After a strong three day bounce, the market softened Thursday with the S&P -0.72%, the NASDAQ -1.71% and the Russell -2.27%. NYSE + NASDAQ Advancers to Decliners were 1,997 to 6,030 on relatively mild volume of 8.3 billion shares compared to what we’ve seen of late.

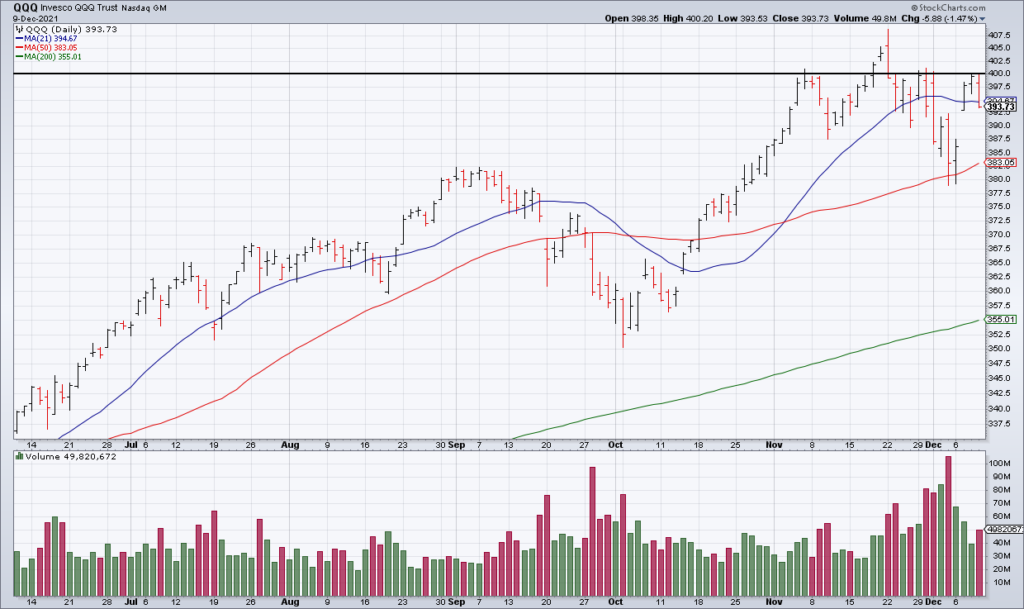

Taking the securities above one by one, the QQQ – representing mega cap tech – is still in an uptrend. While it could not break the key $400 level to the upside, it bounced off its 50 DMA and closed Thursday right around its 21 DMA. Because the QQQ represents the biggest and most popular stocks in the market – stocks like AAPL MSFT AMZN & GOOG/GOOGL – the major indexes will not top until and unless it does. The excellent technician Greg Rieben pointed out a potential topping formation known as a head and shoulders in the above tweet but QQQ is innocent until proven guilty IMO.

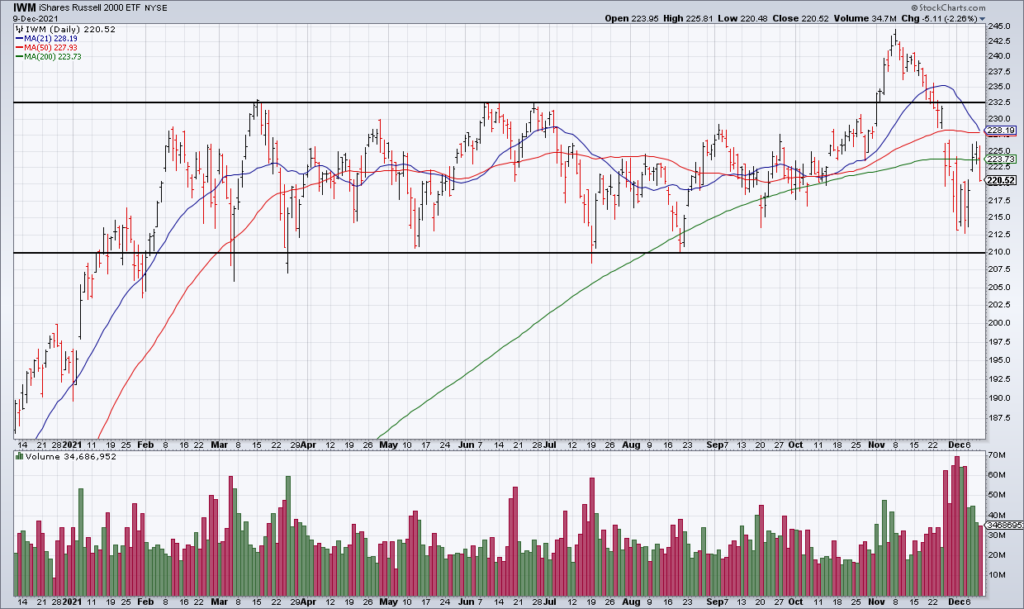

Moving on, the IWM – representing small caps – is still smack in the middle of its 2021 range between $210 and $232.50 closing Thursday at $220.52. A potential failed breakout is in play but unconfirmed until IWM closes below $210. While QQQ is still in an uptrend, IWM is clearly in a sideways range. Is it consolidating or topping? Only time will tell.

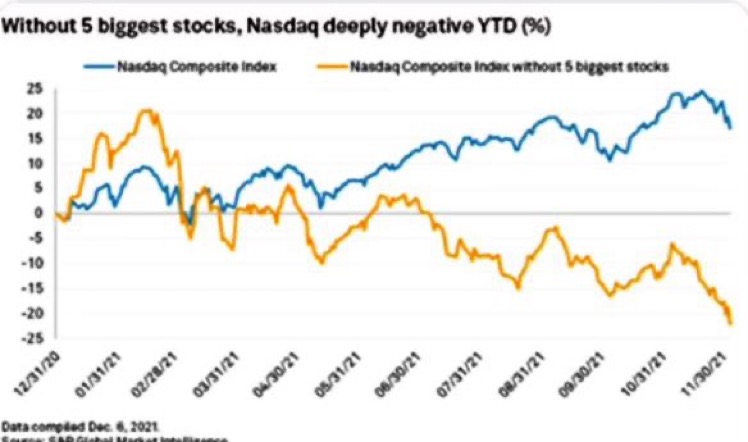

ARKK – representing popular non mega cap tech – has broken down. It topped in February nearly kissing $160, bottomed in May around $100 and has now broken down below $100 closing Thursday at $97.73. As you can see in the chart above, without its five largest stocks the NASDAQ is actually down 25% YTD! You wouldn’t know it from the performance of the overall index but beneath the surface there is carnage in tech land.

We are now entering the homestretch for 2021 with the only remaining data points of great significance being tomorrow morning’s November CPI Report and the Fed Decision next Wednesday. President Joe Biden seemed to be trying to get ahead of a bad CPI number today when he said that energy prices have come down since the end of November. Wall Street probably sniffed this out and started pricing it in today.

If the number is indeed hot, the Fed will likely accelerate its tapering next week. That means that monetary policy – the primary driver of the huge move we’ve seen post-COVID – will be tightening significantly going forward which is bearish for stocks. On the other hand, seasonality is bullish through year end. IMO the market is topping out but I am agnostic as to whether we will see one last push higher, a breakdown or a sideways market into year end.