The money is starting to pour into clean energy from all corners as the energy transition emerges as a wildly lucrative opportunity rather than simply a threat to the oil and gas industry.

For the first time in 2020, energy transition investment topped half a trillion … and that’s just the starting point.

BloombergNEF says clean energy investment is set to hit $2.6 trillion this decade.

Over $14 trillion in assets of institutions, foundations, and endowments are ready to back an energy transition. Forbes calls it a “paradigm shift” …

Now, there’s a new climate czar in town, John Kerry, appointed by Biden, and he’s calling on the U.S. to accelerate the development of hydrogen, carbon capture, and other tech innovation that can reduce emissions.

The government is ready to throw tons of money at this … and the US Department of Energy is now ready to deploy the $40 billion sitting in its loan program for the energy transition.

The entire world is about to move towards running on batteries … and absolutely anything with a tie-in to this is a potential pathway to capitalizing on the momentum of this multi-trillion-dollar energy change.

That means rival EV stocks like Fisker (NYSE:FSR) …

Or highly speculative but thoroughly exciting QuantumScape (NYSE:QS), a solid-state battery offering that could disrupt everything …

And Facedrive (TSXV:FD; OTC:FDVRF), the Canadian “Silicon Valley” darling with a dizzying number of tech-driven verticals from electric ride-sharing and food delivery to an innovative EV subscription service that has picked the perfect time to get more people into EVs …

And hopes to completely change the way North America thinks about car ownership.

The EV Playing Field Is Bursting With Upside

This isn’t just about Tesla now, even if Musk is voted most likely to become the world’s first trillionaire.

EV stocks could climb up to 50% this year, Wedbush analyst Daniel Ives tells CNBC, citing a “green tidal wave globally”.

Ives expects the EV industry to grow to a $5-trillion market over the next decade, and there’s plenty of room for players other than Tesla.

EV rival stocks like long-battered General Motors (NYSE:GM), which is working hard to make EVs have that “all-American” feel.

Lucid Motors is planning to challenge Tesla, taking its first step by going public through a reverse merger with Churchill Capital Corp IV (NYSE:CCIV), and it plans to start manufacturing this year.

Fisker (NYSE:FSR) looks highly promising, as a bet on an EV maker that takes things one step further with recyclable materials and is headed up by Henry Fisker, a legend in automotive design. It’s also working towards a “platform-sharing” business model for premium EVs at less-than-premium prices.

Facedrive (TSXV:FD; OTC:FDVRF) is an EV related stock, and its recent acquisition of Washington, D.C.-based Steer is where things get really interesting …

Facedrive’s flagship carbon-offset ride-sharing and food delivery were early pioneers who saw where the EV megatrend was going … and they saw the multitude of lifestyle changes that would come along with it. That means an impressive collection of revenue verticals.

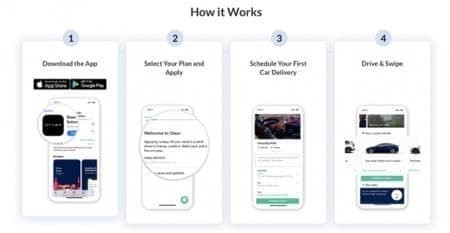

When Facedrive added Steer to their portfolio in September 2020, they upped the ante for transportation options available to consumers.

This isn’t Hertz. This is where Hertz meets Tesla.

Steer offers users an EV showroom (virtual, of course), sporting on-demand EV delivery for consumers, offering a flexible alternative to car ownership.

It makes driving an EV so much easier … and more luxurious. Users can drive the hottest EVs on the market, with no extra insurance, no maintenance and no hassle–on demand, in your driveway for as long as you want.

The Megatrend Is About To Get Another Mega Boost

The California city of Petaluma just voted to outlaw new gas stations. In fact, the entire state of California has banned the sale of new gas-powered cars by 2035.

It’s not just California, either. New Jersey is following suit, and New York City is banning new gas hookups by 2030, and the state of Washington is pushing a bill to ban new gas car sales by that same year. Even Michigan is eyeing carbon neutrality by 2050.

It’s going to prove impossible to reverse this momentum.

It’s got a world-wide effort at energy transition drive behind it, boosted by the Biden Administration.

In the meantime, the costs of clean energy are becoming dramatically cheaper than before.

EVs will soon be as cheap as conventional cars, possibly by 2024 or earlier, and energy storage prices are heading south on a fast train as well.

And all eyes will be on the innovators coming out of every corner of this megatrend … especially those that recognize the nexus between the twin threats of pandemic and climate change.

That’s where Facedrive really surprises with the depth of its tech-driven ecosystem: It’s also been on the front lines of the COVID-19 pandemic from Day One. The tech element of the pandemic is critical.

It’s not as simple as inventing a vaccine, that might not work against new variants.

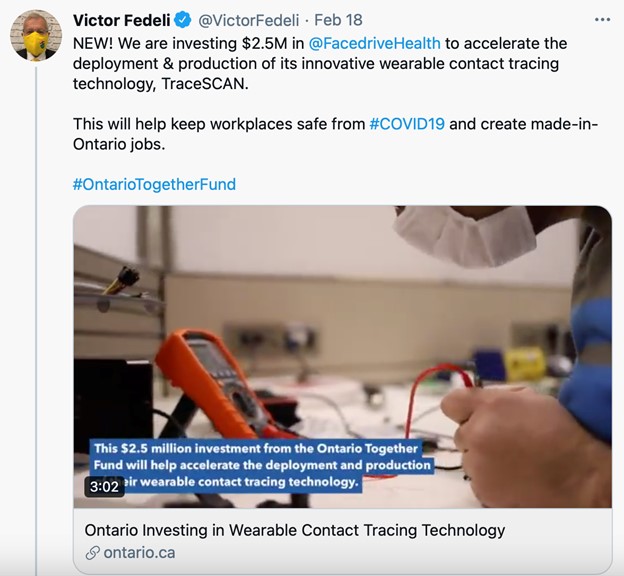

Facedrive (TSX.V:FD, OTCMKTS:FDVRF) was an early innovator of COVID contact tracing technology in Canada, and that’s won it several big deals, but the biggest boost came on February 18th, when the government of Ontario injected $2.5 million into Facedrive to accelerate deployment of the tech company’s wearable contact-tracing technology.

TraceSCAN alerts users within a workplace who have been in close contact with individuals who have tested positive for COVID-19. That means that workers in Ontario can return to the workplace for economic recovery more quickly.

Under this government project alone, Facedrive plans to manufacture some 150,000 devices and create 68 new skilled jobs for Ontario.

For a company like Facedrive, which continues to surprise investors with the diversity of its verticals that all tie into our changing lifestyle, the coming weeks and months are likely to be packed with news.

Other companies to watch as this new trend kicks into high gear:

Compared to Tesla or the legacy automakers listed above, Fisker (NYSE:FSR) is a relative newcomer to the booming electric vehicle scene, having only IPO’d in October. While it hasn’t seen quite the attention other electric vehicle stocks have seen in recent weeks, it is an important company to watch. It’s unique in the industry because it boasts the most sustainable vehicle on the road: It’s not just electric… it’s also is made with some recycled materials. That’s a huge plus considering how much investors are focusing on sustainability these days.

Though Fisker has underperformed on the market compared to NIO, Tesla, Xpeng or Li, it’s still trading on massive volume and in February alone, the company nearly doubled its share price thanks to its dealmaking abilities.

It’s becoming increasingly clear that Fisker is going places. The four-year old California based EV provider is already turning heads thanks to its innovative battery tech, and it’s already securing some major deals. In fact, just last month, Fisker signed a deal with Viggo, a European ride-hailing service to add hundreds of vehicles to its fleet.

General Motors (NYSE:GM) is one of the legacy automakers benefiting from a shift from gas-powered to EV technology. With the news of GM’s new business unit, BrightDrop, they plan to sell electric vans and services to commercial delivery companies, disrupting the market for delivery logistics.

That’s not all its working on, either. In October, auto industry legend, GM announced that it’s majority-owned subsidiary, Cruise, has just received approval from the California DMV to test its autonomous vehicles without a driver. And while they’re not the first to receive such an approval, it’s still huge news for GM.

Cruise CEO Dan Ammann wrote in a Medium post, “Before the end of the year, we’ll be sending cars out onto the streets of SF — without gasoline and without anyone at the wheel. Because safely removing the driver is the true benchmark of a self-driving car, and because burning fossil fuels is no way to build the future of transportation.”

Canada is not likely to be left out of this boom, either. GreenPower Motor (TSX:GPV) is an exciting company that produces larger-scale electric transportation. Right now, it is primarily focused on the North American market, but the sky is the limit as the pressure to go green grows. GreenPower has been on the frontlines of the electric movement, manufacturing affordable battery-electric busses and trucks for over ten years. From school busses to long-distance public transit, GreenPower’s impact on the sector can’t be ignored.

NFI Group (TSX:NFI) is another one of Canada’s most exciting companies in the electric vehicle space. It produces transit busses and motorcycles. NFI had a difficult start to the year, but it since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

Recently, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

Investors looking to take a slightly different approach to the EV boom is through auto-dealers. AutoCanada (TSX:ACQ), a company that operates auto-dealerships through Canada. The company carries a wide variety of new and used vehicles and has all types of financial options available to fit the needs of any consumer. While sales have slumped this year due to the COVID-19 pandemic, AutoCanada will likely see a rebound as both buying power and the demand for electric vehicles increases. As newer exciting EVs hit the market, AutoCanada will surely be able to ride the wave.

And investors shouldn’t ignore resource companies, either. Lithium Americas Corp. (TSX:LAC) is one of North America’s most important and successful pure-play lithium companies. In a way, Lithium Americas is literally fueling the green energy boom. With two world-class lithium projects in Argentina and Nevada, Lithium Americas is well-positioned to ride the wave of growing lithium demand in the years to come. It’s already raised nearly a billion dollars in equity and debt, showing that investors have a ton of interest in the company’s ambitious plans, and it will likely continue its promising growth and expansion for years to come.

Magna International (TSX:MG) is a another unique way to gain exposure to the EV – and by extension ESG – market without betting big on one of the new hot automaker stocks tearing up Robinhood right now. The 63-year-old Canadian manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

By. Rex Everett

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help change car ownership in favor of subscription services; that new tech deals will be signed by Facedrive and deals signed already will increase company revenues; that Facedrive will achieve its plans for manufacturing and selling Tracescan devices; that Facedrive will be able to expand to the US and globally; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.