Every few years or so, the investing universe gets word about a looming shortage of a certain–usually niche–commodity. Soon thereafter, dozens or even hundreds of natural resource companies, both large and small, quickly “pivot” to said commodity and the next thing you know a commodity bubble ensues before, eventually, bursting.

This script has played out numerous times with commodities including cobalt, rare earths, vanadium, potash, graphite, and even marijuana.

But the script may be playing out very differently with the latest commodity to fall on Wall Street’s radar: helium.

As one of the rarest yet most valuable and indispensable elements on our planet, the world is quickly coming to grips with one of the biggest supply squeezes of our times as severe helium shortages continue pushing prices up.

Scientists have been forced to shut down their superconducting magnets for lack of helium…while refiners have been limited to drawing amounts well below their requirements since 2017.

A helium supply crunch may be growing more critical with each passing day… and oil and gas executives are now said to be looking for this precious rarefied gas that is used for everything from rocket ships to computer chips.

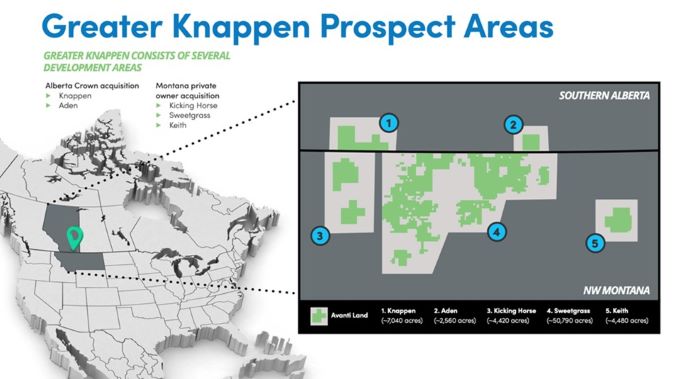

It’s against this backdrop that early mover Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) has announced the completion of its first helium well in its initial three-well program in its 100%-operated Greater Knappen property that extends from Montana to Alberta, Canada—which could be one of the best prospects for securing future helium supplies.

The great news: the first well indicates a smashing success..

Avanti says the Rankin 01-17 well was successfully drilled to a depth of 5,860 feet and encountered all the targeted zones for helium potential.

With Avanti’s drilling program off to what appears to be a successful start with up to six wells planned to be drilled in the initial exploration phase, here are some important things we think investors should know about Avanti Energy’s Drilling Campaign.

Avanti Hits The Ground Running

Avanti’s maiden helium well open-hole logging indicated five zones with reservoir characteristics (good porosity and low water saturation) suggesting further testing is warranted.

Drill stem tests were also performed to high-grade zones for completions and two of the targeted zones showed economic helium potential.

“The team is excited to have completed our first exploration well in Greater Knappen. Our initial analysis has demonstrated that there is potential for economic helium production in two of the three target zones. Following additional analysis by the technical team, our completions program will further define the economics of the well as we continue to develop the economic potential of Greater Knappen,” Ali Esmail, Avanti VP Engineering, has said.

The Avanti team has spent the last 8 months assembling the land package, managing to put together a 69 thousand acre property they have dubbed ‘Greater Knappen.’ Avanti estimates a potential helium yield of 1.4-8.9 bcf from Greater Knappin, which is almost unbelievable as we shall explain shortly.

A big reason why the Avanti (TSX:AVN.V; OTCMKTS:ARGYF) team may have had drilling success so quickly is due to the fact that they chose an area that appears pretty targeted with the right mineralogy for helium production.

Other wells surrounding Avanti’s lands have high helium shows in multiple Devonian and Cambrian targets with helium percentages of up to 2% and nitrogen percentages of up to 96%. A helium percentage of just 0.3% is considered economically viable, and 2% is almost too good to be true.

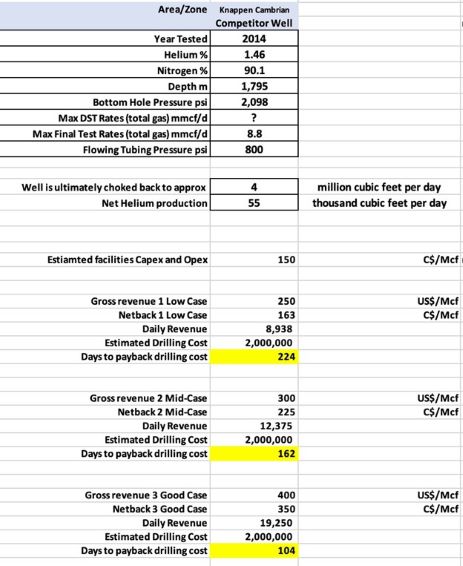

The most exciting thing: potential for very fast payback.

Avanti estimates that if their wells produced~55,000 cubic feet of helium per day they would require just 104 days to fully pay back drilling costs.

The potential MATH looks impressive:

With their substantial acreage and potential for fast payback, Avanti should have little trouble getting early inventors in.

In November, North American Helium was able to raise $127 million. For context, the company has 5.5 million acres, but a risked reserve report shows the land holds approximately 20 bcf of helium.

In comparison, Avanti is estimating its potential at 1.4-8.9 bcf from just 70,000 acres, showcasing incredible productivity and efficiency.

Avanti (TSX:AVN.V; OTCMKTS:ARGYF) estimates that its helium wells could potentially yield at a high level of 55-60 mcf a day for the first five years, then gradually decline at ~10% annually thereafter for a total productive life of ~20 years.

That’s incredible production and could provide stable cash flows for 15-20 years. To us, that’s simply stunning.

Helium is a critical gas, and we’re facing a serious future shortage

Helium is the second most abundant element in the universe after hydrogen, and the fact that it’s so rare on our planet is something of a paradox.

It’s important to understand that helium’s scarcity and value mainly stem from the fact that it’s an inert gas that’s generated naturally very slowly with the majority leaking off into space.

Our planet generates about 3,000 tons of helium each year through radioactive decay deep in the bowels of the earth, but with helium being ~7x lighter than air, it drifts off into the upper atmosphere where it’s eventually torn off by solar winds.

That leaves very little of the wonder gas to meet our global demand of 32,000 tons per year (~6.2 billion cubic feet measured at 70°F and under earth’s normal atmosphere), making helium a finite, non-renewable resource.

Air is considered the only practical source for all of the helium-group gases (argon, neon, krypton, and xenon)–except helium. That’s the case because demand for other helium-group gases is insufficient to make air an important source of commercial helium, while extraction of helium from air as a primary product is prohibitively expensive and likely to remain so for the foreseeable future.

The only commercially viable helium source on our planet is from ancient shale formations.

Yet, there’s an ongoing helium boom thanks to explosive growth in the semiconductor and healthcare industries as well as space and quantum computing.

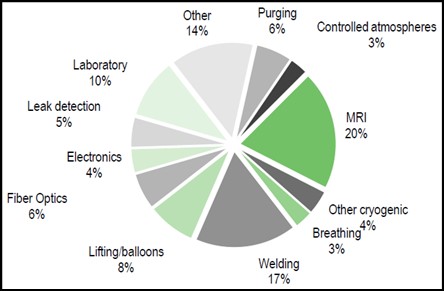

Helium’s unique qualities make it an indispensable commodity in many critical medical, tech, and industrial applications including MRI scanners, nuclear magnetic resonance spectrometers, rocketry & space exploration, telecommunications, superconductivity, fiber optics, electronics, cryogenic shielding, leak detection, lifting balloons and in underwater breathing.

About 30% of the world’s helium supply goes into MRI scanners while another 20% goes into the manufacture of hard disks and semiconductors.

Helium Uses

Source: Helium One

With the lowest boiling point of any element at minus 261.1°C (-429°F), there’s no known substitute for helium where ultra-low temperatures are required such as superconductors. It’s for this reason that the fastest train ever built, Japan’s SC MagLev that’s capable of speeds of more than 600 km per hour, uses liquid helium to cool the superconducting material, a niobium‐titanium alloy, to 452 degrees Fahrenheit below zero.

Meanwhile, Big Tech companies such as Facebook, Amazon Google, and Netflix are heavy users of helium in their massive data centers. With one-seventh the density of air, helium produces less buffeting or disturbance on rotating disks thus allowing hard drive platters to be thinner and placed closer together, thereby increasing capacity as more disks can now fit into less space.

According to ResearchAndMarkets, the global helium market is projected to reach almost US$18.2B in 2025, growing at a CAGR of about 11.2% during the period 2021 to 2025 mainly driven by robust medical and consumer electronics demand.

With demand constantly outstripping supply, the world may be facing a severe helium shortage, and prices have substantially increased to $35 per liter–more than double the average of $14.60 per liter they commanded three years ago.

Companies and their shareholders are feeling the helium shortage keenly.

In 2019, Party City (NYSE: PRTY) closed 45 stores amid a global helium shortage that has impacted the retailer’s balloon sales. PRTY stock has crashed 70% since 2018.

No more helium from the Fed

But the biggest chink in the helium supply chain is the fact that the U.S. federal government–the world’s largest supplier of the rare gas–ain’t selling no more.

The U.S. government created the Federal Helium Reserve (FHR) out of a giant, abandoned salt mine located 12 miles northwest of Amarillo, Texas back in 1925 when it seemed like helium-based airships would become vital to national defense. Over several decades, FHR stockpiled as much helium as it could, in the process becoming the world’s largest strategic helium reserve, responsible for meeting ~40% of the world’s needs.

But, predictably, the FHR eventually ran into debt trouble thanks to its habit of selling helium at well below market prices. In 1996, the Fed passed laws mandating FHR to sell off its reserves and close shop in 2021 in an effort to recoup billions of dollars in debt.

The Bureau of Land Management (BLM) outlined the process and timeline by which the FHR would dispose of its remaining helium and helium assets. BLM managed to sell off most of the stored helium by 2018, with the remaining 3 billion cubic feet (84 million cubic meters) restricted for sale to only federal users, including universities that use helium for federally-sponsored research.

BLM held its last Crude Helium Auction in Amarillo, Texas, in 2019 with the price rising almost 135%, from $119/Mcf in 2018 to $280/Mcf in 2019.

The sale deadline was later extended to 30 September 2022, but privatization likely won’t be completed until at least 2023.

In other words, up to 40% of the world’s helium supply has already been cut off, and the private sector will have to step up to the plate if some of the world’s most critical industries such as MRIs, NMRs, cryogenics, and superconducting magnets among others are to continue operating.

Luckily, we think Avanti Energy (TSX:AVN.V; OTCMKTS:ARGYF) appears to be more than up to the task.

Other companies looking to capitalize on the commodity boom:

Magna International (NYSE:MGA; TSX:MG) is a really interesting and roundabout way to get in on the explosive commodity market without betting big on one of the new hot stocks tearing up among the millennials right now. More than a decade ago, Magna International was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment in batteries, however, has paid off in a big way. Since its controversial bet of yesteryear, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the increasingly competitive battery business.

Westport Fuel Systems (NASDAQ:WPRT, TSX:WRPT) isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since May 2020, the company has seen its stock price rise by 322%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential-and-often-overlooked in the mitigation of rising carbon emissions.

Telus Corporation’s (TSX:T) long-standing commitment to putting its customers first fuels every aspect of its business, has had it a definitive leader in Canada. In fact, Telus Health is one of the country’s biggest healthcare IT providers. And it’s done so with sustainability in focus.

Driven by its goal to connect all Canadians for good, it has contributed over $55 in community giving, reduced emissions by 31% and has four consecutive years on the Dow Jones Sustainability World Index.

Shaw Communications Inc. (TSX:SJR.B) is a major player in the Canadian telecoms sector. It owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them. As online gaming depends on solid internet connections, Shaw will likely become a backdoor benefactor in increased online activity. Not only that, it’s growing higher on ESG investors’ lists, as well, thanks to its forward-thinking approach to the environment and its governance.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries and that helium will retain its value in future due to the demand increases and overall shortage of supply; that Avanti will able to successfully pursue exploration of its licenses and properties; that Avanti’s licenses and properties can achieve drilling and mining success for commercial amounts of helium; that indications of potential for economic helium in Avanti’s initial wells will predict future results; that Avanti will be able fulfill its obligations under its licenses and in respect of its properties; that Avanti will be able acquire the rights to the helium on its prospective helium properties; that the Avanti team will be able to develop and implement its helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist on Avanti’s projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; that the Company may not fulfill the requirements under its licenses for various reasons or otherwise cannot pursue exploration on the project as planned or at all; that the Company may not be able to acquire the helium rights on its properties as contemplated or at all; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, results of the recent drilling and exploration may be inaccurate or otherwise fail to result in locating or developing any commercial helium reserves on the Avanti properties, and that there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “Oilprice.com”) has been paid by Avanti fifty thousand US dollars for this article to provide investor awareness advertising and marketing for TSXV:AVN. The information in this report and on our website has not been independently verified and is not guaranteed to be correct. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Avanti and therefore has an additional incentive to see the featured company’s stock perform well. Oilprice is therefore conflicted and is not purporting to present an independent report. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.