Like I wrote Wednesday night, paraphrasing Orwell, some days are more equal than others. The “Dueling Tails” created Monday and Tuesday and so brilliantly charted by David Zarling continue to define the relevant range (3512-3646). Both Wednesday and Thursday traded within that range, though the bottom was tested late yesterday. The Futures are suggesting another day within that range today with the S&P and NASDAQ Futures +0.9% and the Russell Futures +1.05% as of 2am PST. It makes complete sense as investors continue to digest Monday’s historic #COVIDVaccine news. As I wrote in yesterday’s morning email, the nice thing about this is that it frees us up from focusing so much on the trading day and allows us to step back and analyze the forest from the trees which is what I’m going to do now.

There is a disconnect between current earnings and stock prices that depends on an assumption that may not be true. I’m going to illustrate this using two stocks that reported earnings this week: McDonald’s (MCD, Monday Morning) and Disney (DIS, Thursday Afternoon).

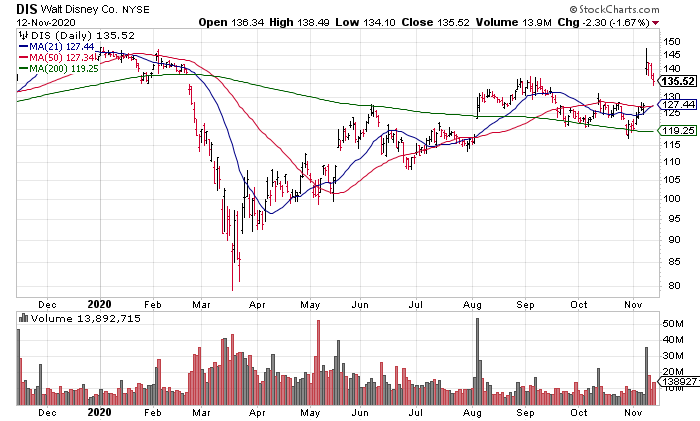

Let’s start with DIS since I already discussed MCD in Tuesday’s morning email. DIS’s business has two major segments, Media, which is itself divided into Cable (includes ESPN) and Broadcasting (includes ABC), and Parks. Not surprisingly, Media had a solid quarter as people are still staying at home more than usual with Revenue +11% and Segment Operating Income +5%. Also no surprise, Parks had a terrible quarter with Revenue -61% and a $1.1 billion Segment Operating Loss. On an adjusted basis, DIS lost 20 cents/share. Nevertheless, investors liked the quarter with DIS shares +4% in the premarket to near all time highs at $141 as of 2:15am PST. Obviously, investors aren’t pricing DIS on current earnings. What’s going on is that investors are looking through 2020 as a “lost year” due to COVID and valuing stocks on 2021 earnings and beyond.

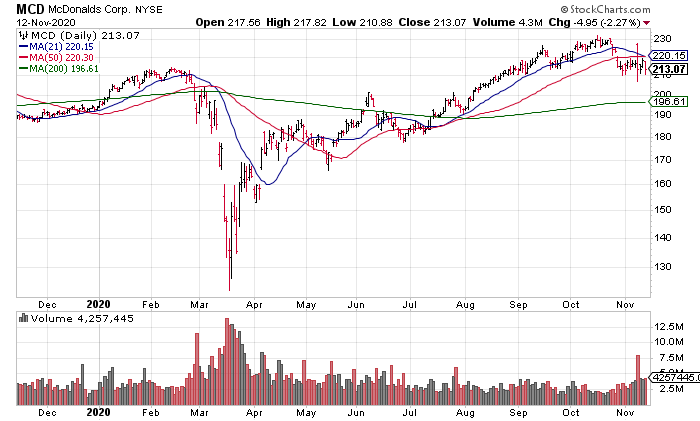

The same dynamic is clearly in play with MCD as well. MCD reported 3Q Global Comps of -2.2%, though the US was +4.6%, with comps improving sequentially throughout the quarter. MCD shares are also trading near all time highs.

The logic to this pricing is that COVID-19 is temporary and not indicative of the likely long term performance of these businesses. Therefore, it makes the most sense to look through 2020 as a “lost year” and focus on the out years. Improving economic statistics and corporate fundamentals support this perspective – though we still remain far below the 2019 peak. However, it depends on the assumption that this trend will continue until the economy reaches its pre-COVID peak sometime next year. It also ignores the fact that these stocks are already trading at extreme valuations based on peak 2019 earnings. I find the first assumption questionable and the second fact a limiting factor for upside in stocks even if the first assumption turns out to be correct.

Let’s start with valuations. While DIS reported calendar year 3Q earnings yesterday afternoon, it was the end of their fiscal year. They earned an adjusted $2.02/share in the year ended October 3, 2020 and $5.76 in the year ended September 28, 2019. Using peak earnings from fiscal year 2019 on the current premarket price we get a 24.5x P/E multiple ($141 / $5.76 = 24x). That’s not cheap. So, even if we were to make a full recovery sometime next year, DIS’s valuation already more than fully reflects this.

Same thing for MCD. MCD earned $7.84/share Non-GAAP in 2019. Using Thursday’s closing price of $213, we get a trailing P/E of 27x. Again, even if we do see a full recovery sometime next year, MCD’s valuation already more than fully prices that in.

Valuations make me think there is little upside for stocks – even if we make a full recovery next year. But I also question the assumption of a full recovery sometime next year. This view is widely held and was exemplified in a presentation I heard last night by Christopher Thornberg of Beacon Economics, sponsored by my CPA Petrinovich and Pugh. Thornberg has complete scorn for hedge fund managers like Ray Dalio who think this will be a multi-year recovery (see the podcast Chris Thornberg: Why The Economic Forecasters Are Dead Wrong: https://poddtoppen.se/podcast/272512829/leadership-and-loyalty/chris-thornberg-why-the-economic-forecasters-are-dead-wrong) claiming that the V-shaped recovery is already a fact and we will make a full recovery by the end of next year.

Thornberg is correct that all the economic statistics as well as corporate fundamentals are recovering from their 2Q (“COVID Quarter”) trough. Like most others economists and strategists, he extrapolates this forward to a full recovery by sometime next year. It seems reasonable but it ignores the potential effects of all the government intervention to combat the pandemic. I wonder if the longer term effects of such massive stimulus won’t derail the macro economy and prevent us from returning to the pre-COVID peak.

Let’s briefly review what the government has done. The Fed added $3 trillion to its balance sheet in a matter of months earlier this year, bringing it to about $7 trillion. That’s a lot of money injected into financial markets and, in my opinion, is the primary cause of the rally in financial securities which, in our highly financialized economy, has stabilized the real economy. The Federal Government has done its part too with massive fiscal stimulus resulting in a $3.1 trillion deficit in the just completed fiscal year 2020. Expect more deficits going forward, especially under a Biden White House, adding to our $27 trillion pile of national debt.

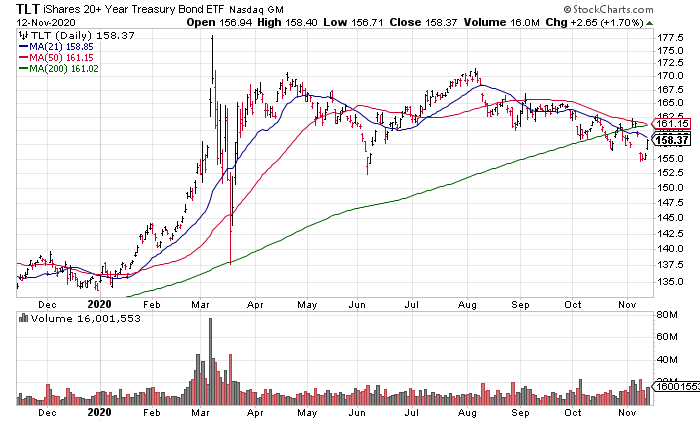

Like Howard Marks (https://www.oaktreecapital.com/docs/default-source/memos/coming-into-focus.pdf), I am concerned about the longer term consequences of this unprecedented government stimulus (https://www.topgunfp.com/the-hallmark-of-a-bubble-the-long-term-consequences-of-massive-government-stimulus-and-bank-earnings/) for the $, inflation and interest rates. Were foreign investors to lose confidence in the $, because everybody knows the Fed will continue to be easy and the deficits monetized, this could lead to a decline in the $ resulting in inflation and rising interest rates. In our heavily import reliant and debt heavy economy, this would be potentially crippling. That’s why I don’t think the assumption of a full recovery sometime next year is a lock: the macro environment may not cooperate as a result of everything the government has done to counteract COVID economically. Watch the TLT ETF (Long Term Treasuries) to see how investors are thinking about these things.

It was difficult to listen to Thornberg dismiss people with views like mine (and Ray Dalio and Howard Marks) with complete contempt yesterday on the podcast and his presentation, but I always like to understand how the other side is thinking. Nevertheless, combining valuations that are already expensive on peak 2019 earnings with the far from certain assumption that the economy will make a full recovery sometime next year suggests to me that most stocks are a bad investment right now, regardless of what Thornberg and his ilk say.