That was the message at a recent Brookings conference, which looked at why inflation has remained lower that predicted in Phillips Curve models.

At one point (around 3:28), Olivier Blanchard suggested a wage inflation target made more sense, as the wage inflation Phillips curve is much more reliable than the price inflation Phillips curve. Then Blanchard said this about wage inflation targeting:

. . . which I think hasn’t been examined and should probably have been . . .

This made me smile, as back in 1995 I published a paper showing that wage inflation targeting might be superior to price inflation targeting. Mankiw and Reis (2002) also suggested that wage inflation targeting might be superior. And of course other economists like Earl Thompson did so even earlier.

In the end, I decided that wage inflation targeting was not politically feasible, as tightening money to slow wage growth would be too controversial.

Later in the session, Paul Krugman indicated that he also found the idea of wage inflation targeting to be appealing, but worried that wage inflation targeting was not politically feasible, as tightening money to slow wage growth would be too controversial.

As David Beckworth recently tweeted, seeing the advantages of wage targeting is the first step in convincing people that NGDP targeting is the way to go, as the ideas are related (albeit not identical.)

It’s interesting to see big names in the field coming around to ideas that George Selgin and I have been advocating for decades.

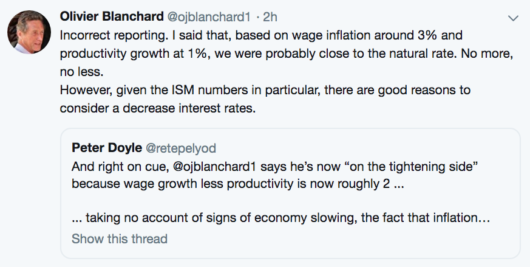

PS. Blanchard recently tweeted:

Actually Doyle’s tweet was accurate, and referred to comments Blanchard made between 3:29 and 3:30. Glad to see that Blanchard changed his mind. The Fed needs to be more expansionary.

Actually Doyle’s tweet was accurate, and referred to comments Blanchard made between 3:29 and 3:30. Glad to see that Blanchard changed his mind. The Fed needs to be more expansionary.