– Bank of England raised interest rates for the first time in ten years

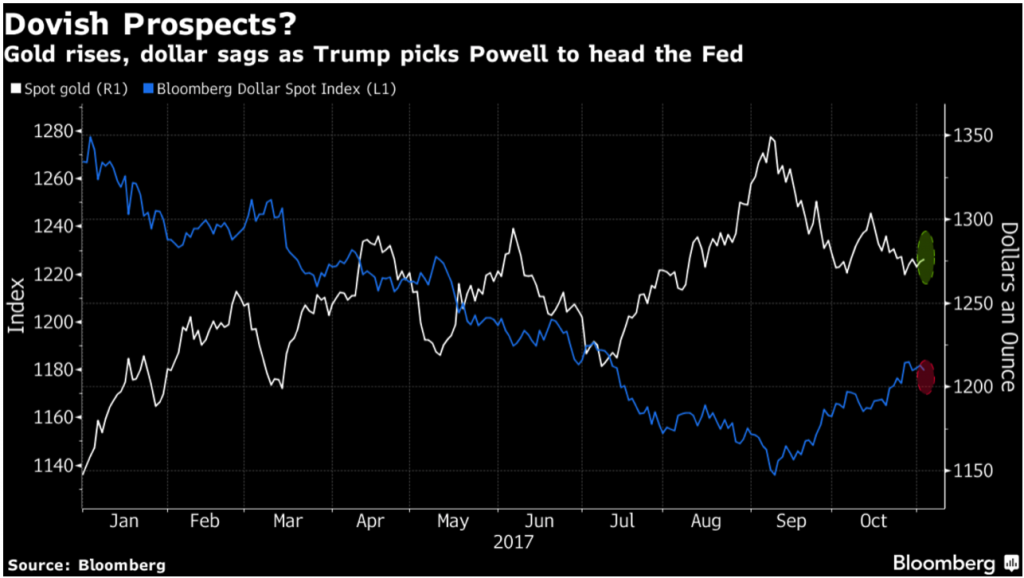

– President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve

– Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news

– Inflation now at five-year high of 3%

– Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners

This week has been a significant week for central banks. The Bank of England raised interest rates for the first time in ten years, the Federal Reserve indicated that a December rate hike may happen and President Trump named Powell as his choice for leader of the Federal Reserve.

Gold reacted positively to Trump’s announcement as markets see little change ahead with a Powell-led Federal Reserve.

The interest rate decision is arguably the most interesting at present. Announcements on both sides of the pond suggest that the age of easy money is coming to an end, albeit slowly.

Since the financial crisis central banks have flooded markets with easy money, kept interest rates near zero and bought trillions of dollars in government and corporate bonds. Now most central banks (excluding Japan) have indicated that the party must soon stop.

The problem is, no one is sure how economies will cope when the moreish juice of central bank assistance will be taken away. None of the financial centres have managed to meet inflation targets which they were all so vocal about. Instead, they are suddenly aware that the encouraged financial excesses of the last ten years may well lead to another crash and something must be done to curb their enthusiasm.

Click here to read full story on GoldCore.com.

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.