In the afternoon of February 5th, 2018, what looked like a bad day for a group of high flying volatility-based products turned into a devastating decline. Four factors combined to ruin their day:

- A Flawed Architecture

- Relying on the Past to Predict the Future

- Billions Under Management

- A Record-Breaking VIX® spike

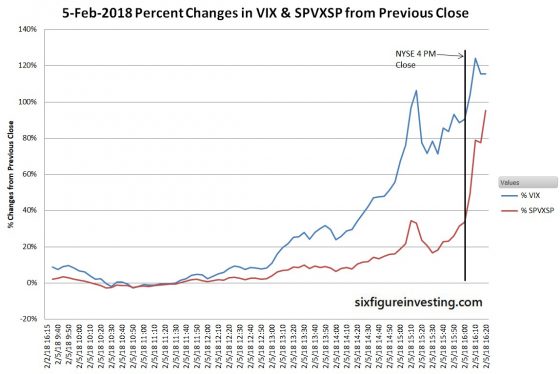

Twenty-five minutes before the close of the New York Stock exchange on February 5th, I tweeted (timestamp was in MST):

Mix of VIX futures tracked by volatility ETPs up (+20.7%) a factor of 0.30 of the $VIX‘s move (+67.5%). Normal factor around 0.45. $VIX futures are being restrained. Lower factors typical during big vol spikes.

— Vance Harwood (@6_Figure_Invest) February 5, 2018

The Cboe’s VIX® increase at that point was in

record territory, yet the moves of the volatility

based Exchange Traded Products (ETPs) and the VIX futures that underlie them had

been muted.

The 50 minutes that followed the tweet were anything but

restrained. The chart below shows the

price action of one of the key VIX futures.

The VIX climbed to close at a 116% gain and the mix of VIX

futures I referred to in the tweet spiked up

an astonishing 97% from the previous day’s close. In those last few minutes the VIX’s daily move

had almost doubled and the short term volatility ETPs more than quadrupled

their percentage moves. At the close, a combined $4 billion worth of the two

next to expire VIX futures changed hands.

With this unprecedented spike in VIX Futures, the combined value

of the inverse volatility ETPs XIV, SVXY, and VMIN dropped billions of dollars. Credit Suisse’s XIV ended up losing 97% of

its value that day, ProShares SVXY 91%, and REX ETF’s VMIN 87%. In the weeks that followed, XIV was

terminated and SVXY and VMIN reduced their leverage factors to make them less

sensitive to big volatility moves.

Any major crises has multiple

causes, so blaming just one of them is simplistic. In the next section of this post, I describe what I believe to be the

primary causes of this debacle.

A Flawed Architecture

In order to explain how the architecture of these ETPs

contributed to this event, we need to dig

into how these funds are constructed.

ETPs offer investors stock-like access to financial

strategies that would be impractical for a

retail investor to implement themselves.

For example, SPY and IWM are ETPs that track the S&P 500 index and the

Russell 2000 index respectively; both of these indexes would be totally

impractical for a retail investor to track by buying the constituent individual stocks.

The primary benefit of the

volatility ETPs is that they track indexes that are designed to enable

volatility trades while avoiding some of the inherent challenges of holding VIX

futures. Specifically, VIX futures:

- Can be difficult or impossible for a retail investor to

access -

Have fixed expiration dates, like options, so a long-term position requires active management to compensate for expirations - Differ

in sensitivity to VIX moves over time, they become much more sensitive to VIX moves as they approach expiration

These volatility indexes (e.g., SPVXSP)

address the expiration and sensitivity issues by specifying a mix of VIX

futures that changes every day, rotating out of the next future to expire into

the future that expires a month later. This mix of futures is tailored to give a

stable sensitivity to VIX moves.

In addition to plain volatility exposure, traders also want

access to volatility ETPs that offer short exposure (going up when the VIX

futures go down) and long products that are leveraged up to better track the

VIX’s moves. Traders can do this with

unleveraged volatility ETPs like VXXB, VIIX, and VIXY by shorting the ETPs or

leveraging via margin, but this has some downsides too:

- Short & margin positions have variable leverage with respect to the moves of the underlying security. For example, if VXXB was to go down 10% per day for two days a short position would make 10% the first day and 9% the second. For more on this see 10 things about short selling. Long leveraged positions have the same behavior—the leverage factor drops if the ETP moves in a favorable direction for the holder.

- The maximum profit on an un-rebalanced short position is 100%.

- A short position has the potential of losing more money than was originally invested and that risk is unconstrained.

ETP architects addressed the variable leverage and max

profit issues by creating daily resetting funds (e.g., XIV, SVXY, TVIX,

UVXY). These funds adjust their assets,

buying or selling VIX futures near the end of every trading day such that the

next day’s leverage will be very close to the advertised level (e.g., 2X, -1X).

This reset also enables the inverse funds to achieve more than 100% profit. The ETP issuers address the maximum loss

issue (and cover their own backsides) by promising that the ETP’s values will

never drop below zero.

Unfortunately, when solving problems architectures often

create new issues. They are commonly framed by marketing as “features”. A couple of

issues associated with the architecture of these ETPs:

- The daily reset introduces path dependency into

the performance of the ETPs. You can’t

determine the multi-day end price of the ETP just by knowing the starting and

ending values of the index it tracks.

For example, a +10% day followed

by a -9.09% day leaves the SPVXSP index back where it started, but a 2X daily

resetting fund would end up being down 1%

after that sequence. Most of the time

this effect is detrimental, but occasionally it can be beneficial. - In case of huge

contrary intraday moves, the ETP issuers need to have the ability to terminate

their funds so that they don’t drop below zero.

If this happens the shareholder

does not benefit if the VIX futures subsequently reverse direction. - The transactions required by the daily resetting

process have the unfortunate characteristic of a pile-on— they always

reinforce the daily move. Both the long leveraged

and inverse funds have to buy more VIX futures when VIX futures are going up and sell VIX futures when volatility is

dropping—reinforcing the overall market trend.

For example, if volatility spikes up the inverse funds would need to

reduce their leverage by buying VIX futures or equivalents (to cover some of

their short positions) and the 2X funds would also need to buy VIX futures or equivalents

to increase their leverage. The “equivalents” to VIX futures are typically

something called a swap. They are used by

ETP issuers to outsource the resetting process to an institutional counterparty.

These swaps are over-the-counter

transactions with nearly zero visibility to outsiders. The counterparty will typically hedge their

risk with VIX futures or a similar strategy

(e.g., delta-hedged SPX straddles).

These architectural issues in themselves weren’t fatal, nor

were they unknown, I had blogged

about them in 2012, but they interacted with other factors that I describe

below.

Relying on the Past

to Predict the Future

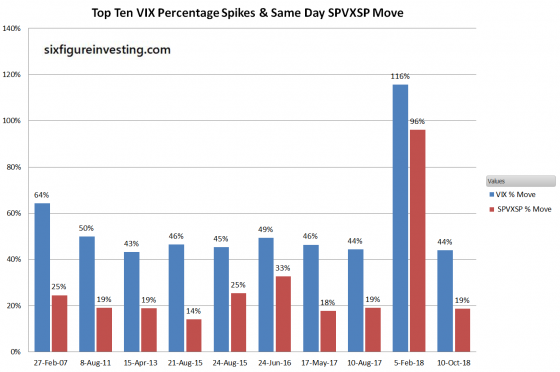

The following chart shows the top ten VIX intraday spikes

compared to the SPVXSP index (VIX future based) on the same days in historical

order.

From their inception in 2004 until February 2018, spikes in the

VIX futures -based SPVXSP index had been relatively subdued compared to the VIX

spikes.

Unlike most futures, VIX futures have a tenuous link to

their underlying asset. Soon to expire

gold and S&P 500 futures, for

example, track the spot “buy/sell it now” price within a percent or two.

The only time VIX futures reliably track that close to the VIX index is

on the day it expires. It’s relatively

easy for gold and S&P 500 futures market makers to precisely hedge their

positions with the underlying assets.

It’s not easy in the case of VIX futures to do that hedge. You can’t store volatility in a vault

somewhere, nor are there securities you can buy that directly track the

VIX. You can try to replicate the VIX

index with options but to do so requires buying dozens if not hundreds of

different option series that carry commissions and high transaction costs. As a result,

the VIX futures market tends to have a mind of its own, and historically that

market has underreacted to VIX spikes.

Analysts did projections

of how large of a VIX move would be required before the inverse volatility

funds would drop into termination

territory (80% or greater one day drop).

Typically they concluded an event

similar to the S&P 500’s 20.5% drop on Black Friday, October 17, 1987, would be required.

The flaw in that reasoning is that it did not ask what can happen. Without a hard and fast linkage between the

VIX and VIX futures, there’s nothing that

structurally prevents VIX futures from tracking closer to, or even overreacting

to VIX moves. In addition, there is the ever-present danger of unanticipated systemic

failures—problems not experienced in normal day to day operations. For example, the normal vibration/

acceleration levels in a car are not in any sense a good predictor for the acceleration

experienced in an accident.

Nassim Taleb points out that unless

we have truly large amounts of data it’s foolhardy to use the data we have to

predict the variability of possible

events (e.g., number of fatalities from terrorist

attacks, Ebola infections). We can

statistically predict with confidence the likely range of shark attacks we will

see next year because there are a lot of people swimming in the ocean and we

have decades of data. However, in the

case of terrorist attacks, it’s not hard to imagine an event (e.g. a purloined Pakistani

nuke detonated in a US city) where there are 100X more fatalities than have

ever been experienced (~3000 on 9/11)—an excursion

that a standard statistical analysis, assuming a Gaussian distribution, would rate as essentially impossible.

The relatively subdued behavior of VIX futures during the VIX spikes of the

2010 Flash Crash, 2011 correction, and the Brexit vote in 2016, led to

overconfidence in the marketplace. When analytically reviewing the risk, the mistake that many analysts

made (including myself) was to rely on the relatively sparse set of historical

data on the VIX and VIX futures. This resulted in overly discounting the likelihood

of the VIX futures spiking high enough to trigger catastrophic losses in the

inverse volatility funds.

Traders that been dealing with inverse volatility funds for years knew that large drawdowns were possible (e.g., SVXY & XIV dropped 60% in 2015) so they knew to hedge or exit their positions when things started to look dicey in the market, but newer traders treated inverse volatility as a buy and hold investment and viewed dips as buying opportunities. This worked really well for a while…

Billions in Assets

In January 2018, the assets of the various inverse and

leveraged volatility funds had climbed to over 5 billion dollars. This was publically available information that

supported an unsettling scenario. As described earlier in the architecture

section, the inverse and leveraged funds internally adjust their positions to

accomplish their end-of-day resetting. The

size of the required resetting trades is proportional to both the product’s asset

size and the daily percentage move of the SPVXSP index. If the SPVXSP index has moved up 10% then

both the inverse and 2X leveraged funds needed to buy additional VIX futures

equal in value to the previous day’s asset size times the percentage move. If SVXY had 1 billion in assets and the

SPVXSP move was +10% then just that fund needed to buy $100 million worth of

VIX futures at the end of the day to achieve its rebalancing rules. With 5 billion in assets overall the combined

buying need for a +10% move was $500 million worth of futures. These are pretty big numbers for a relatively

minor move, how did they relate to the overall size of the VIX futures market? By late 2017 the overall notional value of the

VIX futures market was around $7 billion and the rebalancing needs of just one

of these ETPs was becoming a significant percentage of the entire VIX futures

market.

Fifty minutes before the VIX futures would settle on

February 5th, the SPVXSP index was up 20% and there were signs that

the market was panicking. Unless things

turned around there was going to be at

least $800 million worth of VIX Futures that needed to be bought by the

ETPs or their counterparties at precisely 4:15 PM

ET when the futures market closed. It

didn’t take a rocket scientist to figure out that prices were likely to climb

near the final settlement time. Savvy

traders likely bought VIX futures at that point in anticipating the run-up and people already holding VIX futures weren’t in a hurry to sell.

A Record-Breaking VIX spike

The Volatility Tsunami required a VIX spike to ignite the

explosive mixture of a flawed architecture and high asset levels. The VIX’s February

5th spike was the largest percentage (+116%) and point moves (+20) since

its inception in 1993. The coincident 4.1% drop in the S&P 500 that day was

far from record-breaking—it’s in 31st place over that same time span.

What caused this apparent overreaction?

The simple explanation was that there was a lot of buying

pressure on the S&P 500 options used to calculate the VIX. But what

precipitated this buying frenzy? A

detailed exploration is outside the scope of this post, but possibilities

include:

- Shock value

- It had been almost two and a half years since the market had had a

one day downswing of that magnitude (-3.96% on 15-Aug-2015) and six and a half years since a larger downswing (-4.3% on 5-Oct-2011). The very low volatility before the event had lured traders into complacency.

- It had been almost two and a half years since the market had had a

- Overall market interactions with the inverse/leveraged volatility ETPs

-

Invest in Vol’s Dr. Stuart Barton makes a case that the hedging required by the volatility ETP market-makers and counterparties could have been large enough to cause a spike in the massive S&P 500

option market.

-

Invest in Vol’s Dr. Stuart Barton makes a case that the hedging required by the volatility ETP market-makers and counterparties could have been large enough to cause a spike in the massive S&P 500

The impact of the VIX spike was to drive the price of VIX

futures high enough that massive, end-of-day rebalancing would be required.

The Result – a Catastrophic

Liquidity Hole

All of the above causes I discussed above (plus others I

omitted or missed) combined on the afternoon of February 5th, 2018,

to trigger an unprecedented spike in VIX futures. Exchange Traded Fund managers and

counterparties tracking the SPVXSP style indexes ultimately needed to buy

around $4 billion dollars’ worth of VIX futures or equivalent volatility instruments

at the ~4:15 PM ET futures close. In the face of this unprecedented buying pressure, the liquidity of VIX futures evaporated

and VIX futures’ prices soared in the last few minutes of trading. The chart below shows the VIX and SPVXSP price

action.

Based on historical price data it appears that some fund

managers, specifically ProShares’ SVXY and UVXY, as well as REX ETF’s VMIN, stepped aside (or were just not able to

fill their orders) and did not complete their purchases that day. If the volatility spike had continued the

next day this would have hurt them, but volatility dropped off on the 6th

so they ended up saving their shareholders some money with their inaction.

The path dependency of the inverse ETPs delivered the final

blow to their shareholders. Someone that

was short VIXY, a long volatility fund would have “only” lost 45% of their

portfolio value on the week of February 5th because in the next few

days VIXY dropped back from its peak on the 5th, but since the

inverse/leveraged funds reset their investments at the end of the day they

locked in the February 5th losses, finishing the week down 95%.

Ironically, the potential for catastrophic losses on the

long / 2X volatility funds is well known. All of them are down more than 99%

since their inception dates. The

difference is that long funds don’t crash suddenly; they just get eroded to

nothing over time.

The Aftermath

The day after the crash, Credit Suisse announced

that it would terminate XIV, with February 15th being its last day

of trading. The -97% move on the 5th

clearly entitled Credit Suisse to invoke the “acceleration event” based shutdown

of the fund if daily losses met or exceeded 80% detailed in their prospectus. I suspect the decision to shut down the fund was a difficult business

decision. XIV had been a real moneymaker

for Credit Suisse and likely would regain significant assets after time dimmed

people’s memories (SVXY assets have climbed to $377 million as of February 2109). The risk of SEC intervention and positioning

for the inevitable lawsuits from the crash might have been the deciding factors

for the delisting.

By the end of February 2018, both ProShares and Rex ETF

(both rumored to be under pressure by the SEC), had reduced the leverage on

their volatility funds to decrease the chances of similar drawdowns in the

futures.

Lawsuits were filed

and accusations

leveled, but to my knowledge, judgments yet to be handed down.

Risk of a Repeat?

With the demise of XIV and VMIN (which was shut down in November 2018 due to low

assets) and the deleveraging

of SVXY, there are no remaining USA short term inverse volatility funds

with the same level of architectural risk as the former -1X leveraged

funds. My simulations

indicate that a February 5th style event would cause the current -0.5X

leveraged SVXY to drop 48%—dramatic, but not devastating.

People no longer claim that VIX futures are inherently less

volatile than the VIX. It only took one

event to disabuse them of that belief. Overall,

I think this healthy dose of reality has made the overall situation less risky.

The assets in short term leveraged / inverse volatility

products currently stand at a little over a billion dollars (February 2019), a fifth of the pre-crash $5

billion number. Lower asset values in

these funds dramatically reduce the risk of a similar event.

The frequency of large VIX spikes has been increasing; seven

of the top ten spikes in the VIX’s 27-year

history have happened in the last four years.

It’s possible that increased asset levels in the volatility funds were a

part of this and it very well might be that other factors are at work

here. These spikes are a risk to the

inverse volatility players and a lure to

the long volatility traders.

As near as I can tell, the Cboe, which operates the VIX

future exchange has not made any improvements that would substantially reduce

the risk of a liquidity hole in a similar

situation. The Cboe did make a change to the Trade At

Settlement (TAS) order type which wasn’t working effectively at the close that day, but I doubt this would have

prevented the spike. My sense is that

the wheels will still fall off if similar amounts of volatility assets needed

to be bought or sold at the very end of the VIX Futures trading day.

History rarely repeats itself exactly. What I do expect to see are failures brought about by: not mitigating the weakness of

architectures, the frailty of systems when disturbed by unexpected failures, people

inappropriately predicting the chances of extreme events using normal day-to-day

variations of processes, and of course, fear and greed.

Resources

- A post

from Kid Dynamite describing the event and common misconceptions - Not everyone lost money on February 5th;

one firm scored

big.