Tops are a process; bottoms are an event – source unknown

I started Top Gun in 2006 to capitalize on my conviction that the bursting housing bubble would cause a nasty recession. 2006 was spent creating my website, studying and taking the Series 65, applying to the State of CA for my RIA (Registered Investment Advisor) license, finding office space and in general getting everything set up. I went live managing money on Jan 1, 2007 with a little less than $1 million AUM. I was 29 years old.

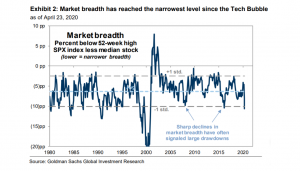

Sharp declines in market breadth in the past have often signaled large market drawdowns – David Kostin and his team at Goldman Sachs (4/24/20; https://www.bloomberg.com/news

The market is being driven higher primarily by The Big 5 tech companies – Amazon (AMZN), Apple (AAPL), Google (GOOG, GOOGL), Microsoft (MSFT) and Facebook (FB) – which now make up 21% of the S&P’s market cap – a higher concentration than even the top of the 2000 dotcom bubble (Note: I am having trouble getting this chart to load. I will try to post it later). Correspondingly, while the S&P is 17% below its February 2000 peak, the median stock in the index is 28% below its peak. That’s because The Big 5, who all report earnings this week, are carrying the entire market. Most stocks in the S&P 500 have not bounced nearly so hard, but with The Big 5 making up such a large % of the market cap of the S&P they are able to carry things for now. Once they breakdown, the entire market will as well. That’s why this week is the most important week of the year so far.

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

825 San Antonio Road #205, Palo Alto, CA 94303

(916) 224-0113

Stocktwits (55k followers)/Twitter: @TopGunFP

Instagram: topgunfinancialria