The semiconductor shortage has wreaked havoc on the tech boom…

Hitting revenues, and profit margins, hard over the past year.

But it could become worse, as a critical gas shortage may soon disrupt every single tech company across the industry.

The shortage of a rare gas could slow the production of all electronics, affecting both consumers and some of the largest companies in the world.

However, it’s a growing crisis that most are still completely unaware of.

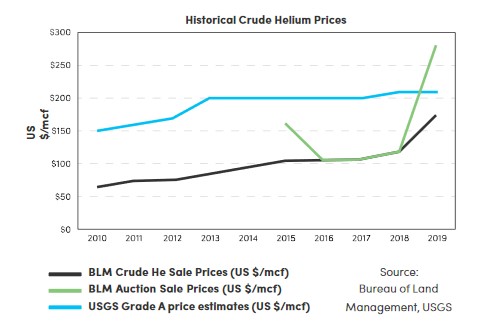

While some of the biggest oil and gas companies are spending billions on capturing natural gas, another rare resource is worth roughly 100 times more today.

Tech companies are spending tens of millions of dollars on the rare gas and its derivatives each and every year.

For example, just for a single space rocket launch alone, aerospace companies need an estimated $12 million worth of this substance.

Considering there have been over 100 of these launches in 2021 already, those numbers can add up quickly.

But it’s not just space travel that depends on this gas – it’s everything across the tech world.

The element is required to make the semiconductors you find in everything from electric toothbrushes to multi-ton automobiles.

It helps cool the data centers the Big Tech giants rely on to keep their servers running for their millions of customers.

It even powers the internet itself, as you can’t produce the fiber optic cables without this rare gas.

That’s why it’s so concerning seeing headlines like one from the New York Times that reads, “The Global Helium Shortage is Real.”

Demand for helium is spiking at an incredible rate today.

The bottom line is that Big Tech needs helium more than ever, and that makes this commodity potentially more valuable than any other around when it comes to our tech-powered world.

And as the largest supplier is now phasing out of the market, that’s created a once-in-a-lifetime opportunity for public companies like Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF).

The company’s shares have already ripped higher for 249% gains so far since the start of 2021. Analysts at Beacon Securities have put a 12-month target price at $3.80 which was maintained as recently as September. With their upcoming drilling phase set to begin, this could be just the beginning.

Which is why all eyes are turning to Avanti after they just signed the contract to begin drilling in their upcoming project, set to start just weeks from now in early December.

Here are 3 reasons why you should be paying attention to Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) in the days ahead:

1 – The Team Behind the Last Great Oil and Gas Discovery

The Montney Formation in Western Canada is one of the biggest natural gas discoveries in recent history.

The gas there makes up around 45% of Western Canada’s gas supply. But that number is expected to climb to 65% by 2030.

In the past year, the Montney has seen at least 9 significant deals that add up to roughly C$2.3 billion, and that’s thanks in large part to the $10 billion titan, Encana (now Ovintiv).

Now, several key figures from Encana that left the oil and gas giant, have joined a small helium exploration company in Avanti.

As this all-star team now plows ahead at Avanti, it’s turning heads across the industry.

Plus, in addition to the leadership team coming in with world-class experience…

They’ve added two key geologists with over 50 years of combined experience to help prove up their next project.

It’s almost unheard of to see a team with direct experience developing multi-billion dollar projects landing with a company with a market cap around $70 million.

That would suggest Avanti Energy (TSX:AVN.V; OTCMKTS:ARGYF) may be onto something big with their upcoming project, especially when you pay attention to how the leadership team is preparing for their upcoming drill program.

CEO Chris Bakker has bought over $500,000 worth of Avanti stock at up to TWICE the price it’s trading at today (i.e. as high as $2.91 per share in May).

Now he’s started buying up shares again just as the announcement came last week that they’re set to begin drilling at their new property.

We’ll have to wait until sometime early in the New Year to hear news of the results, but signs like these suggest that where there’s smoke, there could soon be fire.

2 – The Next Big Billion Dollar Discovery?

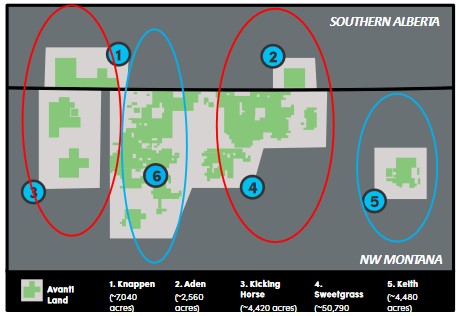

In keying in on their upcoming project, Avanti’s team did an incredible amount of due diligence.

Avanti Energy (TSX:AVN.V; OTCMKTS:ARGYF) has estimated an undiscovered, unrisked resource potential could fall somewhere between 1.4 billion and 8.9 billion cubic feet of helium.

But while most of their competitors get caught up in the total potential or a project’s “showing,” Avanti’s experienced team uses a different system to see where the potential truly lies.

They focus on the pressure and how accessible the gas is, looking at a rate of recoverable helium per day.

Fortunately, in addition to all the promising 3D seismic data they’ve obtained this fall, they have something that could be even more exciting.

Looking less than 10 km up the road, Avanti’s nearby competitor gives us a sneak peek as they’re already hard at work on structures very similar to what Avanti has in the Greater Knappen.

Their competitor is producing 55,000 cubic feet per day of helium.

When you add that up at $150 per 1,000 cubic feet, that means roughly $3 million in revenue each year.

Since these structures could produce helium at that rate for 5 years, and even continue producing at a lesser rate for another 10 years, those numbers add up quickly…

Especially considering Avanti’s Greater Knappen project could produce those kinds of returns in a single zone if all goes to plan.

3 – The Tidal Wave of Catalysts is Approaching

Things are finally starting to heat up at Avanti’s property as they’re set to begin an initial 3 well drilling program on their property in the coming weeks.

Test results from the first well could break sometime just after the New Year.

But as Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) plans to tick off another new well each month through May, there’s hope for a wave of steady news and exciting catalysts continuing over at least the next 6 months.

And while they’re starting with these 3 wells, Avanti has already identified 17 different drill targets, which means that could be just the start.

This all-star team has experience and a track record that could push the potential to significant highs.

Now, with Big Tech’s future success potentially dependent on another huge helium discovery, eyes are set on Avanti and the news that could be coming just weeks from today.

From helium and hydrogen to lithium and beyond, here are a few more companies to keep an eye on in the months to come:

Air Products & Chemicals (NYSE:APD) has been at the forefront of global hydrogen production for years. They recognize that this clean alternative fuel can help make an impactful dent in boosting our country’s green energy initiatives as well as reducing carbon emissions across industries by decreasing reliance on fossil fuels like coal and petroleum products, etc., which Air Product’s own extensive experience with helping others achieve sustainability goals through chemical innovation will bring about even more progress than before

Air Products and Chemicals has well over 60 years of experience producing hydrogen, and more than two decades designing fueling stations. It’s SmartFuel stations have been deployed across the globe and support a number of different unique and interesting transportation applications. The fully-integrated stations include compression, storage and dispensing systems that have proven to be safe and reliable for its customers. Though Air Products has been around for some time, the $66 billion company has had a particularly strong year in 2021 thanks to the growing interest in Hydrogen applications.

Dow Chemical Company (NYSE:DOW) is an American multinational chemical corporation headquartered in Midland, Michigan with over a century in operation. This company has been called “the chemical companies’ chemical company” as its sales are to other industries rather than directly to end-use consumers and it employs around 54 thousand people worldwide. Along with being one of the three largest producers of chemicals in the world, they also make plastics, agricultural products and more.

George Kehler, Dow’s commercial manager for Fuels and Energy, notes, “One of Dow’s options to develop a diverse portfolio to power our facilities is to produce energy off the grid through cogeneration, as well as having renewables become an increasingly more important part of the mix”

Dow is also teaming up with GM to produce hydrogen for fuel cells and reduce their reliance on natural gas. Dow produces chemicals that help the environment as well as plastics, which can be used in everyday items like water bottles or cell phones; but now they’re looking into something more than just a single product line! In addition to reducing costs by using another company’s resource (hydrogen), this partnership will also provide clean energy while making it easier – these two companies are committed not only toward improving our technological future…but extending it so we never run out!

Linde plc (NYSE:LIN) i has been in the business of manufacturing and distributing gas for over 130 years, making it one of THE oldest companies still operating today! It was founded by Carl von Linde who invented an improved process for liquefying air. Today they have customers all around the world including hospitals (especially ones that use anesthesia), petrochemical plants, steel mills – you name it; if there’s anywhere with a demand on atmospheric gases then likely someone at this factory can help meet those needs.

Linde is also involved in engineering. Linde Engineering designs and builds large-scale chemical plants for the production of industrial gases including oxygen, nitrogen, argon, hydrogen and carbon monoxide. These chemicals are used in a variety of industries from food to medicine manufacturing as well as other places like welding or gas appliances. The engineering division also develops process plants that use technologies related to natural gas processing so they can provide energy efficient solutions for their customers around the globe who want safe operations with minimal environmental impact

The company is currently looking forward into new projects such as renewable energies where it will be developing an innovative solar project combining steam power generation technology (SPG) with thermal storage modules. The 130 year old industry giant might not have some of the incredible upside potential of newer companies in the space, but that doesn’t mean it’s not worth keeping an eye on as the renewable revolution kicks into its next stages.

Xcel Energy Inc. (NASDAQ:XEL) is a leading electricity and natural gas utility that services 3 million customers in Minnesota, Michigan, North Dakota South Dakota Wisconsin Colorado Texas New Mexico among others with nearly 9KMW for its wind projects on top of another 1 600MW coming from solar generation plans over the next couple years which has increased 4x since 2011 making them one of America’s fastest growing utilities while they also plan an increase by as much 50 percent more soon!

Xcel Energy operates one of the biggest and fastest-growing investor-owned transmission systems with more than 20,000 miles of transmission lines across 10 states. Xcel has a goal to invest $24.3 billion through 2025 to expand its operations, with 25% of that earmarked to expand its transmission business to help support increased renewable energy deployment. One of the company’s top projects is the proposed Colorado Pathway Transmission expansion that will see the company invest up to $1.7 billion to build 560 miles of new transmission lines to support 5.5 gigawatts of new renewable power generation.

Maxar Technologies (NYSE:MAXR, TSX:MAXR) is an aerospace and defense company that was founded in 2003. They have a variety of services, including satellite development, space robotics, and earth observations. One of their most well-known products is the Canadarm2 robotic arm for the International Space Station (ISS). The ISS has been operational since 1998 with more than 100 missions to date. Maxar Technologies has had a history of partnering with NASA to maintain the ISS’s systems as well as providing them with new technologies such as the Canadarm2 robotic arm. is a moon-bound tech stock to keep an eye on. While space firm specializes in satellite and communication technologies, it is also a manufacturer of infrastructure required for in-orbit satellite services, Earth observation and more.

More importantly, however, Maxar’s subsidiary, SSL, a designer and manufacturer of satellites used by government and commercial enterprises, has pioneered research in electric propulsion systems, lithium-ion power systems and the use of advanced composites on commercial satellites. These innovations are key because they allow satellites to spend more time in orbit, reducing costs and increasing efficiency.

Thanks to Maxar’s incredible tech and innovative approach to the already extremely complicated space industry, the company has seen its share price climb where many of its peers have struggled.

Polaris Infrastructure (TSX:PIF) Is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Turquoise Hill Resources Ltd. (TSX:TRQ) is a key player in Canada’s resource and mineral industry. It is a major producer of coal and zinc, two resources with distinctly different futures. While headlines are already touting the end of coal, zinc is a mineral that will play a key role in the future of energy for years and years to come.

In addition to its zinc operations, Turquoise Hill is also a significant producer of Uranium. Uranium is a key material in the production of nuclear energy, which many analysts are suggesting could be a major component in the global transition to cleaner energy. While the mineral has not seen significant price action in recent years, there are a number of new projects set to come online across the globe in the medium term, which could be a boon to Turquoise Hill, especially as alternative energies gain traction in the marketplace.

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential-and-often-overlooked in the mitigation of rising carbon emissions.

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. OpeningTrades.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Avanti Energy Inc. (“Avanti” or “AVN”) to conduct investor awareness advertising and marketing. Avanti paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of Twenty Eight thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Avanti) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries (including key technology sectors) and that helium will retain its value in the future due to the demand increases and overall shortage of supply; that the Avanti team will be able to develop and implement helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist in the Alberta and both Montana projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; the degree of success of the coming drilling campaign; the accuracy of the initial estimates of helium on the land; the commercial viability of any obtainable helium, the ability to get any helium obtained to market; the accuracy of the production timeline estimates; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://OpeningTrades.com/Terms-of-Use, If you do not agree to the Terms of Use http://OpeningTrades.com/Terms-of-Use please contact OpeningTrades.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. OpeningTrades.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.