This post is not about forecasting the stock market, something I doubt that anyone can do with a high level of consistency. Rather I’d like to consider some possible reasons why stocks have rallied to relatively high levels by historical standards, despite an economy that appears headed for 20% unemployment.

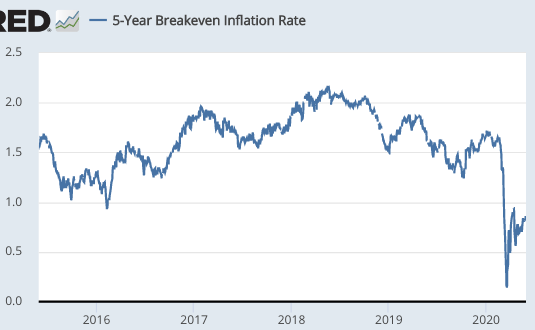

1.Perhaps the economy will recover quickly, as Lars Christensen predicts. I certainly think this is possible, but note that TIPS spreads remain quite depressed:

Overall, I’m a bit skeptical of the claim that the unemployment rate will fall below 6% by October. I hope I’m wrong.

2. Another possibility is that we’ll see a shift of national income from labor to capital. The NASDAQ index is especially strong, reflecting the profitability of (capital intensive) internet companies that benefit from social distancing. But how long with the pandemic last?

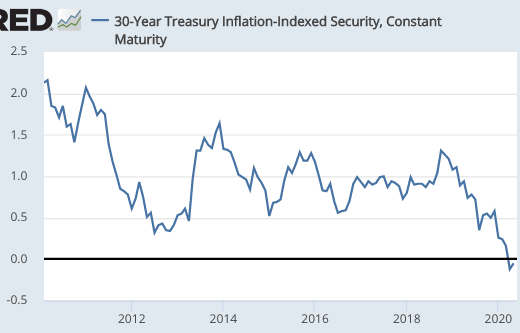

3. Another possibility is that the now almost 40-year downward trend in real interest rates is still underway, with no sign of a reversal. Look at 30-year real interest rates on Treasury debt:

If future cash flows are being discounted at a much lower real interest rate, then you’d expect stocks to be doing better than what one would expect during a period of high unemployment. The counterargument is that real interest rates often fall during slumps.

Bloomberg has a new article on the bull case for stocks:

The Really Big Stock Bull Case Says Fed Stimulus Doesn’t Go Away

You and I know that monetary policy is not currently stimulative, indeed it’s disinflationary. But recall that average people ascertain the stance of monetary policy by looking at interest rates. If the markets are signaling near-zero rates for as far as the eye can see, most people (including Bloomberg reporters) would consider that “easy money”.

Thus Bloomberg is saying that the “bull case” for stocks is due to easy money, which I translate as the bull case is due to a relatively permanent fall in the equilibrium real interest rate.

I’d put at least a little bit of weight on all three of the factors above. But in my view the fall in real interest rates is the biggest factor.

If the S&P500 can reach 3000 at a time of 15% (more likely 20%) unemployment, then it seems increasingly likely that the Robert Shiller model of the stock market is simply wrong. It’s dead as that parrot in the Monty Python sketch.

Was it ever true? Probably not, at least not in the sense of being useful. But hey, he’s got a Nobel Prize and I don’t, so what do I know?