I’m going to write my “morning email” tonight to free up tomorrow for my long workout day (I have my personal trainer @ 8am) and for work on our investment properties.

Some days are more equal than others, to paraphrase George Orwell. While I found myself with a ton to say on Tuesday and Wednesday morning after two historic days, especially Monday, in the wake of Pfizer’s #COVIDVaccine announcement Monday morning, earlier tonight when creating my outline for this email I found myself wracking my brain to come up with content. There just isn’t as much to say right now as there was this morning and yesterday morning.

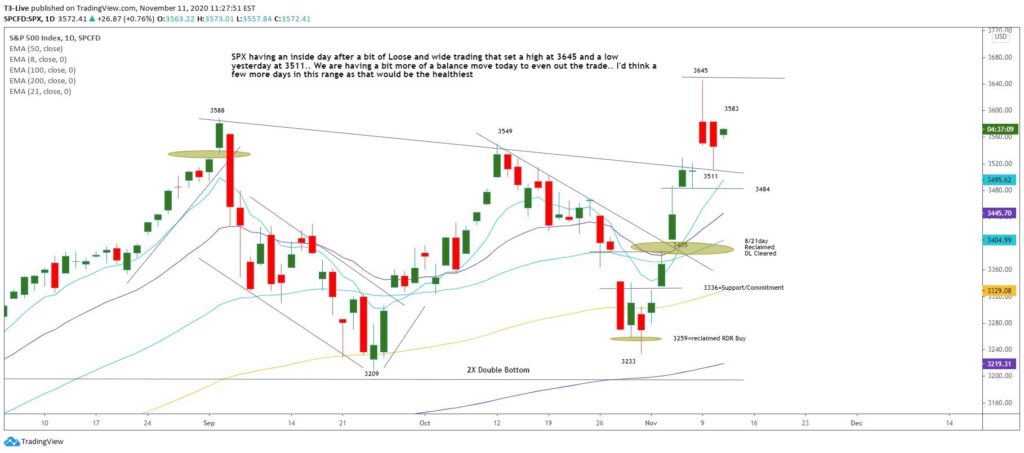

The first thing about today (Wednesday) is that it was an “Inside Day”. That is, the S&P traded well within the range defined by the “Dueling Tails” established on Monday and Tuesday. The S&P’s range Wednesday was 3,577-3,581 with a close at 3,573. That’s well within the “Dueling Tails” established by the high from Monday’s open (3,646) and Tuesday’s intraday low (3,512). In other words, that range still contains the action and Wednesday did nothing to resolve it.

Volume also dropped off markedly today (Wednesday) to 4.6 billion on the NYSE and 3.8 billion on the NASDAQ. It’s early but the Futures are currently suggesting another inside day tomorrow (Thursday) with the S&P Futures -0.53%, the NASDAQ Futures -0.35% and the Russell Futures -0.77% at 11:35pm PST. Put another way, today was “just another day” and tomorrow is looking like more of the same.

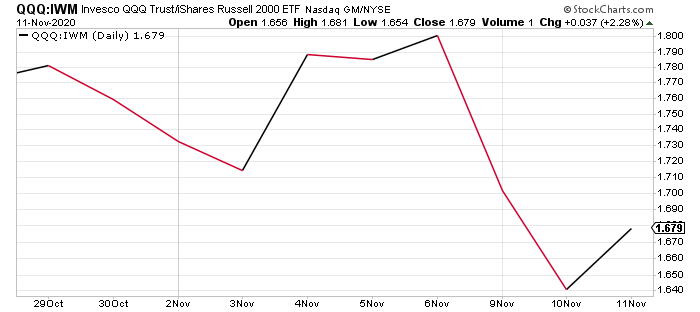

In this morning’s email, I wrote: “It will be interesting to see whether [the #Rotation] trade continues today or if investors think it has gone a little too far and it reverses a bit.” That was prescient because it’s exactly what happened with the NASDAQ +2.01%, QQQ +2.24%, S&P +0.77% and the Russell unchanged. The Futures currently suggest a continuation of that reversal tomorrow (Thursday) as the market tries to correctly price in the #COVIDVaccine news.

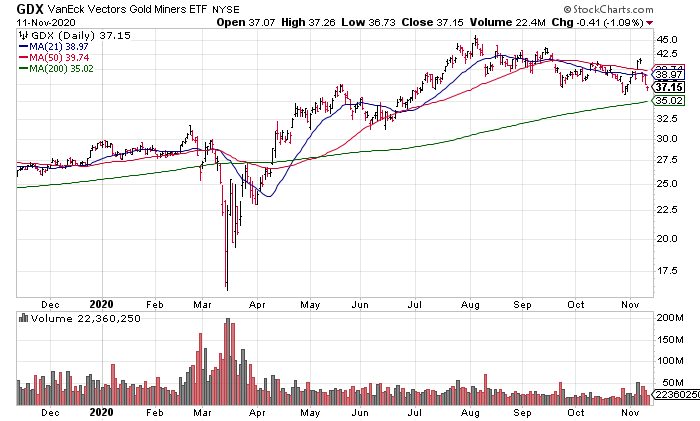

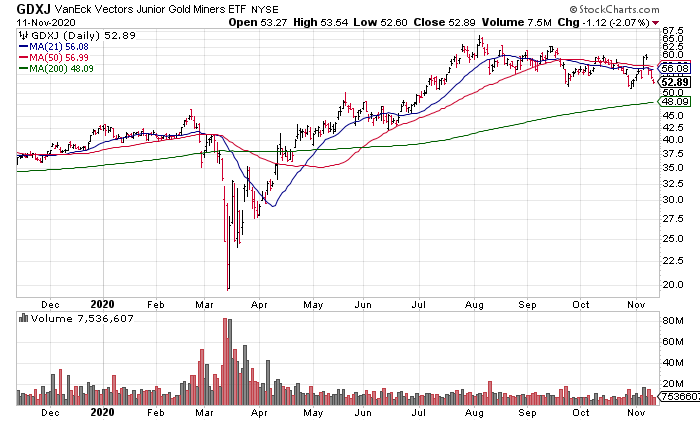

The nice thing about this kind of action is that it gives us room to breathe and step back and focus on some bigger picture issues. For me, because of our heavy weighting in the gold miner ETFs GDX & GDXJ, staying on top of them is very important. While it’s been a poor week for each of them, both still remain above their respective 200 DMAs and I continue to believe that the fundamentals remain strong going forward with the Fed continuing to be active when necessary to support financial markets.

With the #COVIDVaccine news now out, 3Q earning season winding down and only 7 weeks remaining in the year after this week, two of them holiday shortened, things are likely to continue to slow down from what has been a manic rally since March 23. The two big issues that will likely be with us as we wind down the year are tying up any loose ends regarding the Presidential Election and the progress of the #COVIDVaccine. News on either front could swing the market one way or the other on a given day. But, overall, I expect a much calmer end to the year from here on out. That’s not necessarily a bad thing after the insanity that has been 2020.

I’ll be using this anticipated slowdown in the action to improve my game by taking Mark Minervini’s Master Trader Program the next two weekends and preparing my mind and body for what promises to be another exciting year in 2021.