Yesterday’s action, especially in the small cap Russell 2000, seems to have lit a fire under financial markets. Here are yesterday’s returns for the major indexes:

S&P: +0.56%

NASDAQ: +0.22%

Russell: +1.85%

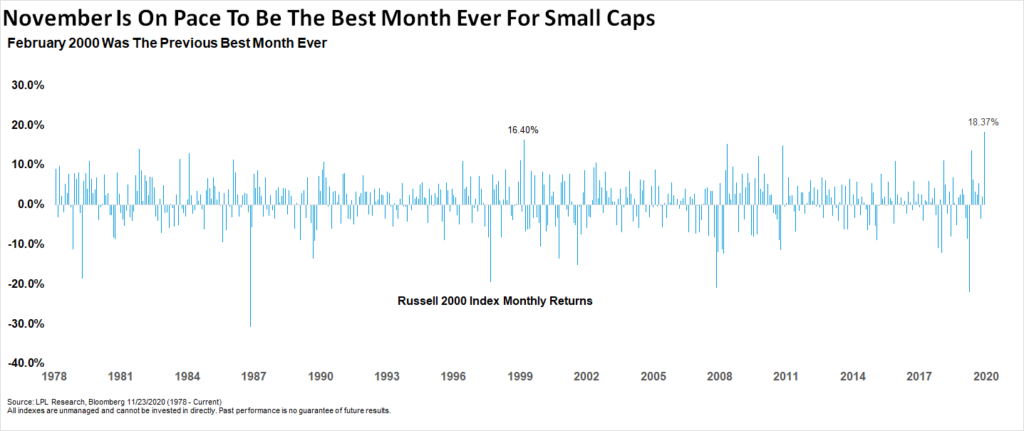

The Russell 2000 is now having its best month ever, up ~18.4% through yesterday (Chart via Ryan Detrick).

In its wake, Japan’s NIKKEI was +2.50% overnight (Tuesday in Japan) and our Futures are ripping again: S&P Futures +0.76%, NASDAQ Futures +0.35% and Russell Futures +1.29% as of 1:42am PST.

The imminent correction I called for, based on Andrew Thrasher’s argument, data and chart in “Can you have too much of a good thing?” (November 17: https://www.athrasher.com/can-you-have-too-much-of-a-good-thing/), prior to a nice year end rally, does not seem to be materializing. Instead, we are just continuing to rally without letup.

Investors are almost universally bullish. It’s very hard to find a bear on 2021 – Mike Wilson, Chief US Equity Strategist, Morgan Stanley (Source: CNBC.com)

The breakout in the small caps above their 2018 highs around 1740 and now their follow through through 1800 yesterday has ignited a bullish mania, especially among technicians.

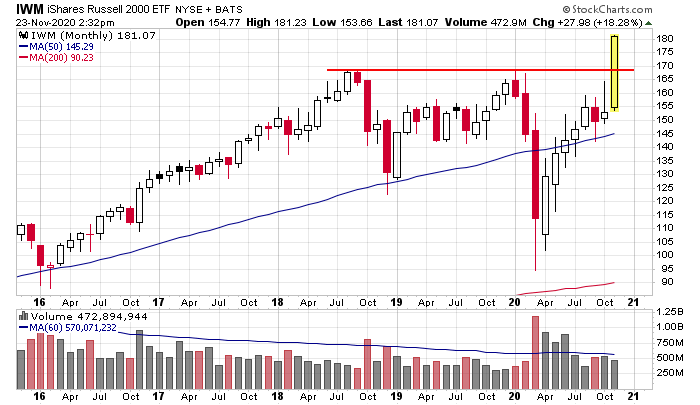

Yesterday’s The Chart Report’s Chart of the Day (https://www.thechartreport.com/11-23-20/) was a beautiful monthly 5 year chart of the Russell 2000 by Jason Leavitt clearly showing its breakout to new all time highs. Also interesting was his commentary: “If you’re looking for a top, STOP. We’re closer to the beginning of the move not the end” (Jason Leavitt, Twitter, Monday November 23, 11:34am PST: https://twitter.com/JasonLeavitt/status/1330957936231915523?s=20).

Another technician who shares the view that this is the just the beginning of a new bull market is Dan Russo (“What if this is the start of the bull market?”, November 16: https://mareamarketmusings.substack.com/p/what-if-this-is-the-start-of-the?utm_campaign=post&utm_medium=web&utm_source=twitter). Russo’s post contains some recent market history but his argument boils down to the strength (at the time) and now breakout in the Russell 2000 which he believes, correctly IMO, closely reflects the real economy.

I tweeted Russo’s blog post with the the commentary “Another technician who thinks this is just the start of a new bull market” (Top Gun Financial, Twitter, Monday November 23, 2:59pm PST: https://twitter.com/TopGunFP/status/1331009558580318209?s=20). Happily, Russo is not one of those rigid dogmatists unwilling to engage with those with differing points of view. He replied that he was willing to entertain bearish views and we had a nice 20-30 minute exchange on Twitter.

Dan demonstrated his extensive knowledge of pricing across a broad array of markets as well as intermarket relationships, the ability to interpret the meaning of the ratios between the prices of various assets. For example, Dan pointed out how investors were moving out on the risk curve in fixed income, how copper was outperforming gold as well as the significantly broadening breadth of the rally (catalyzed by Pfizer’s COVID vaccine study results announcement on Monday November 9).

I quickly discovered that I was engaged with a worthy opponent. What was ultimately revealing for me was that Dan and I kept bumping up against the same issue: all his arguments were price i.e. technical ones while price only reflects investor perception not economic reality. (Like most technicians, Dan has a different take on the meaning of price). When I pressed him on this, he finally cited some fundamental reasons to be bullish but it was half hearted. I’m sure that even he will admit that he’s bullish because of the price action i.e. technicals.

For me, technicals are never a reason to be long term bullish. Technicals tell you what’s happening right now and how investors are positioning themselves going forward. It is a pure reflection of investor psychology as distinct from economic reality which can only be gleaned by doing fundamental analysis on corporate earnings reports as well as Macroeconomics (which, admittedly, is less precise and more of an art).

I ultimately suggested that Dan and I were unlikely to persuade one another because our investment philosophies were “incommensurable”, but the exchange appears to have been profitable for both of us as we followed each other on Twitter. The best way to develop and improve one’s views IMO is to engage with the best that can be said from the opposing point of view. While this is emotionally difficult to do, and therefore few are willing to do it, I personally seek it out and was fortunate to find someone who does as well. Thank you Dan!

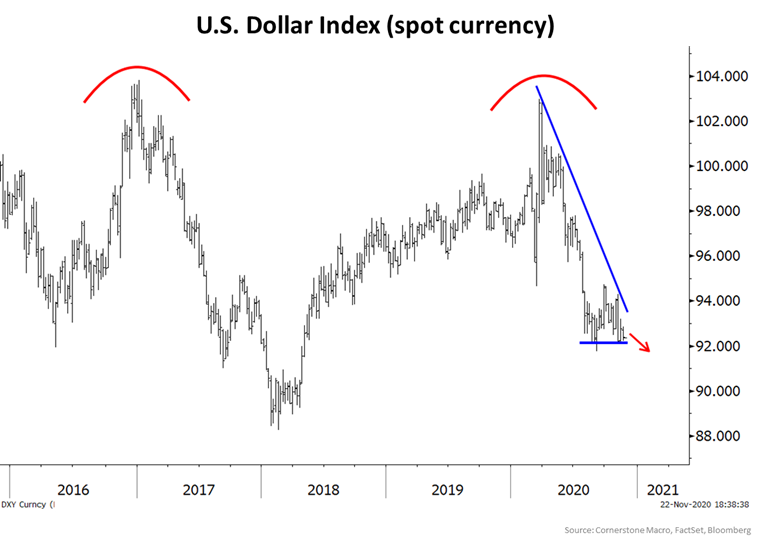

Before wrapping up, I want to point out that the dollar index is close to breaking down below previous support at 92 (Chart via Carter Braxton Worth).

What’s interesting is that there is a debate about whether this is bullish or bearish for risk assets. As some of you know from previous writing, I think it’s bearish as a declining dollar means higher import prices for our import reliant economy which means inflation. In addition, a declining dollar could cause foreign investors to sell dollar denominated assets, especially treasuries, as the decline in the dollar versus their home currency overwhelms any return they are getting, resulting in higher interest rates.

Some technicians (Russo and Gary Savage, for example), however, believe dollar weakness is bullish. A weakening dollar does seem to light a fire under risk assets and this is more than mere correlation. Anything priced in dollars goes up as the dollar declines in value generally, but, for some reason, especially risk assets. There is an argument as to why but I can’t for the life of me articulate it at the moment.

At any rate, this should be on your radar. We’ll see what the implications are for the economy and risk asset prices should the dollar index break down below 92.