Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

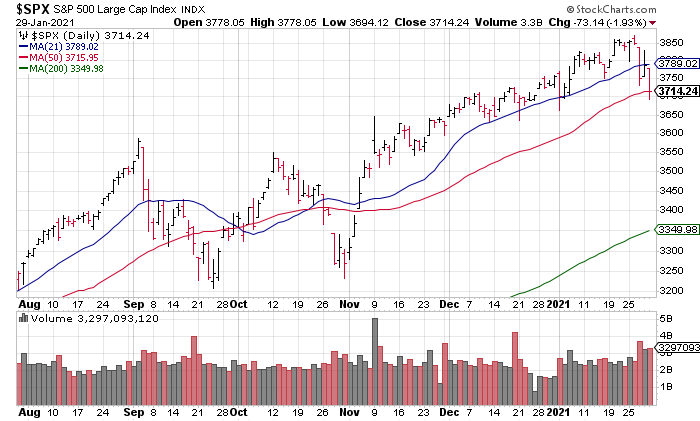

It may or may not come into play but I’m interested to see if the 50 DMA at 3,714 holds – Greg Feirman, “The Week In Review, Declining Participation, GME as Microcosm and The Weekend Rule”, Top Gun Financial, Friday January 29

In Friday morning’s market blog, I talked about Peter Brandt’s The Weekend Rule: The Friday close is the most important price of the week because it represents the price at which traders are willing to hold positions and assume the risk of a gap down on Monday.

Well, the rush to sell at yesterday’s close showed that investors aren’t too excited about assuming risk right now – a major change in investor psychology from the previous 10 months.

The selling in the last few minutes drove the S&P down to 3,714 (the number I referenced at 1:17am Friday morning in the last sentence of yesterday morning’s blog) – 1 point below its 50 DMA. If we can’t reclaim that, I don’t see much support until all the way down at the 200 DMA at 3,350. If we were to reach that level, the whole rally since the March 2020 lows would be at stake.

To me, higher volume means stronger confirmation that a move is real and we had historic volume last week of 78.5 billion shares on the NYSE + NASDAQ compared to something in the low 40 billion range for the week ending Friday January 22nd.

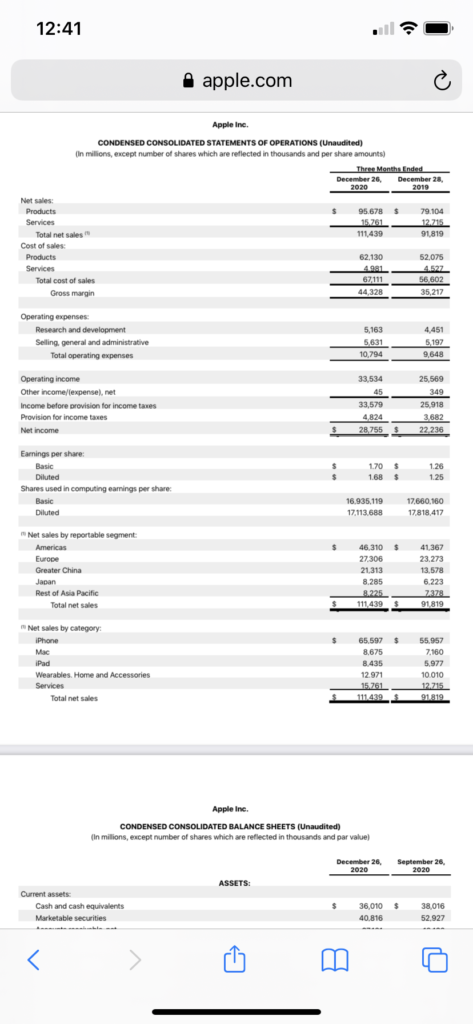

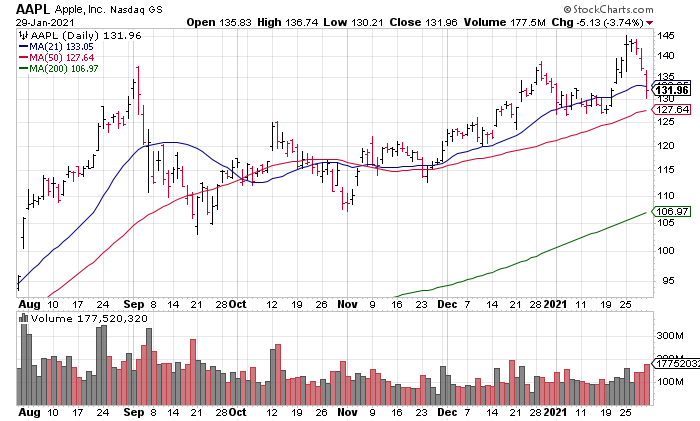

Next, I think I should say a few words about Apple (AAPL, $2.26 trillion market cap), the most important stock in the world. AAPL reported a stellar quarter Wednesday afternoon with Revenue +21% and Net Income +29%.

One would have thought such an excellent report would have propelled the stock even higher but, in fact, AAPL sold off to the tune of 7.1% in its wake on Thursday and Friday. The reaction to the news is always more important than the news itself. And such a reaction suggests that AAPL’s breakout from its early September 2020 highs may have been a false one. If so, that doesn’t bode well for the overall market.

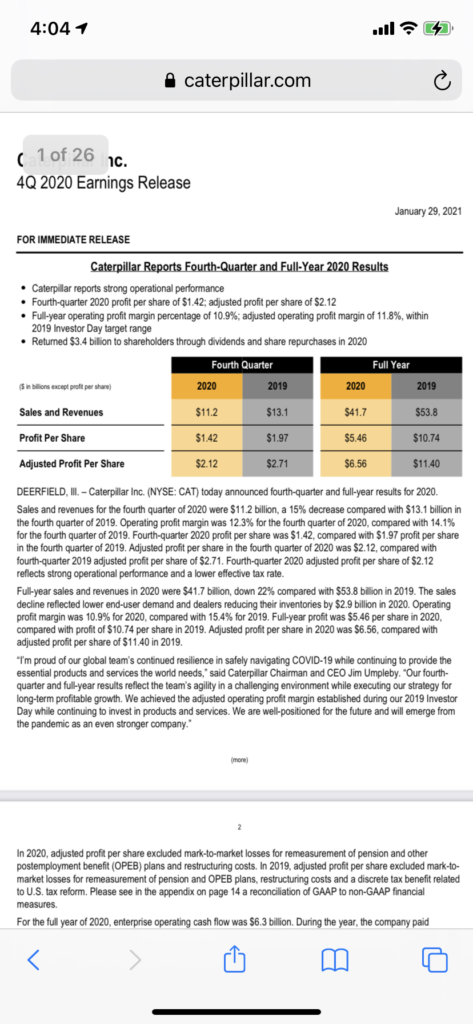

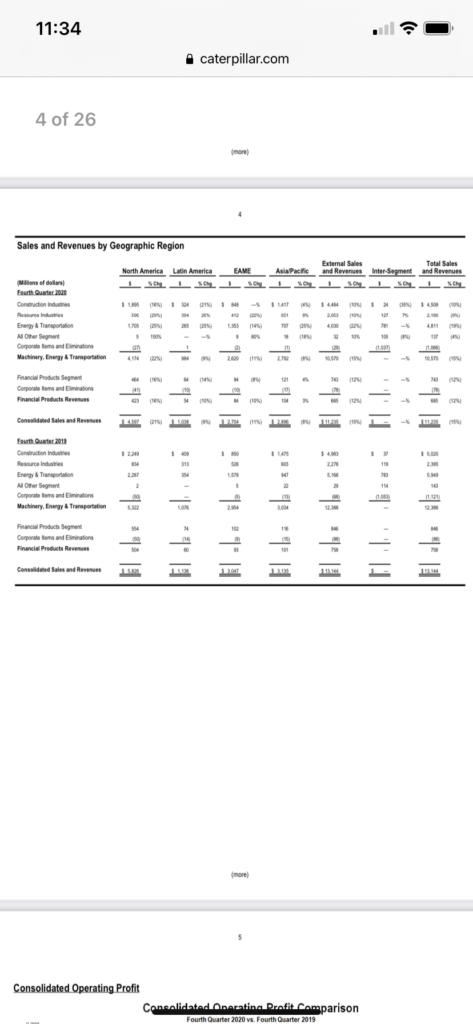

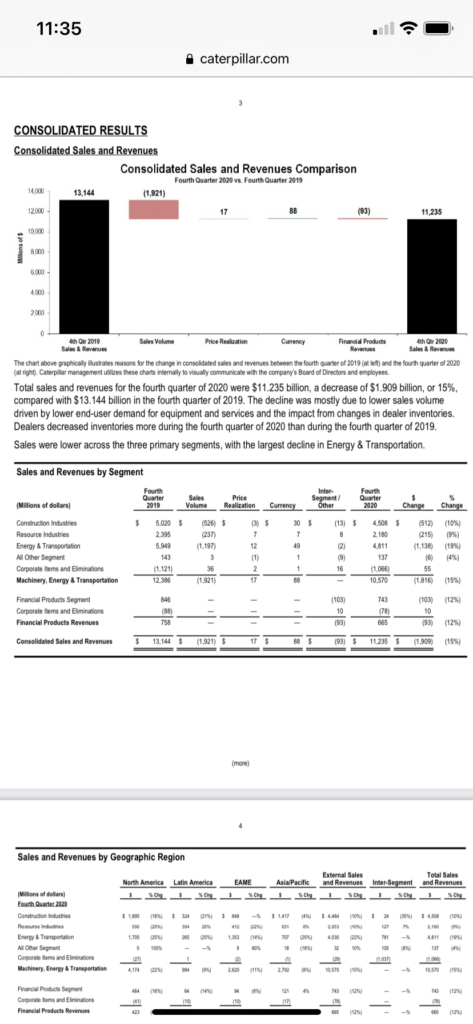

Third, I’d like to discuss Caterpillar (CAT, $100 billion market cap) earnings from Friday morning. CAT is a bellwether of economic activity and its 4th quarter results show that no V-shaped recovery is under way. Revenue was -15%, including -21% in North America, Adjusted EPS -22% and every segment of its business was down year over year: Construction -10%, Resources -9%, Energy & Transportation -19%.

The bulls narrative all along since the March 2020 lows has been one of a V-shaped recovery like 2009 but I’ve shown again and again that the fundamentals do not support such a view.

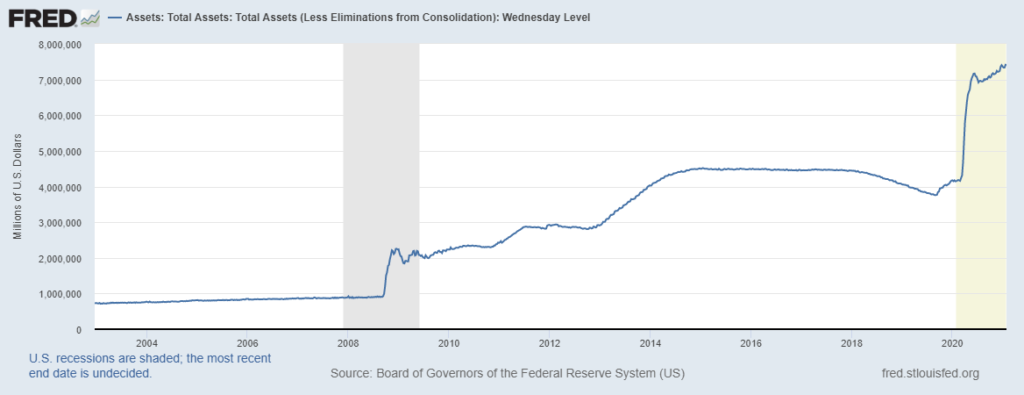

Instead, what the bull market since 2009, and especially since March 2020, has been primarily about is Quantitative Easing (QE) from the Federal Reserve. The Fed pumped trillions of dollars into the financial markets in the wake of The Great Recession and has taken that to a whole new level in response to the coronavirus pandemic. We’ve been trading primarily on liquidity, not fundamentals, the entire bull market.

We fully expect this kind of pullback will be a healthy buying opportunity. Ringing out some of this speculation is likely to be a positive – Julian Emanuel, Strategist BTIG

If all goes as planned, Chair Powell and [Treasury Secretary Janet] Yellen will be able to take a bow – Michelle Meyer, Economist, Bank of America

(Both quotes from Ben Levisohn, “GameStop Erased the Stock Market’s January Gains. February Could Be Worse”, Barron’s, The Trader Column, Saturday January 30).

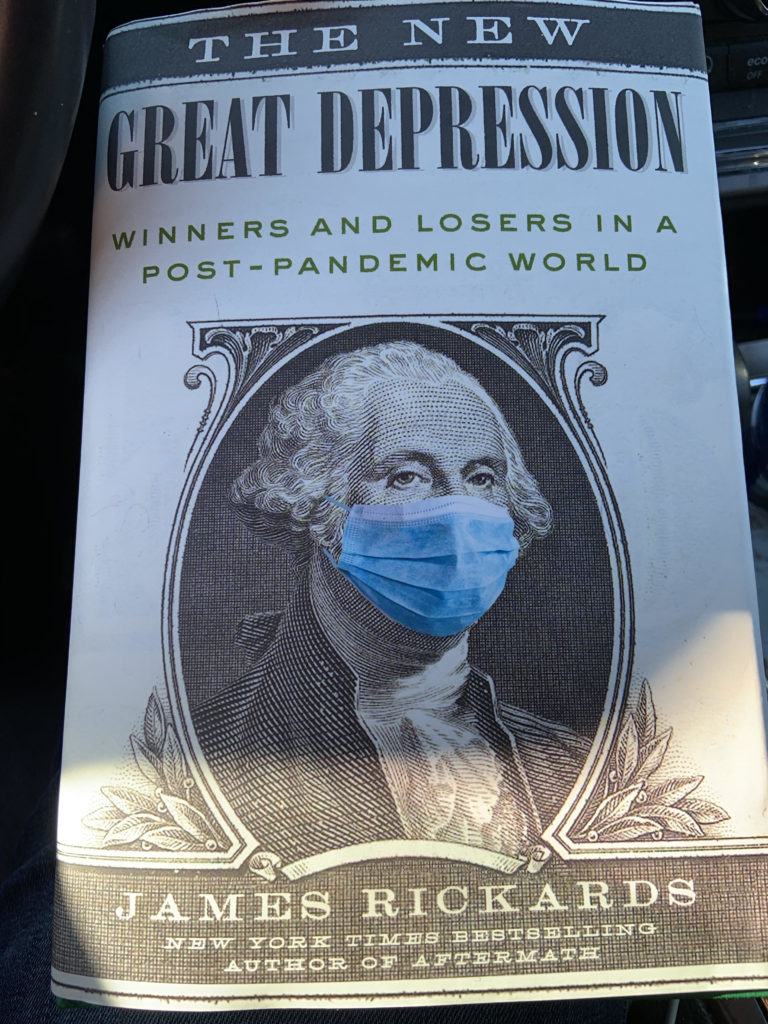

Like most, BTIG Strategist Julian Emanuel sees this as a correction and buy the dip opportunity. BofA Economist Michelle Meyer agrees, expecting economic growth to accelerate in the months ahead and achieve 6% GDP growth in 2021. It’s very likely that, after being right for 12 years, it’s wrong this time IMO. In fact, it is my belief that the bubble is popping and that will precipitate a Second Great Depression worse than the first one.

For an excerpt from Jim Rickards new book “The New Great Depression”, with which I am in full agreement, on the debate between those who believe we are in a V-shaped recovery and those who believe we are in a massive bubble see this excerpt from my Instagram. These are the moments when the wheat separates itself from the chaff and we find out whose who.