January 30th, 2019 VXX will be delisted and will no longer trade. It’s highly unusual, if not unprecedented for a product normally in the daily volume top 10 lists to go away. This post will discuss why VXX is disappearing, how Barclays, VXX’s issuer, is handling the transition, and the impacts on shareholders, options traders, and short sellers.

Why is VXX Going

Away?

VXX is an Exchange Traded Product (ETP)

Enter VXXB

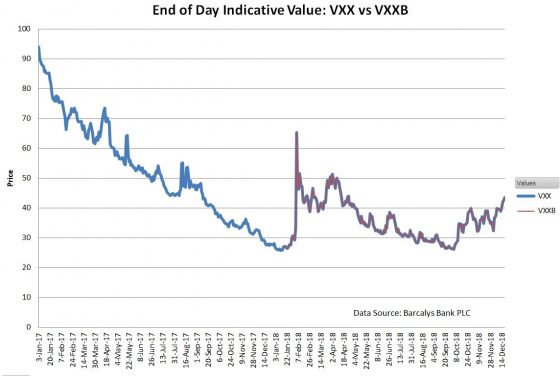

For most of its existence, VXX’s assets have ranged between $800 million and $1.2 billion—making it a good money maker for Barclays. Unwilling to let this money making machine die, Barclays created a “Series B” version, this time with 30 years until maturity. Barclays introduced VXXB over a year before VXX’s end date, on January 17th, 2018, allowing plenty of time for shareholders to transition. As you can see in the chart below the values of the two funds track very well, in fact, they match down to the last decimal point.

Differences between VXX and VXXB

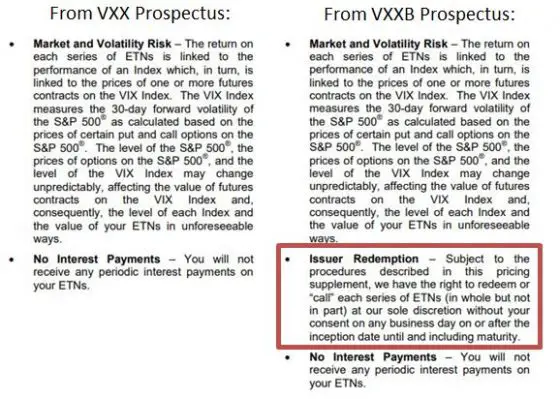

VXXB is almost identical to VXX. It has the same fee structure (0.89%/year) and tracks the same index (SPVXSTR). One difference noted in Barclays’ VXX vs VXXB comparison is that VXXB has an “Issuer Call” feature. Of course, the two words “Issuer Call” do not appear together in the VXXB prospectus, so a brain damaging dive into the prospectuses was required to figure out this “feature.”

The verbiage in the red box below characterizes the “Issuer Call” feature:

The VXXB’s issuer call provision is equivalent to provisions in competitive products, VelocityShares’ VIIX and ProShares’ VIXY. VelocityShares has “Accelerated Redemption” and ProShares has “Termination Events.” These provisions allow the product issuers to shut down their funds if they wish, without cause, and pay the shareholder the share’s value at that point in cash. As long as VXXB is economically viable it’s unlikely that Barclays will shut it down.

Bottom line, VXXB is effectively the same as VXX except for the January 23rd, 2048 maturity date.

What About VXXB’s Liquidity?

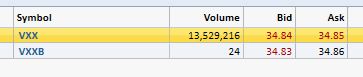

Even through VXXB has been trading for almost a year its

volumes have been meager. For example,

see this mid-day screenshot from May 14th,

2018.

Some people incorrectly infer that low trading volumes in

VXXB’s indicate inferior liquidity. With

the stock of a corporation there’s some merit to this assumption, but with ETPs, the story is completely different. Liquidity refers to how much the price of a security changes in the face of out of

balance buying or selling. With company stocks, liquidity is dependent on how many

shares are publically available for trading and how inclined the stockholders are

to buy or sell at a given price.

ETP liquidity is

fundamentally not dependent on the

supply/demand dynamics of the fund itself, but rather on the underlying securities that the fund tracks. In VXXB’s case,

the underlying is short term VIX futures, the same underlying as VXX—and short

term VIX futures are very liquid. This post

goes into detail on the liquidity of ETPs,

but the key point is that Authorized Participants (APs), institutional players

in the market maintain liquidity and earn a profit by keeping the price of ETPs

close to their tracking prices, the price set by the underlying securities. Unless conditions are extreme, the APs do a

very good job of selling shares in the face of buying pressure, and buying

shares if sellers predominate when the underlying securities are liquid.

While VXXB’s liquidity is very good, there’s still an opportunity to be stupid. Don’t just put in a market order to buy or sell, use a limit order so that you control the price of

It’s no mystery why VXXB’s trading volumes have been

low—there’s been no need. When VXX goes

away VXXB will effortlessly take up the liquidity load.

What About Options?

VXX/VXXB options are an area that has already been impacted by the transition plan. Because VXX is going away the end of January 2019, it can’t have listed options with expirations beyond that. As of December 2018, VXXB has option expirations listed out to June 2019 but so far volumes have been light and bid/ask spreads are wide. For example, the bid on March $70 strike calls is $4.70 and the ask price is $9.00—a huge gap. However, experienced option traders know that selling options at bid or buying them at ask is a sucker’s move, equivalent to selling a used car at the first offered price or buying a new car at list price at a sleazy car dealership. Using limit orders within a few cents of the mid-price, halfway between the bid and ask price, will almost always get filled.

Transition Plans for

Longs

If you are currently holding VXX and would like to hold that position beyond January 2019 what should you do? First, consider any possible tax consequences. I’m guessing that the IRS will view VXX and VXXB as separate securities so you’ll want to consider if you want to take gains or losses in 2018 or in 2019.

If you have 25000 shares or more, Barclays has made special provisions available, but if you’re not in that league then I’d suggest waiting for a fairly quiet day on the market and put in a sell limit order at the bid price for VXX while having a buy limit order for VXXB at the mid-price plus one cent ready to go as soon as your sell order fills. This transaction will likely cost you two or three cents per share. If that’s painful, I suggest you call your broker to see if they can do better than that.

If you do nothing you’ll be automatically cashed out using

the Indicative Value (IV) closing price on January 29th.

Transition Plans for

Shorts

If you’re short VXX and do nothing, I expect that your

position will be called back by the owners before the 29th of

January—at a price that you might not like, so I’d suggest being

proactive. I don’t know what the current borrow rate is, or even which brokers

are supporting VXXB short sales, so some phone calls would be in order. VXXB’s assets are up to $160 million as of

December 21st, 2018, so I would expect that the borrowing process is

fully operational.

VXZ and VXZB—Another

Transition

Until now I haven’t mentioned VXX’s sister product,

VXZ. Instead of being tied to short term

VIX futures, VXZ’s price is set by a rolling mix of 4th, 5th,

6th, and 7th-month

VIX futures. VXZ is a much mellow

performer than VXX on both the up and downsides

and has never has been as popular (currently

$45 million in assets). VXZ also matures

on the 30th of January with VXZB standing by to take over.

A Final Analysis of VXX

The final numbers aren’t in, but assuming that the final value of VXX is $47, its lifetime

stats would be:

-

Final value of $1 million worth of VXX purchased at inception: $118.48 - Performance since inception: -99.988%

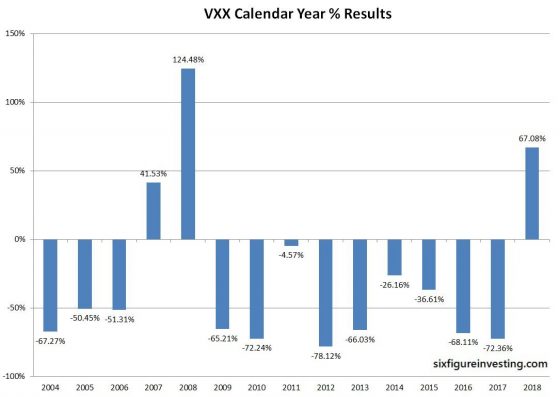

- Yearly percentage gains/losses (years before 2009 are from my VXX simulation)

- Average Compound Annual loss -40% / year

- Average Compound Monthly loss -4% / month

- Estimated cumulative shareholder loss $6.7 Billion

(Assuming average assets $800 million, average monthly loss 7% for 120 months) - Five reverse splits since inception, an average of one every 20 months. If you had bought 1024 shares at inception you’d now hold one share.

- Largest one day gains: +96% (5-Feb-2018), +32.7% (24-Jun-2106)

- Largest one day drops: -25.9% (6-Feb-2018), -18.% (28-Jun-2016)

- Appreciation during 2011 correction (29-Jun-2011 through 03-Oct-2011): 164%

- Simulated appreciation during 2008 crash July-2008 thru Nov-2008): 250%

Conclusion

VXX is handing the baton to VXXB. We can expect VXXB to continue VXX’s tradition

of brutal losses punctuated with a few

dramatic victories. Long term we can

expect VXXB to continue its predecessor’s

march to zero.

For More Information: