A new commodity supercycle is being driven by a massive energy transition …

And two elements are experiencing a supply squeeze that is creating huge opportunities for investors.The first is lithium, the super metal fueling the EV and energy storage boom.

The second is helium, the key to future tech innovation and an irreplaceable necessity for semiconductors, which are also undergoing a long-running supply squeeze.

Lithium prices have surged 500% over the past year on the fast-paced global adoption of EVs.

BNEF predicts that before the end of this decade, the battery sector’s lithium consumption will soar to 5X current levels.

Mining.com’s EV Battery Metals Index has more than quadrupled since mid-2020, and rapidly falling EV battery prices are shifting this race into fifth gear.

Helium, too, is in dangerously short supply ever since the U.S. Federal Helium Reserve in Texas auctioned off its remaining stockpile and closed its doors forever, taking some 40% of supply off the market late last year …

That’s a nightmare for the auto industry, at large, with the giants forced to suspend production and miss vehicle targets.

Why? Because a single car typically needs over 3,000 semiconductor chips.

They need helium to manufacture those chips, and there may be no element that can replace it or come close to its cooling powers, which also makes this gas critical to the world’s most important scientific research and technological innovations … from space travel, cryogenics and the Large Hadron Collider, to everyday technology such as MRIs and fiber optics.

With prices hitting $280/Mcf in 2019 during Fed auctions, helium can now sell for up to $600/Mcf. It’s wildly more expensive than natural gas–even in the middle of an unprecedented gas price surge.

Now, for both lithium and helium, it’s all about who can make the next significant discovery the fastest, creating new opportunities for investors to get in on what could be the supply squeezes of the decade.

Here are 2 stocks that could position you to take advantage of some critical timing:

#1 Lithium Americas (NYSE:LAC)

Upgraded by three analysts last week alone, LAC is solidly positioned to take advantage of the lithium craze with its Thacker Pass mine in Nevada.

Would-be investors have been horribly impatient with lithium, that’s largely because the soothsayers started pumping up lithium long before it was ready for the supply squeeze and the surge in EV and energy storage demand.

But all good things come to those who wait …

LAC is up around 34% over the past 12 months, and looks very well-positioned for more growth this year, in tandem with a global lithium market that is set to top $8B over the next 5-6 years.

For LAC, the investor reward is more of the juicy potential returns you can only get from a pure-play. This is an exploration play. There aren’t any revenues–yet. But the potential is enormous, in the form of two world-class projects in Argentina and Nevada.

While Nevada is an exciting exploration-stage play that brings lithium to North America at exactly the right time, LAC’s Argentina play is already close to production. In fact, it should come online in the middle of this year and that will be LAC’s first major revenues. We’re looking at production from Argentina of around 40,000 tonnes per year, with lithium prices soaring right now. And that production number is just Cauchari Olaroz’s Phase 1. They’re also planning a 20,000-tonne expansion and this is being billed as a “low-cost” lithium brine project.

In Nevada, at LAC’s Thacker Pass project, mineral reserves are 3.1 million tonnes of LCE at 3,283 ppm Li.

LAC is expecting all major permits to move forward with this by the end of this quarter.

Yes, it’s a lot of spending right now before we get into production, but with market prices what they are, investors should be willing to wait for this one out because the exploration risk appears to be much lower.

#2 Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF)

The other critical element supply crunch in this new commodity supercycle is helium, and because it’s flown under the radar, there could be even more potential upside …

Especially when you get a micro-cap company that’s just completed its first helium well with very encouraging results.

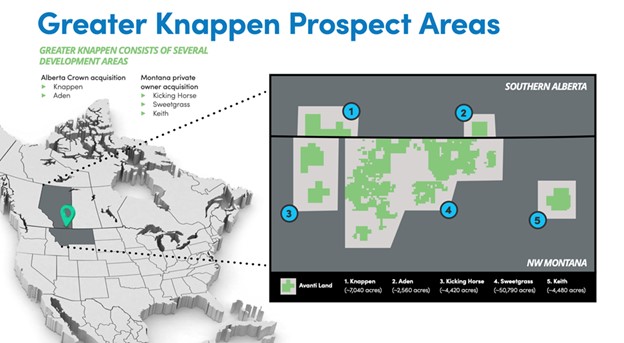

Avanti Energy is a smart early mover on this supply squeeze, and its initial 3-6-well program in its 100%-operated Greater Knappen project that runs from Montana to Alberta could have the potential to be an important element in North America’s ability to secure enough helium supplies.

All the better when a tiny company like this reports encouraging results in its maiden drill program.

Drilled to a depth of 5,860 feet, Avanti’s first well (Rankin 01-17) encountered ALL the targeted zones for helium potential.

Avanti’s maiden helium well open-hole logging indicated five zones with reservoir characteristics (good porosity and low water saturation) suggesting further testing is warranted.

Drill stem tests were also performed to high-grade zones for completions and two of the targeted zones showed economic helium potential.

Avanti has secured nearly 70,000 acres spanning Alberta and Montana in highly prospective helium territory.

And geological interpretations suggest anywhere from 1.4 billion cubic feet of helium to 8.9 billion cubic feet.

But the biggest thing investors may be latching onto here is the potential payback time …

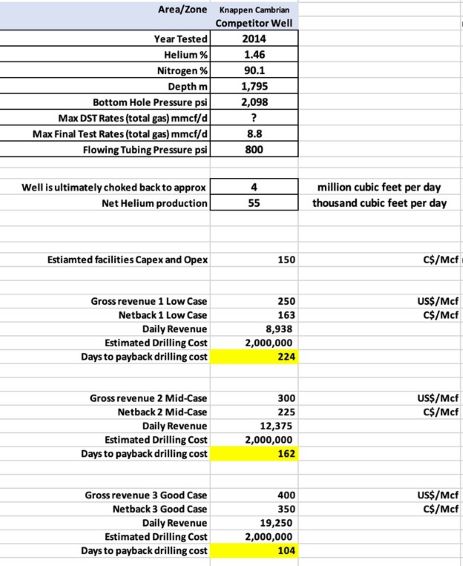

Avanti estimates that their wells, if commercially successful, could yield ~55,000 cubic feet of helium per day, and require just 104 days to fully pay back drilling costs.

Avanti estimates that its wells may yield at a high level of 55-60 mcf helium a day for the first five years, then gradually decline at ~10% annually thereafter for a total productive life of ~20 years. That could mean some two decades of major production and steady cash flow.

We think a setup like this is the sort that set up a tiny company for the major leagues, possibly through an investor-rewarding JV deal once you near the development phase.

Avanti has spent the past eight months securing this huge land package in ancient shale formations, and now it’s doing its first drill campaign at the beginning of a helium supply crunch that has absolutely no way of producing the numbers we need without big new discoveries.

With the maiden drill hole completed, this is one to watch for exciting news flow as more results come in and drilling continues on the project.

Other companies that could be impacted by the commodity supply squeeze:

Even old-school fossil fuel producers are getting in on the clean energy race. Suncor (NYSE:SU, TSX:SU) might be known mostly for its oil production. But it’s one of the few majors really pushing the boundaries. In fact, it has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

Though that’s just one part of its business. Suncor is also a world leader in renewable energy innovations. Recently, the company invested $300 million in a wind farm located in Alberta. Additionally, as Canada moves away from oil, Suncor is well-positioned to take advantage of another one of the country’s resource reserves; Lithium. The best part? It doesn’t even have to move very far. In fact, Alberta’s oil sands are a major hotspot for lithium production.

As demand for energy continues to explode in a post-pandemic China, CNOOC Limited will likely be one of the biggest winners in this boom. It’s the country’s most significant producer of offshore crude oil and natural gas and may well be one of the most controversial oil stocks for investors on the market. A label that has nothing to do with its operations, however.

Recently, U.S. regulators announced their intention to de-list Chinese companies from the New York Stock Exchange, going back on their announcement just a few days later. The sustained negative press surrounding Chinese companies, however, has put CNOOC in an uncomfortable position for investors. While many analysts see the company as significantly undervalued, it is still struggling to gain traction in U.S. markets. Though that could be changing as Biden works to ease tensions with China

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential-and-often-overlooked in the mitigation of rising carbon emissions.

Mogo Finance Technology Inc. (TSX:MOGO) is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads. With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries and that helium will retain its value in future due to the demand increases and overall shortage of supply; that Avanti will able to successfully pursue exploration of its licenses and properties; that Avanti’s licenses and properties can achieve drilling and mining success for commercial amounts of helium; that indications of potential for economic helium in Avanti’s initial wells will predict future results; that Avanti will be able fulfill its obligations under its licenses and in respect of its properties; that Avanti will be able acquire the rights to the helium on its prospective helium properties; that the Avanti team will be able to develop and implement its helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist on Avanti’s projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; that the Company may not fulfill the requirements under its licenses for various reasons or otherwise cannot pursue exploration on the project as planned or at all; that the Company may not be able to acquire the helium rights on its properties as contemplated or at all; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, results of the recent drilling and exploration may be inaccurate or otherwise fail to result in locating or developing any commercial helium reserves on the Avanti properties, and that there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “Oilprice.com”) has been paid by Avanti fifty thousand US dollars for this article to provide investor awareness advertising and marketing for TSXV:AVN. The information in this report and on our website has not been independently verified and is not guaranteed to be correct. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Avanti and therefore has an additional incentive to see the featured company’s stock perform well. Oilprice is therefore conflicted and is not purporting to present an independent report. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.