It seems like supply chains are stressed almost everywhere in the world. So why is Japan’s price level lower than two years ago. Why haven’t they had any inflation at all?

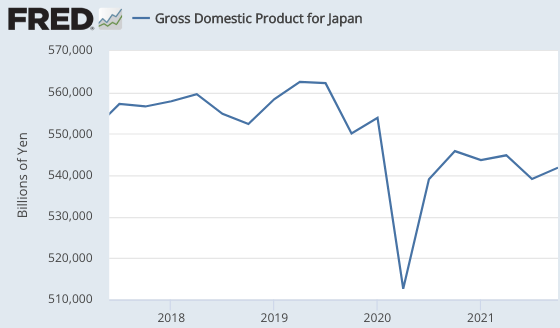

The answer is simple. In the US, NGDP has risen by more than 10% over the past two years. In Japan, NGDP has fallen by nearly 2%. Monetary policy is far more contractionary in Japan than in the US.

Of course, NGDP is not the only factor explaining inflation; RGDP matters too. But over any extended period of time, NGDP is by far the most important factor.

The Philadelphia Fed’s survey of professional forecasters predicts continued rapid growth in NGDP in 2022. They don’t specifically ask about NGDP, but the rapid expected growth in RGDP and (PCE) prices clearly indicates that forecasters expect fast growth in NGDP. In other words, monetary policy is still too expansionary.

PS. I have a new piece at Discourse.