Note: A few months ago I started writing a daily morning market email for clients, friends and family. I recently decided to start making this email more broadly available. Email me at gfeirman@topgunfp.com if you’d like to be added to the list.

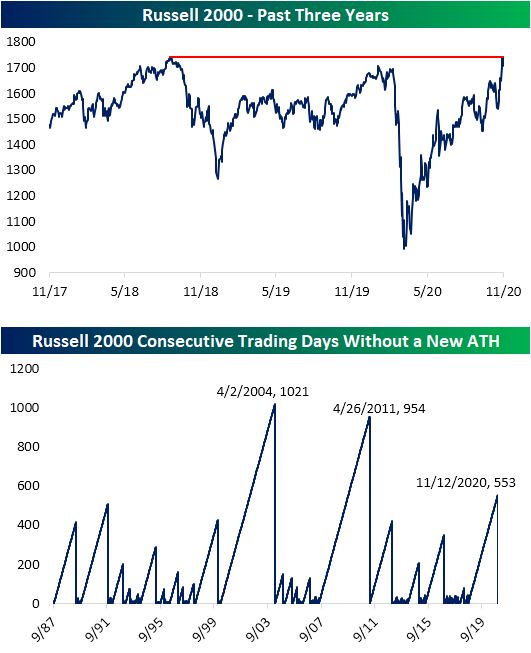

The most important thing that happened yesterday (Monday) was the continued outperformance of the Russell 2000, which followed through on Friday’s marginal new all-time closing high by breaking out (+2.37%) while the NASDAQ underperformed (+0.8%), thus adding weight to the idea that the rotation from Growth to Value is for real this time (The best chart I could find shows the Russell 2000 as of Friday’s close. Remember to add +2.37% to that chart which would make the breakout much more apparent).

I listened to about half of Grant Williams and Bill Fleckenstein’s October 15, 2020 podcast with Macro strategist Felix Zulauf last night (https://podcasts.apple.com/us/podcast/the-end-game-ep-9-felix-zulauf/id1508585135). Zulauf apparently called the start of the great bond bull market in 1981, stayed bullish bonds for 40 years and is now calling its end. (This interview was done before Pfizer’s #COVIDVaccine announcement last Monday and the yield on the 10 year treasury was about 15 basis points lower than it is now). What’s relevant for my purposes here is that Zulauf thinks rising interest rates will be bullish for #Value and bearish for #Growth. Add in the #COVIDVaccine plus the price action since last Monday and you have more and more evidence that the #Rotation is lasting and durable this time.

I’m guessing that yesterday (Monday, November 16) was the 3Q deadline for investors who are required to file quarterly 13Fs of their holdings with the SEC because everybody seemed to be filing theirs. The one that always interests me is Berkshire Hathaway.

Four moves stood out to me in Buffett’s 3Q 13F, which I used Whale Wisdom to analyze (https://whalewisdom.com/filer/berkshire-hathaway-inc#tabholdings_tab_link). The first two were a 46% reduction in its holdings of Wells Fargo (WFC) and a 95% reduction in its holdings of JP Morgan (JPM). Berkshire sold about $3 billion of the former and $2 billion of the latter. The third move that stood out to me was that Berkshire sold its entire Costco (COST) position (approximately $1.5 billion). Lastly, and this is more of personal interest, Berkshire increased its position in Kroger (KR) by 13% during the quarter. Top Gun bought KR on 9/14/20 for $33.15. I think it’s a high quality business at a compelling valuation and I’ve done well with it a number of times in the past. Apparently, Buffett, or one of his lieutenants, likes it too.

A couple loose ends to wrap up this morning. Japan’s Nikkei has broken out to levels not seen since 1991. I’ve been hearing a lot of chatter about the value in Japanese shares and investors seem to be rotating into them along with the overall shift from growth to value that I’ve been analyzing in my morning emails since last Tuesday (Zulauf discussed how the American indexes are more heavily tech and therefore growth weighted while Europe and Japan have more real economy representation and are therefore weighted more towards value).

If you want to speculate in stocks, I think the preferred vehicle is now the IWM instead of the QQQ and you might want to add some spice with the iShares MSCI Japan ETF (EWJ). In both cases, you’re buying cheap, long neglected value stocks which are finally showing technical strength. That’s the kind of trade that can really work. I’ll be looking for a pullback to potentially put on this trade myself.

Lastly, the S&P announced yesterday after the close that Tesla (TSLA) will be added to the S&P 500 before trading on Monday December 21 (https://www.prnewswire.com/news-releases/tesla-set-to-join-sp-500-301174104.html). TSLA shares are currently +$50 (12%) in the premarket so that will be a stock to watch today.