Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

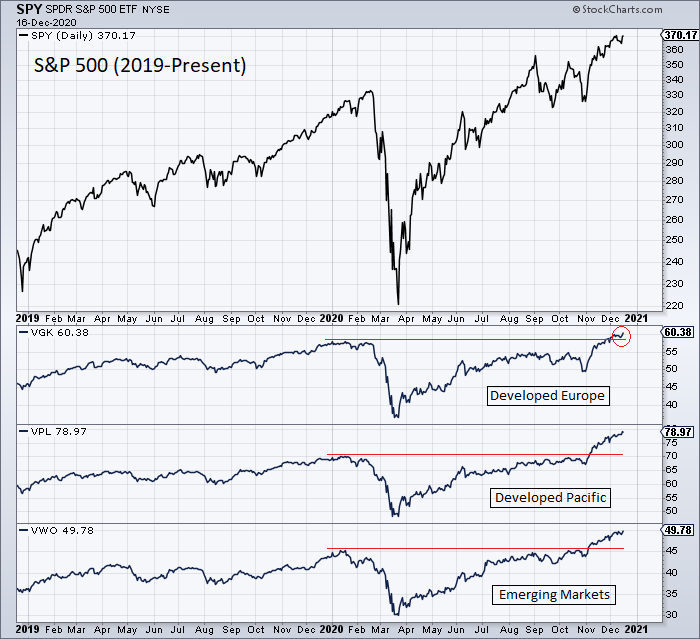

Yesterday (Thursday), the S&P surged above Scott Redler’s resistance zone of 3,697-3,712 to close at 3,722.5 – a new ATH. And it’s not just American stocks that are making new ATHs: The whole world is breaking out (Source: Mark Ungewitter Twitter, Thursday December 17, 4:02am PST).

There are two perennial investment philosophies. Their fundamental premises can be stated as follows:

1 – Price is truth

2 – There is a distinction between price and value

The former is usually associated with Technical Analysis, the latter Value Investing. To the technicians, the price action looks like the beginning of a mega bull market. To value investors, this looks like a massive bubble (see yesterday’s “The Biggest Bubble In History”, Top Gun Financial, Thursday December 17).

Value Investing implies contrarianism: You invest when the price of a stock diverges significantly from its value. The main problem with contrarianism is timing: “The stock market can stay irrational longer than you can stay solvent,” John Maynard Keynes famously said.

The great Michael Steinhardt had a theory called Variant Perception. He wanted to look for stocks where price diverged significantly from value. However, he also wanted a catalyst that would cause the two to converge. That is, he recognized that just because the two diverged didn’t mean they would converge once he put on a position. Something had to cause them to. He needed his timing to be right.

Ben Graham was getting at the same thing when he said that “The market is a voting machine in the short term and a weighing machine in the long term.” In other words, price is determined by the crowd in the short term but ultimately the fundamentals prevail and determine longer term market direction.

A second problem with Value Investing is that it’s psychologically difficult. It’s difficult to take a position against the crowd and and miss out or even watch the market move against you. Most people don’t have the psychological makeup to do it and so they become technicians or simply chase the hot stocks of the moment. Going against the crowd isn’t easy and it can make you look out of touch at the moment, but it is what great value investors sometimes do.

Buffett on what an investor should have done in response to the rise of the automobile industry: The thing you should have been doing was shorting horses. I’m kind of disappointed that the Buffett family was not shorting horses – Warren Buffet, Sun Valley, July 1999 (quoted in Alice Schroeder, The Snowball (2008), pg. 18)

Going contrarian is exactly what Warren Buffett did in a famous speech at Herbert Allen’s Sun Valley Conference in July 1999. Buffett does not like to prognosticate on the overall market. July 1999 at Sun Valley was the first time he’d done it in 30 years, when he shut down his initial investment partnership in 1969 citing overall market conditions and psychology.

In that speech, Buffett essentially said that the Dot Com Bubble was unsustainable. It had been a great bull run since 1982 but the next 17 years were unlikely to be like the previous 17. Many at the time questioned Buffett, believing that his time had passed (see Schroeder pg. 21). In the end, the bubble popped 9 months later and the speech ended up cementing Buffett’s legacy as one of the greatest investors of all time.

Buffet told another funny anecdote in his Sun Valley speech. An oil prospector arrived in heaven to find that the pen where they kept the oil prospectors was full and there was no room for him. So the oil prospector yelled out “Oil discovered in hell” and all the oil prospectors took off for the underworld. St. Peter, who had been apprising him of the situation, told him to go ahead and make himself at home. “No, I think I’ll go along with the rest of the boys. There might be some truth to that rumor after all” (quoted in Schroeder pg. 19). Sometimes you got to short horses but you really shouldn’t prospect in hell.

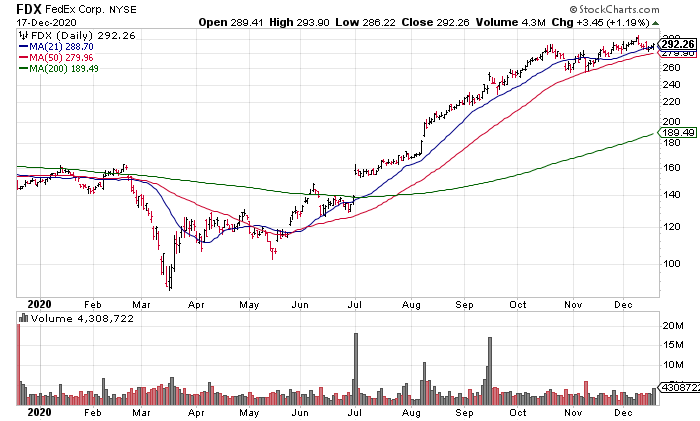

Lastly, I want to briefly mention Federal Express (FDX) earnings and their reaction from yesterday afternoon. FDX reported a terrific quarter with Revenue +19% and EPS +92%. However, it is off about 3% in the premarket as the stocks run up has apparently already priced it in.