Roughly 99% of people think that low interest rates are an expansionary monetary policy. But the readers of this blog know otherwise. They know that low rates often reflect the delayed effect of previous tight money policies.

Roughly 99% of people think lockdowns are a restrictive Covid-19 policy. I hope to convince you that lockdowns are mostly endogenous. That countries like Taiwan did not close their restaurants precisely because they had quite effective Covid-19 policies. That lockdowns are often (not always) a sign of failure, of previous excessively lax policies.

Check out today’s Bloomberg headline:

Hmm, two states going in opposite directions. Who has the more lax polices? It’s a complicated question, isn’t it?

It’s not about a single “concrete step”, it about the overall policy regime.

I.e. never reason from a lockdown.

PS. I said “mostly endogenous”, because there are (exogenous) exceptions, such as Sweden.

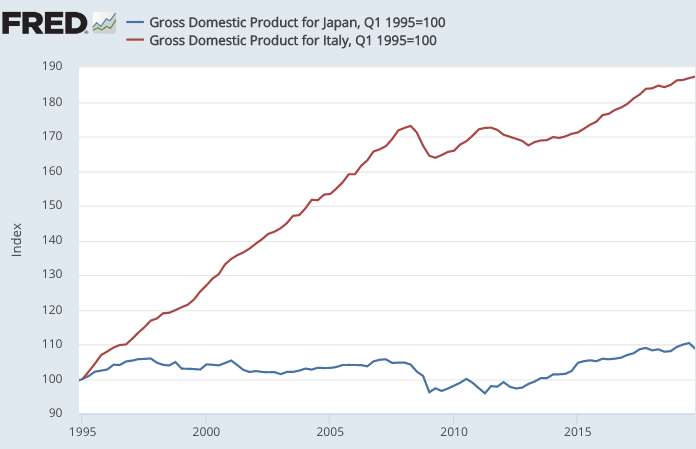

PPS. The graph below shows the pathetically weak growth in nominal GDP since 1995 in Italy (red line), and also the mindbogglingly and almost incomprehensible lack of spending growth in Japan (blue line). Which one do you think the MMTers keep citing as a successful example of their (aggregate demand) policies in action? Yup—Japan.

If conventional macro occasionally lapses into reasoning from a price change, MMT is reasoning from a price change on steroids.

Yes, Italy’s population rose by roughly 6%, vs. almost no growth in Japan, but that explains only a tiny portion of the divergence. And again, I am comparing Japan to ultra-pathetic Italy.

And yes, Japan looks somewhat better using RGDP, but when evaluating AD policies it’s NGDP that matters, not RGDP. The latter is also influenced by supply factors. Do MMTers distinguish between NGDP and RGDP?