Most foreign policy experts in the US, and the overwhelming majority of foreign countries, believe the Iran nuclear deal was a good thing, and that Trump made a mistake in walking away from the agreement. But it’s worse than that. Not only does the US no longer wish to participate in this agreement, but we insist that the rest of the world follow our wishes.

And now the US has arrested a top Chinese business executive for violating our misguided Iran sanctions policy. News of the arrest caused stock prices to plunge all over the world, as investors expected the US-China trade war to get worse. And the war may not be confined to China, as there is talk of putting tariffs on cars made in Europe and Japan. Let’s hope the administration comes to its senses, before things get out of control. Everyone loses from trade wars.

I still expect neoliberalism to win out in the long run (see my previous post), as the alternative is too dangerous. But right now the Trump administration is playing with fire.

In recent posts here and at Econlog I’ve been discussing how the US should respond to Chinese misbehavior. How should the rest of the world respond when the US becomes a rogue nation? That’s a difficult question.

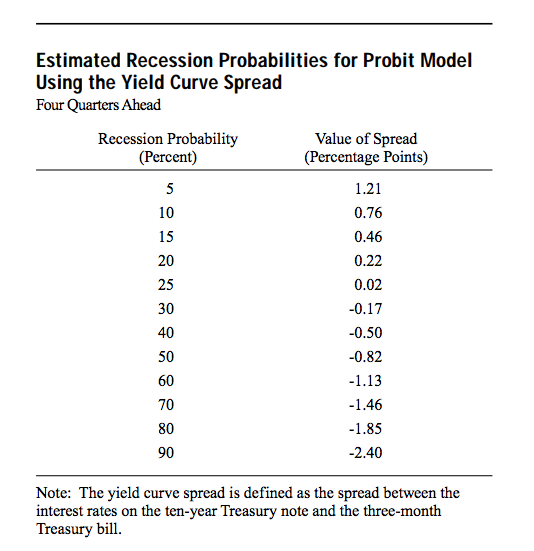

PS. The 10-year yield still exceeds the 3-month yield by 45 basis points. Based on an empirical study by Arturo Estrella and Frederic Mishkin, the probability of recession within 12 months is now about 15%:

Fed funds futures also point to a slowdown but no recession. A slowdown doesn’t concern me because recent growth has been unsustainable—partly a sugar high from fast NGDP growth, and partly a one-time response to the corporate tax cut.

BTW, fed funds futures markets are currently predicting a fed funds rate of 2.55% in July 2020. If that outcome occurs, the yield curve will still likely have a positive slope, and we probably won’t be in recession.

Nonetheless, the probability of recession is certainly a bit higher than last week. There is reason to be concerned.

If I were the Fed, I’d probably raise rates this month (by 20 basis points), but also announce that no further rate increases are expected, unless the economy moves in an unanticipated direction. But then if I were the Fed, I wouldn’t even have this policy regime in the first place. I’d end IOR and use the monetary base (which would then be 98% currency) as my policy instrument. I’d use 3.5% and 4.5% futures contract “guardrails”, to help steer the base.

Monetary policy should be about money and NGDP expectations, not about banking and finance and interest rates and inflation. K.I.S.S.