Since my previous post was a bit of a fiasco (I seem to have mixed up Canada and the UK on the mortgage interest deduction), let me set this up as a question, so I don’t have two stupid posts in a row. Here’s today FT:

Republicans’ proposal to slash corporate tax rate to 20 per cent helped spur a rally in Treasuries last week. The expectation was that lower corporate taxes would jolt economic growth and prompt policymakers to step up the pace of their monetary tightening.

But the Senate’s proposal to delay a headline corporate tax cut until 2019 appeared to be driving a reversal in the rally on Friday.

I’m doubly confused. First of all, when something like economic growth (or inflation) causes interest rates to change, it’s not because it causes policymakers to adjust monetary policy. Economic growth, inflation, and other macro variables have a direct impact on interest rates. They would cause a change in interest rates even if the Fed did not exist, and indeed did cause changes in interest rates before the Fed was created (in 1913.)

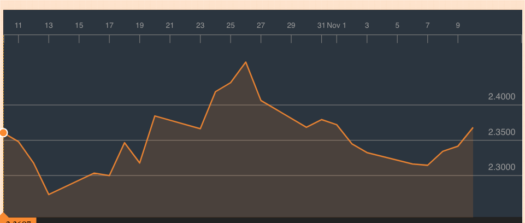

But that’s not my main source of confusion. Reading this piece I couldn’t tell whether the FT was talking about bond prices or bond yields. I had to check the bond yield graph to figure out that it had to be bond prices, as yields fell last week and rose today:

So bond prices rose last week and fell today, as yields and prices move in the opposite direction. Just as they said. But then I don’t get the FT claim that Treasuries (prices) rallied last week on expectations of faster economic growth. Am I having my second brain freeze in a row? Am I just as mixed up as my undergraduate students occasionally were at Bentley?

So bond prices rose last week and fell today, as yields and prices move in the opposite direction. Just as they said. But then I don’t get the FT claim that Treasuries (prices) rallied last week on expectations of faster economic growth. Am I having my second brain freeze in a row? Am I just as mixed up as my undergraduate students occasionally were at Bentley?