Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The first thing I want to talk about is “The Biggest Consensus In History” (the term is Deutsche Bank Head Strategist Jim Reid’s, quoted in Randall Forsyth, “All the Goods News Is Already Baked Into Stocks” [SUBSCRIPTION REQUIRED], Barron’s, Saturday December 19). Almost without exception, investors believe that 2021 is going to be a great year for the economy and stock market due to the COVID vaccines and subsequent economic reopening. Strategists are tripping over each other to raise their 2021 price targets (Chart Source: Sentient Trader, “Wall Street looks set to party in ’21”, Friday December 18).

The problem is that, as Bob Farrell said, “When all the experts and forecasts agree, something else is going to happen” (MarketWatch, “Learn a lesson — before you get one”, June 11, 2008). Sam Stovall added some color: “If everybody’s optimistic who is left to buy? If everybody’s pessimistic, who is left to sell?”

The vaccines are extremely good news from an economic and human standpoint. If everything goes smoothly, medical experts suggest COVID should be mostly under control by the second half of 2021. The problem is that the market’s move since Pfizer announced its vaccine on Monday November 9 has already priced this in.

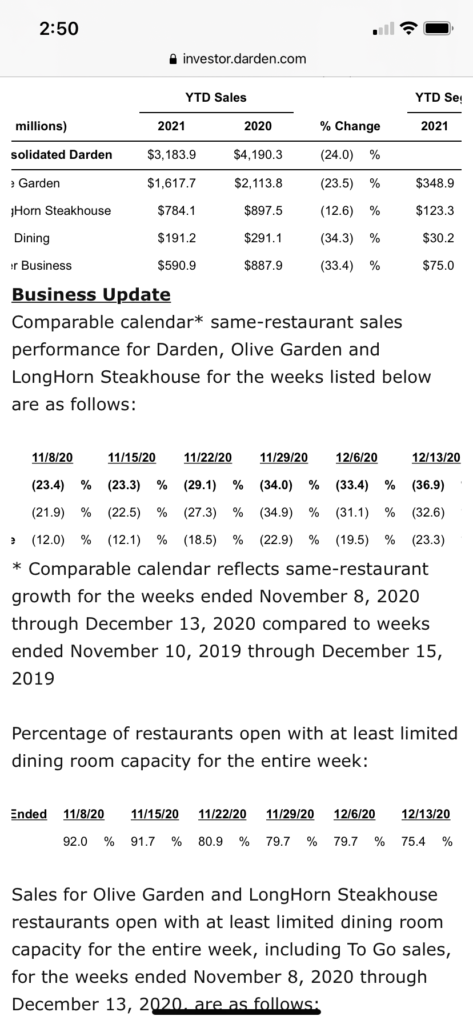

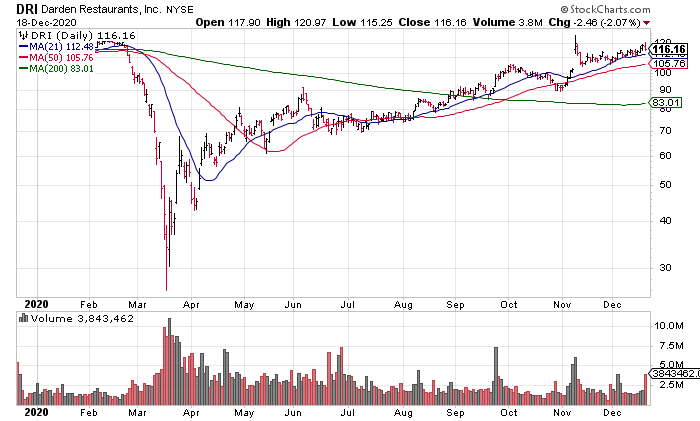

Next, as an example of what I just said, I want to say a word about Darden Restaurants (DRI, $15 billion market cap) earnings Friday morning. While -20.6% comps for the quarter ended November 29 was already bad, DRI included a table under the heading “Business Update” showing things getting worse as the coronavirus surges once again and restaurants are forced to suspend on site dining.

As you can see from the tables above, comps got even worse towards the end of the quarter and in the two weeks after the quarter ended as the coronavirus surged and DRI was forced to close on site dining in more of its restaurants.

While the stock market is pricing DRI for full normalization, DRI forecast sales of 65% to 70% of the prior year for the current quarter. This is just another example of how the stock market has already priced in normalization. So, even if everything goes smoothly and we get it, stocks are already priced for it and they go nowhere. If things don’t go so smoothly, they’re overpriced and go down. There is very little upside for a stock like DRI and so many others at these prices.

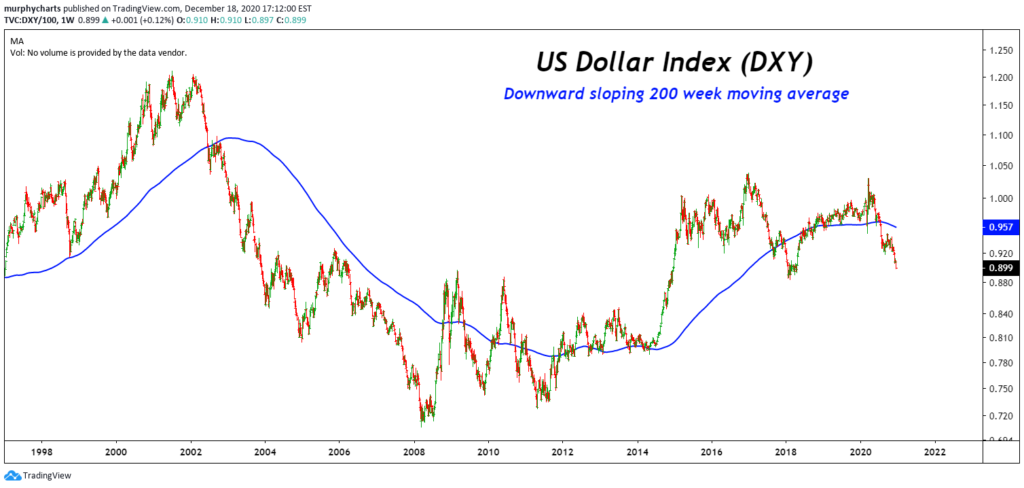

Third, I want to discuss the $ which continues its freefall. Shane Murphy had a nice weekly candlestick chart of the dollar going back to the late 1990s yesterday (Chart Source: Shane Murphy Twitter, Friday December 18, 2:14pm PST)

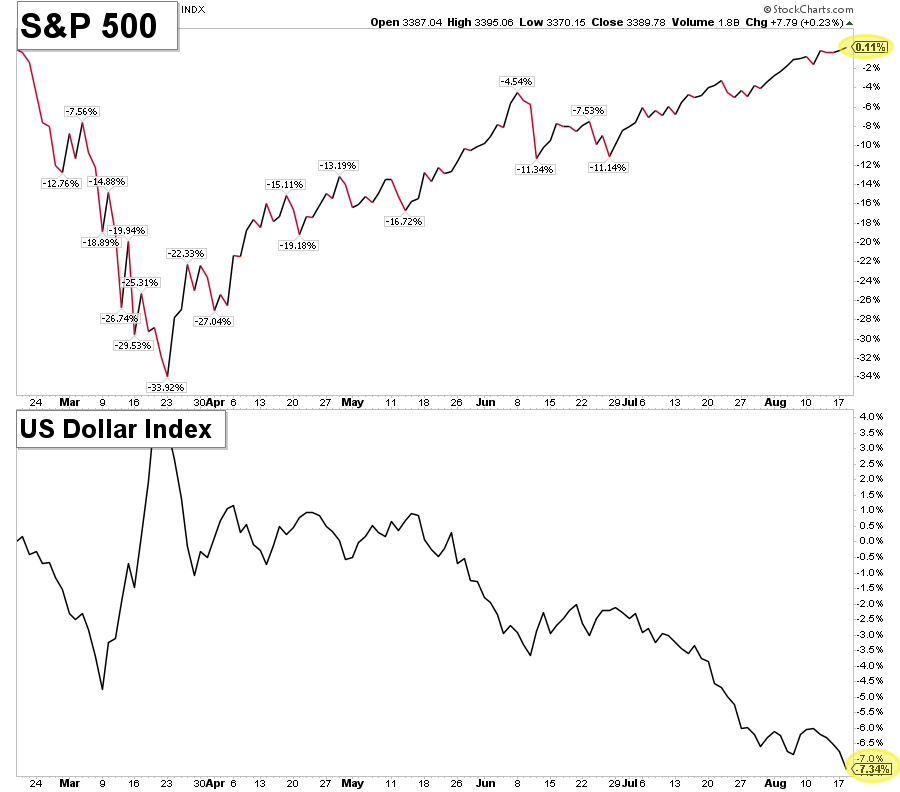

The question is if this is bullish or bearish. Aaron Jackson did the first step of the analysis in “King Dollar” (August 19) with a chart showing the inverse relationship between the S&P and the $ which makes sense, according to Jackson, because the $ is the “denominator” of the S&P and everything else priced in $s so that when it goes down, they go up.

This is correct as far as it goes but there’s more to be said. A declining $ is inflationary and is likely to cause interest rates to rise. It is inflationary because when we import something, we must first convert our $s into the exporting country’s currency. If the $ is declining against that currency, as it is against almost all of them now, it takes more of them to buy the import. That means the price of things goes up for consumers and businesses buying imported goods i.e. inflation.

Second, foreigners holding $-denominated assets now have to factor in the currency risk on their investments when they convert them back into their home currency. A 1% yield on the 10 year treasury is one thing. But when the $ declines 3% against your currency over your holding period, that’s something you need to consider as well. In other words, as the $ drops, foreign investors are likely to sell $-denominated assets, especially the vast amount of treasuries held by foreign central banks, which will cause interest rates to rise.

It is with great pain that I am sharing with you that my 42 year old son was killed in a car crash yesterday – Ray Dalio Twitter, Friday December 18, 5:41pm PST

First, my heart and prayers go out to Ray and his family. It’s a terrible tragedy. Second, being 43 years old and having been in a couple of close call car accidents, this strikes close to home. It’s a reminder to us all that even if you’re a multi-billionaire like Dalio, money doesn’t insulate you from many of life’s hardships. We’re all human and therefore vulnerable and mortal, even the rich and famous. There’s more to life than money. Carpe Diem!