Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

In order to free up time tomorrow (Sunday) and the rest of next week for other work, I am going to write Monday morning’s market blog tonight.

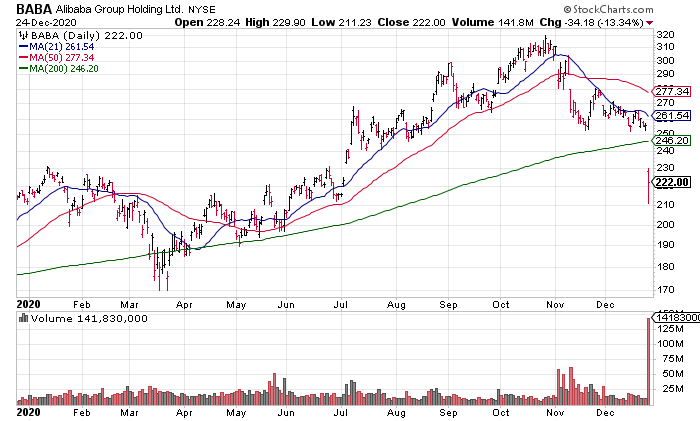

On Thursday, a completely unimportant day, something important happened: The Chinese government initiated an antitrust probe into Alibaba (BABA), hitting its shares to the tune of 13.34% on 7x average volume – by far the highest volume day of the last 12 months.

BABA has a market cap of in excess of $600 billion – even after Thursday’s hit – and is one of the seven most important stocks in the world (#1 – AAPL #2 – AMZN #3 – MSFT #4 – GOOGL GOOG #s 5-7 FB TSLA BABA (not sure about the order)). It is an important component of the FXI, the leading Chinese Market ETF, and the largest component of the EEM, the leading Emerging Markets ETF. Clearly this is a negative for world equity markets and bears watching.

Above all, Xi Jinping Thought aims to grant Mr. Xi the legitimacy to remain in power and continue his quest to make China a rich, truly global power by 2049, the centenary of Mao’s victory – Jeremy Page, “How The US Misread China’s Xi: Hoping for a Globalist, It Got an Autocrat”, WSJ, Thursday December 24, A1 [SUBSCRIPTION REQUIRED]

The WSJ ran an important front page piece on Xi Jinping, China’s leader, on Thursday. What becomes clear from the article is that China is has no intention of becoming a free society like ours but it does have ambitions to be THE global superpower. This is The New Cold War. It will likely be fought in the economic sphere but its outcome will have important geopolitical consequences.

Beijing has used the crisis to accelerate its long-planned transition from an export-led economy dependent on the rest of the world to one driven more by domestic consumption – Randall Forsyth summarizing Stephanie Pomboy, “China’s Currency Is Getting Stronger, What That Means for the US”, Barron’s, December 26 [SUBSCRIPTION REQUIRED]

One important development that hasn’t gotten a lot of discussion is the appreciation of the Yuan against the Dollar over the last 7 months. At its peak in May, the Dollar bought almost 7.2 Yuan. Now, it buys slightly more than 6.5.

This is important because of the amount that we import from China and how much of our debt they have historically bought. As the Yuan strengthens against the Dollar, our imports from them become more expensive resulting in inflation for consumer goods and business inputs. China has also stopped accumulating US treasuries which, ceteris paribus, should cause our interest rates to rise. Finally, according to Stephanie Pomboy, by letting its currency appreciate, China is trying to make the Yuan a viable alternative to the Dollar: “Progress toward that goal, I believe, will be the central topic shaping the New Year and those that follow,” Pomboy wrote.

“[FANMAG has] refused to confirm the new highs in the market.” If they start to break down, “that could be an important warning”, writes Ned Davis of Ned Davis Research, quoted in Ben Levisohn, “Small Caps Have Been Too Hot”, Barron’s, December 26 [SUBSCRIPTION REQUIRED]

While everybody is focused on the red hot Russell 2000 which has doubled in the last 9 months, less attention is being paid to the lagging Mega Caps that led most of the bull run since March. Of AAPL AMZN MSFT GOOG GOOGL FB & NFLX, only GOOG GOOGL has made new highs since September 2 and are therefore not confirming the overall markets new highs. As these six stocks make up more than $8 trillion in market value as of Thursday’s close, it’s a concern how much higher the market can go without them.

The best lack all conviction while the worst are filled with passionate intensity – WB Yeats, “The Second Coming”

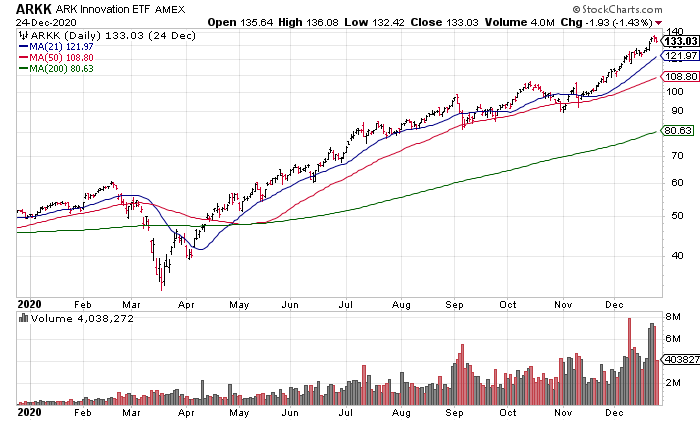

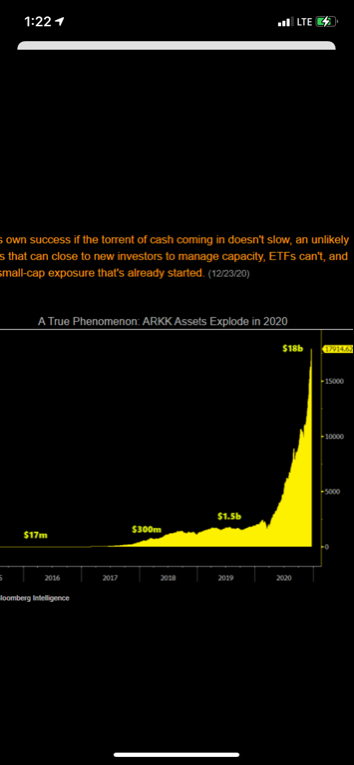

Instead of investing in the Mega Caps, investors have moved on to hotter, sexier, smaller names like those owned by Cathie Wood’s Ark Invest. Wood became famous for her outlandish TSLA Price Target which has miraculously come to fruition and Ark’s Innovation ETF (ARKK) is up more than 300% since the March lows, 40% of which has come just since November. As a result, performance chasing investors have rushed into the ETF causing AUM to explode to around $18 billion.

The Fed has made a moron look like the new Warren Buffett. What a year! You can’t make this stuff up!