The consensus view is that this crisis is all about the coronavirus. Once the coronavirus is contained, markets will bottom, if they haven’t already, and we’ll rally into year end, eventually making new highs as the bull market resumes.

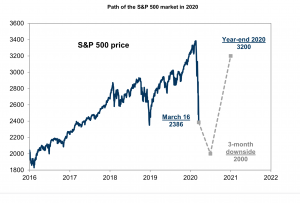

One of the best examples of this point of view is Goldman Sachs. Goldman is calling for a bottom in the S&P around 2000 around the middle of June and then a ferocious 60% rally to 3200 into year end.

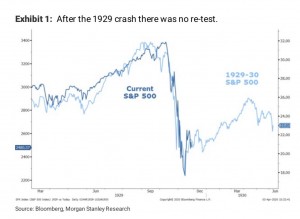

(Added 4/6): Morgan Stanley also holds the consensus view claiming that the market has already bottomed, there will be no retest of the lows, and that this is the end of a cyclical bear market within a secular bull market.

Another excellent example of this point of view comes from Gary Savage of Smart Money Tracker in his 7-minute video “Ignore the permabears they will be wrong again” (Thu 3/26) (https://blog.smartmoneytrackerpremium.com/2020/03/ignore-the-perma-bears-they-will-be-wrong-again.html). In that video, Gary makes the analogy of the coronavirus crash to the 1987 crash which, while violent, lasted a very short time after which the secular bull market that started in 1982 continued on until March 2000. Gary believes the same thing will happen this time. He believes the bottom is already in, though it will be retested in the coming weeks, and that this is the best buying opportunity of a secular bull market that has 10-15 more years to run due to being in the early stages of a technological innovation cycle.

Also sharing this perspective is the renowned hedge fund manager David Tepper who told CNBC on Monday 3/23 that he was “nibbling” and that stocks had bottomed or were close to doing so (https://www.cnbc.com/2020/03/23/watch-the-full-interview-with-david-tepper-on-when-stocks-will-bottom-and-what-hes-buying-now.html?&qsearchterm=David%20Tepper).

Finally, the well known member of CNBC’s Fast Money, Josh Brown (“The Reformed Broker”) wrote a blog post on Sunday 3/29 called “Three reasons it’s not 1929” (https://thereformedbroker.com/2020/03/29/three-reasons-its-not-1929/) concluding: “Everyone knows it’s temporary”.

In an exchange with Howard Lindzon on Stocktwits last Monday (3/30) about Josh Brown’s piece, he said the current downturn would last “a few months” while twice calling me an “angry asshole” for my bearish views (https://stocktwits.com/TopGunFP/message/203470866).

*****

Unfortunately for those who hold it, the consensus view is wrong. In order to explain why I’m going to make a slight digression.

When I was in Philosophy Graduate School at UC Davis (Fall 2003 through 2005), I took a Philosophy of Science class in which I read Nelson Goodman’s classic Fact, Fiction and Forecast (1954). In that book, Goodman uses the example of lighting a match to make an important point. Under normal circumstances, when you scratch a match against the side of the case, the match lights. However, if the case is wet, for example, the same scratch will not cause the match to light.

What’s his point?

His point is that in order for the match to light, you need the catalyst (scratching the match against the side of the case) plus the proper initial conditions. In the latter instance where the case is wet, the scratching of the match doesn’t cause it to light because of the initial conditions.

What does this have to do with the current situation in the stock market and the economy?

Clearly, the coronavirus was the catalyst for the massive selloff we’ve experienced over the last month. Nobody disagrees with that. But the consensus view contains a hidden premise: Before the coronavirus, the financial markets and real economy were strong and would have continued so absent the virus. To use Goodman’s terminology, this how the consensus view sees the initial conditions.

However, as I argued in Part II of “The Everything Bubble and The Second Great Depression” (Jan 2019) and “The Possibility of Civilizational Breakdown” (March 2020), the initial conditions were not strong, even before the coronavirus. For one, financial assets were in an Everything Bubble fueled by 12 years of unprecedented easy money policies from the Federal Reserve (Gary Savage calls the claim of an Everything Bubble “absurd”). Second, the real economy was unbalanced due to massive inequality as a result of the hollowing out of the middle class resulting from the outsourcing of manufacturing jobs to China and other foreign countries with cheaper labor. This cleaved society into the Haves (the Professional-Managerial Elite consisting of the Top 20% of society) and the Have Nots (those in the Service and Gig Economy catering to the Top 20%). For an outstanding deep dive into this divide, see Musa al-Gharbi’s “Disposable People”

(4/1) (https://thebaffler.com/latest/disposable-people-algharbi; also Nelson Schwartz’s book “The Velvet Rope Economy: How Inequality Became Big Business (2020)). Put another way, the match case was wet.

Combining the coronavirus (catalyst) with The Everything Bubble and an unbalanced real economy (initial conditions) leads to a very different conclusion about the depth and duration of the current downturn. In my latest Client Note, “Rethinking My S&P Price Target Under Civilizational Breakdown”, I put the probability of Civilizational Breakdown (think Germany in the early 1920s) at 63.5% and the probability of a Second Great Depression (think The United States in the 1930s) at 36.5%.

In conclusion, I want to say that I am not a permabear. While I have been bearish during the 2009-2020 bull market, that’s because I view it as a massive cyclical bull market within a secular bear market that began in March 2000 – the exact opposite view of Gary Savage. For evidence of this, see the chart on pg. 27 of Jeff Gundlach’s webinar “A Tale of Two Sinks” (3/31) showing that the ratio of the S&P 500 to the price of gold peaked in March 2000 (https://cache.webcasts.com/content/doub001/1296855/content/6eb12e188d39ea9ebfdd866dd60f96aabe006c2e/secured/3-31-2020%20Two%20Sinks.pdf). This suggests to me that the real value of the S&P 500 was lower at both the October 2007 and February 2020 tops than at the March 2000 top.

I love this country. In fact, I believe The United States is the greatest country in history, founded on the Enlightenment principles of reason, liberty (including free markets) and equality. I want to see the country and its citizens do well. And I want to be bullish and hope that once we work our way through the current crisis I can be. My bearishness is not a reflection of a pessimistic or misanthropic psychology; I am not an angry asshole! (LOL) My bearishness is simply a reflection of my best analysis of the current moment.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

825 San Antonio Road #205, Palo Alto, CA 94303

(916) 224-0113