I’ve recently been asked about why I don’t put more weight on the TIPS spread, as compared to 3 to 5 years ago. I still consider the TIPS spread a useful indicator, but there are a bunch of reasons why I talk about it less frequently:

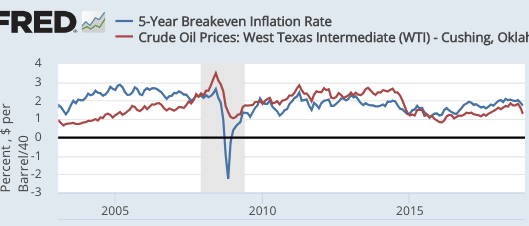

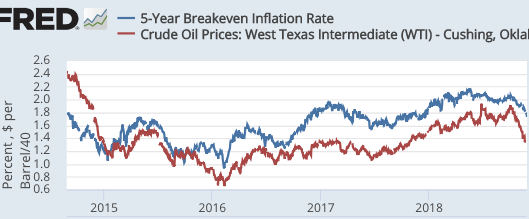

1. The TIPS spread does have a few biases, which need to be taken into account. One is the lag in the adjustment of inflation-indexed bonds to CPI inflation. In the short run, fluctuations in CPI inflation are caused by oil price fluctuations. This causes the TIPS spread to change in the same direction as the level of oil prices, without changing the actual expected rate of inflation at all. It’s an artifact of the lags, and this phenomenon has recently depressed the spread.

2. I’ve known about the preceding issue for quite some time, and always took it into account when making comments. But I’ve more recently become convinced that the risk premium is also an issue. It seems likely that the TIPS spread slightly understates the expected rate of CPI inflation, due to the fact that conventional bonds are viewed as more liquid, and thus offer a slighter lower expected yield. I don’t think this is a big issue, but it might bias the result by a couple tenths of a percent.

3. On the other hand, the Fed is targeting PCE inflation, which runs about 0.3% below the CPI inflation used to adjust TIPS returns. So the biases cut both ways.

A few years ago the problem with monetary policy was obvious. Actual PCE inflation had been running substantially below target, and the TIP spreads were also well below the target. In addition, unemployment was too high.

Today, unemployment is below the estimated natural rate, actual inflation has run roughly on target, and the TIPS spreads show only a small problem (at least when you adjust for the recent plunge in oil prices.) Furthermore, wage inflation is up to 3%, as compared to 2% a few years ago, indicating increased long run support for a core inflation rate at close to 2%. I suspect wage inflation will rise a bit more.

That’s not to say I’m completely sanguine about the situation. While the consensus of private sectors forecasters is for 2.1% PCE inflation going forward, I believe that there’s at least a 25% chance that we still haven’t gotten inflation up to 2%, and that the TIPS spreads are correct. So it’s something I’ll be watching. But don’t put too much weight on the next few months inflation numbers, as the recent oil price plunge will surely lower the rate for a while. (Back in July, the 12-month PCE inflation rate was running at 2.36%, whereas the actual underlying rate of PCE inflation was never that high–it was due to rising oil prices.)

Overall, I still believe monetary policy is roughly on target regarding inflation. But if the data proves otherwise over the next 24 months, I’ll change my view.