In 2016, conservative commentators told us that Trump was doing well because the economy was performing so poorly, especially for average Americans. Trump said the same thing, using terms like “American carnage” in his inaugural address. Now we are told that the economy is doing well. Here’s Jim Geraghty of the National Review:

If the economy is still humming like this in November, and incumbent Republicans perform badly in the midterms, it will blow up the conventional political wisdom of, “it’s the economy, stupid.” Those of us who are not fans of the daily drama and perpetual controversies of this White House will have evidence to support the argument that Trump’s tweets and tirades are not just silly distractions; they’re enough to counteract what would be a key political strength for most administrations.

And of course Trump engaged in his usual hyperbole in his recent State of the Union.

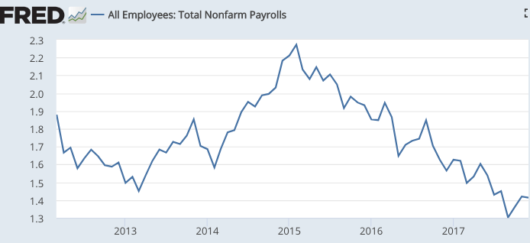

I’m going to try to bend over backwards to be fair to both sides. I think you can make a reasonable argument for each of the assertions made above, for 2016 and 2017. What you cannot do is simultaneously claim that both assertions are true. After all, jobs were the key issue that people used in 2016, when describing the plight of average Americans. And job growth in 2017 actually reached the lowest levels in years (the graph shows year over year percentage change in payroll employment):

That’s not a bad performance, just no sign that the jobs crisis we were told about in 2016 has been solved. Remember when Trump said the “true” unemployment rate was anywhere from 20% to 40%? His supporters can’t now claim that job growth slowed in 2017 because we are running out of workers.

That’s not a bad performance, just no sign that the jobs crisis we were told about in 2016 has been solved. Remember when Trump said the “true” unemployment rate was anywhere from 20% to 40%? His supporters can’t now claim that job growth slowed in 2017 because we are running out of workers.

Inevitably, some commenters will misread this post. They’ll accuse me of saying the economy is not doing very well, even though I never said the economy is not doing very well.

Or they’ll cherry pick other indicators. Some, such as stock prices, are of no relevance to this post. Stocks did extremely well under Obama, and obviously were not a part of the economic “carnage” that Trump referred to in January of last year. Some will point to other indicators. But for every indicator that’s gotten modestly better in 2017 (RGDP) you can find another that’s gotten modestly worse (from a Trumpian perspective):

That means that the final 2017 U.S. deficit with China/HKG may be up 17%-18% from the $280 billion consolidated China/HKG deficit recorded for 2016.

If you believe the Autor, Dorn and Hanson study of the impact of China trade, (or perhaps I should say how it’s been interpreted, their claims are more nuanced); this is really bad news for the US economy, and especially for the blue collar Trump voters. As Forbes correctly notes, however, our ballooning trade deficit with China is actually good news for the US economy (and, I would add, even for Trump voters.) Another way of putting it is that the entire Trump campaign was built on misinformation, and that’s really, really good news. (And I’m not going to exempt the conservative intellectual establishment (especially non-economist intellectuals), which to some extent bought into the claims that trade was hurting average Americans.) So which is it? Is the trade deficit with China a big problem? Or is the economy doing better? Trump would say both, but you can’t have it both ways.

I think people need to stand back and look at things objectively, the view from 30,000 feet. When you do so you see an economy that is gradually growing, a bit better than in 2016 (in my view due to better public policies), but not dramatically different from what was occurring during recent years.

Why does this matter? After all, everyone entitled to describe the economy any way they wish. The problem occurs when you start to make inferences about things like the midterm elections. Notice that Geraghty suggests that if the economy is the deciding issue, the GOP should do well in 2018. But if that were the case then the Democrats should have done well in 2016. His post is written as if the stuff that Trump says, or that gets reported on Fox News, is actually true. But it’s not true. The economy is not that much different from a year ago.

PS. The problem of bias reminds me of a wonderful Eliezer Yudkowsky post of fairness:

The notion that you can “be fair to one side but not the other”, that what’s called “fairness” is a kind of favor you do for people you like, says that even the *instinctive* sense people had of law-as-game-theory is being lost in the modern memetic collapse. People are being exposed to so many social-media-viral depictions of the Other Side defecting, and viewpoints exclusively from Our Side without any leavening of any other viewpoint that might ask for a game-theoretic compromise, that they’re losing the ability to appreciate the kind of anecdotes they used to tell in ancient China.

Unfortunately, the post is hard to excerpt–you really need to read the whole thing.

PPS. Hypermind is currently forecasting 4.6% NGDP growth from 2017:Q1 to 2018:Q1. If my math is correct, that implies about a 4% annualized growth rate in the first quarter of 2018. The implied RGDP forecast is probably about 2%, or a bit higher. The Blue Chip consensus has first quarter RGDP growth coming in around 2.6%. But the Atlanta Fed is forecasting 5.4% RGDP growth in Q1. It will be an interesting quarter to watch.

HT: Craig Fratrik