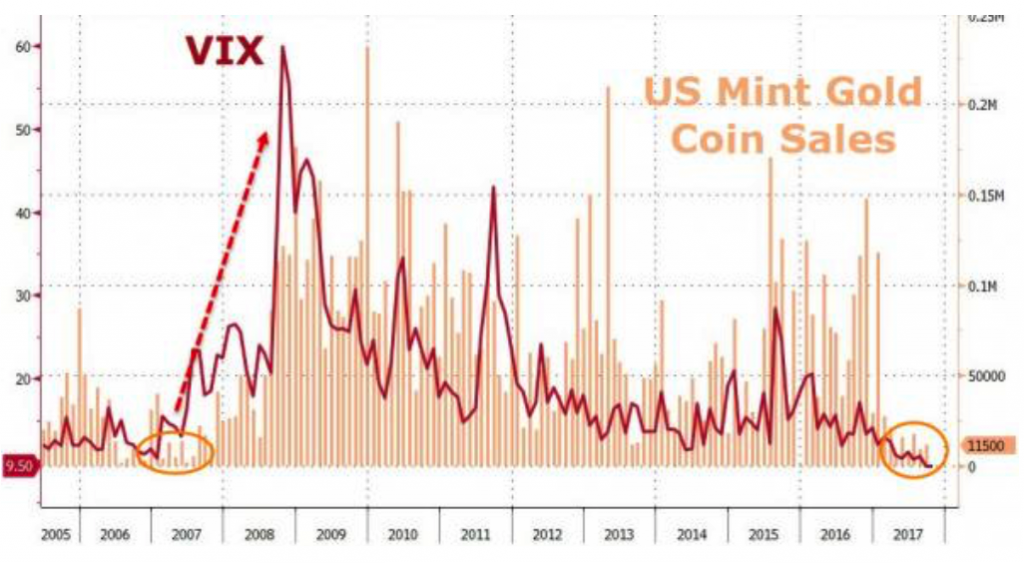

– US Mint gold coin sales and VIX at weakest in a decade

– Very low gold coin sales and VIX signal volatility coming

– Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week

– U.S. Mint sales do not provide the full picture of robust global gold demand

– Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe

– Middle East demand likely high given geopolitical risks

– Iran seeing increased gold demand and Iran’s gold coin price up by 5%

– Trump’s war mongering could see demand accelerate

– Germany seeing very robust demand and now world’s largest gold buyer

Editor: Mark O’Byrne

US Mint coin sales fell to a decade low last month. This follows poor sales since the beginning of 2017. In the third quarter sales reached nearly 3.7 million ounces. September gold coin sales were down a whopping 88% compared to the same period last year.

Year to date sales at 232,000 ounces are 66.5% lower than the 692,500 ounces delivered during the first nine months of 2016, according to the U.S. Mint.

American Eagle gold coin sales did see a slight uptick in demand from very low levels and increased by 11,500 ounces in September which was up by 21.1% in August.

Is this pick-up in US coin demand a sign of things turning around? Perhaps, but we believe the low coin sales this year might say something else about the wider economy. It is also important to look at gold coin and bar sales across the globe to get a better feel for actual demand.

Click here to read full story on GoldCore.com.

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.