Nine years ago I did a post discussing how the CPI was distorted by mis-measurement of housing prices:

Good News! There was no housing crash.

At least according to the US government.

The BLS claims that housing prices are up 2.1% in the last 12 months. Why does this matter? For all sorts or reasons, but first let’s try to figure out what really happened. According to the BLS, housing makes up nearly 40% of the core basket of goods and services.

Category weight inflation

Housing 39 % 2.1%

Other 61% 1.4%

Overall 100% 1.7%

Suppose that instead of rising 2.1%, housing costs have actually fallen 2.1% over the past 12 months? In that case the core rate would be zero. Which number seems more likely? For much of the past year house prices have been falling at more than 2% a month.

Bloomberg reports a new academic study that reached similar conclusions:

New research shows that the CPI is slow to reflect changes in prices—and, equally important, understates the degree to which prices move up and down. The problem stems from the way the government calculates the price of shelter, a category that makes up one-third of the index.

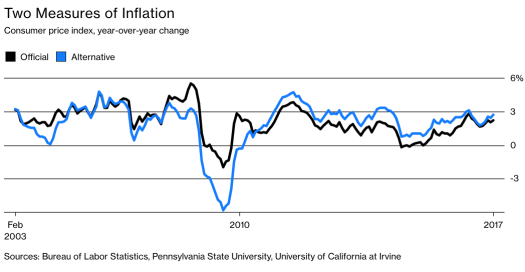

Three economists have developed an alternative measure that captures price moves as soon as they occur and shows the full range of changes. If it had existed in 2008-09, when the economy was in the deepest recession since the Great Depression, it would have shown far deeper deflation than the Bureau of Labor Statistics registered. The official CPI, they write in a new paper, was overstating inflation by 1.7 percentage points to 4.2 percentage points annually during the Great Recession. More recently, they write, the problem has been the opposite: Annual readings have understated inflation by 0.3 to 0.9 percentage points. Those are huge disparities given that forecasters make a big deal of fluctuations of just one or two tenths of a percentage point in the official rate.

Here’s a graph that shows how big a difference it makes:

That correction is actually a bit larger than even I would have expected. But even if their method is not perfect, I have little doubt that the basic point is correct; the CPI is less volatile than an alternative price index that reflects actual market prices in the economy.

The problem they point to is similar to the one I mentioned back in 2009. The BLS uses rent payments on existing contracts that do not reflect the market rent on apartments currently on the market. During a slump, it’s not unusual for a new tenant to get one or two months free rent:

The economists behind it are Brent Ambrose and Jiro Yoshida of Pennsylvania State University’s Smeal College of Business and Edward Coulson of the Merage School of Business at the University of California at Irvine. Their latest version is described in an April 20 academic paper titled “Housing Rents and Inflation Rates.” The key difference from the CPI is that their measure factors in only new rental leases, including those of new tenants and old ones who recently renewed. The BLS, in contrast, also includes rent paid by tenants whose leases weren’t up for renewal in the latest month, which means it’s slower to pick up on changes in market conditions.

Kudos to Ambrose, Yoshida and Coulson for putting a spotlight on a very important flaw in the CPI, which many professional economists use too uncritically.