Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

2020 represents the complete triumph of liquidity over fundamentals – Matt King, Citigroup, 2021 Outlook (Source: Lisa Abramowicz Twitter, December 8, 11:06am PST)

Stocks have won big, not primarily because earnings went up but because the cost of money went down almost to zero – James Mackintosch, “Thank the Fed for This Year’s Run in the Stock Market” (SUBSCRIPTION REQUIRED), WSJ, December 7

Matt King of Citigroup has kicked off his 2021 Outlook with the investment sentence of the year. Nothing better encapsulates 2020 than “the complete triumph of liquidity over fundamentals”. In his article from Monday’s WSJ, James Mackintosh does an excellent job analyzing why this is so and the implication of 2020’s massive stock rally for 2021 and beyond.

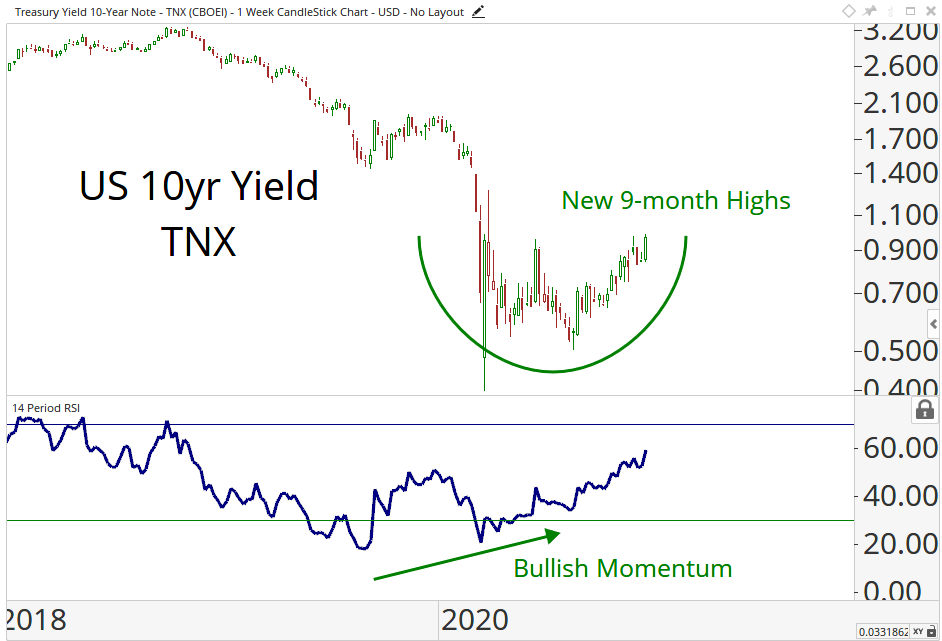

JC Parets of All Star Charts had a nice post yesterday on interest rates (“Are US Interest Rates Going Higher?”, JC Parets, December 8) in which he argues that interest rates are rising and that is bullish for stocks because it means money coming out of bonds and into stocks. That is true but there’s more to it than that.

While money flowing from bonds to stocks is bullish, the rise in interest rates will put pressure on our heavily indebted economy. Governments (State and Federal), businesses and households are all heavily indebted. In fact, we have never had more debt and it just keeps growing. Which means that, in the words of Investech’s Jim Stack, this is “the most interest rate sensitive market in history”. If interest rates keep rising, this bearish effect will squash the bullish effect of money flowing out of bonds and into stocks.

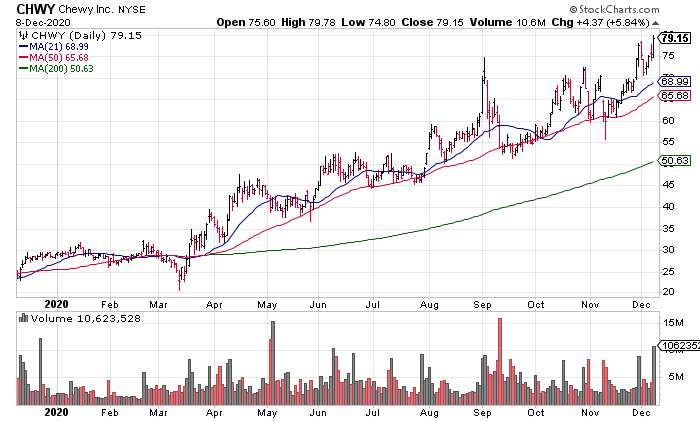

Lastly, I’ll briefly review Autozone (AZO) and Chewy (CHWY) earnings. AZO ($26 billion market cap) reported comps +12.3% and EPS +30% to $18.61 Tuesday morning. The numbers looked fine to me but the stock is extended and got hit to the tune of 5.29% yesterday on 3x average volume.

CHWY ($32 billion market cap) reported revenue +45% and an 8 cent EPS loss Tuesday afternoon. The stock closed yesterday at ATHs, is massively overextended and down more than 1% in the premarket.