As the world continues to evolve into endless modern conflict, governments attempt at combat have resulted in historical debt records spiking to new highs. Concerns surrounding inflation seem to have become common discussion amongst global societies, and as history tends to repeat itself, investors of late have once again begun to pursue shelter in precious metals, specifically the unrivalled value of gold, to protect against the damages of drastic inflation.

Gold is Canada’s most valued mined commodity, having reached a productivity value of $12.3 billion in 2020. At this time, gold demand for investment purposes reached a staggering 47% as it surpassed jewelry as its primary use. Gold is mined in nine provinces and territories, with the majority coming from Ontario and Quebec, but the mining friendly jurisdiction of British Columbia seems to be attracting positive attention as we venture into 2022.

While British Columbia has proven time and time again to be one of the most exciting, mining friendly jurisdictions in Canada, having accounted for an astonishing 32 million ounces of gold production in the province over the course of the previous centuries, one junior miners ambitions appears well positioned to generate significant results through its ongoing drill program and add its contributions to the industry with a mining license allowing approximately 25,000 oz gold per year production and further strengthen sector and shareholder value.

Blue Lagoon Resources Inc. (CSE: BLLG)

Blue Lagoon Resources Inc. (CSE: BLLG) is a mineral exploration company focused on its past producing high-grade gold project, Dome Mountain Mine. The mine is located withing driving distance from the town of Smithers, British Columbia, granting year-round access to a robust local workforce. The company also owns 100% in each of the Big Onion Porphyry Copper Project located near Smithers, British Columbia, the Pellaire Gold Property located near Williams Lake, British Columbia, and the Golden Wonder Project located in west-central British Columbia in the Hazelton area.

One of the main attractions for investors of BLLG seems to be consistent communication in the form of continuous news releases regarding key progress related to drilling and assay results. This catalyst alone has the power to keep junior mining companies relevant and draw attention from key investors looking for a prime opportunity. Since the end of January, positive news flow has been relentless, and investors keen enough to place value within Blue Lagoon since then have garnished upwards of 70% returns on their investments.

Having incorporated and operated as Blue Lagoon Capital Inc. as of 2017, the company upgraded to its current name Blue Lagoon Resources Inc. in December of 2018 and commenced trading on the CSE in July of 2019. Based out of Vancouver, British Columbia, Blue Lagoon Resources acquired its flagship project, Dome Mountain, through the common share acquisition of Metal Mountain Resources in March of 2020. At the time, current CEO Rana Vig stated “in a very short time, management’s focus has led Blue Lagoon from being a newly listed junior mining exploration company to one that just acquired a very promising high grade gold property in British Columbia.”

For more information, visit their website at https://bluelagoonresources.com/

Dome Mountain

The Dome Mountain Gold Project, considered to be Blue Lagoon’s flagship project, is a year-round accessible mine that holds both an Environmental Management Act Permit (EMA) and a Mining Permit allowing up to 75,000 tonnes production annually. The 22,000-hectare property already boasts 15 known high grade gold veins even though it remains relatively unexplored.

The Dome Mountain area has a long history of exploration, having unearthed several gold bearing quartz-carbonate veins. Investments in the property by past handlers such as Gavin Mines and Timmins and Noranda have exceeded $68 million, with $28 million having been invested by Gavin in the past 12 years alone. Considerable infrastructure upgrades, along with underground development and mine permitting were completed on the mine between 2010 and 2012 which included roughly three quarters of the planned underground development necessary for initiating site production.

Blue Lagoon opened 2022 by announcing the mobilization of its crew and its first drill rig to start on a 20,000-meter drill program on its Dome Mountain Gold Project. The first phase of the drill program is expected to be roughly 10,000 meters of diamond drilling and ground-based geophysics over the Freegold Intrusion and follow up soils and anomalous zones found in the 2021 soils program results.

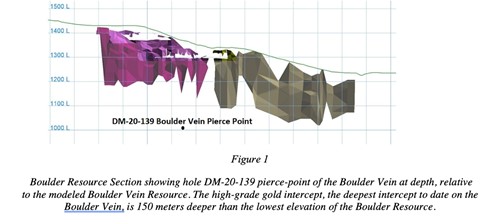

Less than one week later, Blue Lagoon announced the mobilization of a second crew to initially focus on down dip mineralization on the Boulder Vein below the 1000-meter level. The company hopes to add to the success of DM-20-139, where mineralization of 17.69 g/t Au and 70.41 g/t AG were struck at depths of 335.47m to 338.6m, extending the depth of existing resources by 200 meters.

Bill Cronk, the Chief Geologist of Blue Lagoon went on to state “The 2022 drilling at Dome Mountain will be a game changer for us”, thanks largely in part to expectation that deep vein intercepts along the Boulder Vein will add significant resource expansions.” The first phase of the 20,000-meter drill program is scheduled to continue into mid to late March and is expected to recommence in late April once snow melt and break-up has concluded and ground conditions are favorable.

A key part of the planned 2022 phase one drill program will target holes drilled in 2021 where lab assay results have been delayed in an industry-wide backlog. The company’s technical team, however, has seen enough mineralization to give confidence to keep drilling.

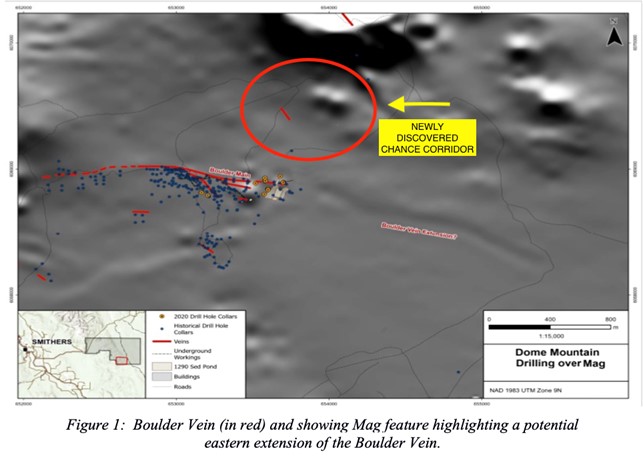

On February 7th, Blue Lagoon encountered a new, high-grade vein in the newly discovered Chance Structural Corridor when hole DM-21-224 produced 14.8 g/t Au and 38.3 g/t Ag over 7.3 meters, along with a second high-grade vein running 26.9 g/t Au and +100.0 g/t Ag over 1.04 meters that was revealed further down hole. William Cronk, Chief Geologist for Blue Lagoon states “We knew we were in a good zone in the Chance Structural Corridor which has shown us multiple mineralized intercepts in previous holes.”

“We systematically worked our way south and then drilled south-southeast into the proposed eastern extension of the Boulder Vein in anticipation of mineralization at the intersection of two strong lineaments: the Chance Structural Zone and the eastern extension of the Boulder Vein. Previously reported intercepts were high grade in this area and the expectation is that we will be able to follow this intercept with near term holes which will test for further high-grade mineralization at depth and along strike.”

Drilling is now being conducted from the same pad as that for DM-21-224 for east-west mineralization north of the pad. Once completed, the drill rig will move approximately 100m south and focus on this high-grade intercept.

Assay results for 28 holes remain outstanding and could further solidify the exceptional mineralization status of Dome Mountain.

Value Added

Blue Lagoon boasts an exceptional management team with more than 100 years of combined experience in publicly traded companies and has proven ability to raise significant capital seamlessly. The company raised proceeds of $2.2 million in 2020 at a share price of $1.00, followed by an oversubscribed $8.13 million raise at $0.55 with a two-year half warrant at $0.75, both of which were easily raised at or above the current share price. Having done so while keeping outstanding share counts low is an impressive accomplishment in itself and seems poised to carry out current value-added strategies to both the mining sector and investors alike.

Looking closer at the share structure, the company currently operates with a mere 89 million shares outstanding, with insiders, family and friends controlling roughly 25% of holdings. In addition to a strong management position, European investment accounts for roughly 17% ownership and have proven to be traditional long-term holders. With roughly 3 million options and 9 million warrants available with a $0.50 strike price, the fully diluted share structure comes in at roughly 101 million, presenting investors the opportunity to add an exceptional precious metals junior to their portfolio with substantially lower risk/reward ratio, especially when considering the backlog of assay results yet to be released by the robust 20,000-meter 2021 drill program. The risk associated with investing in any gold explorer will always be imminent, but considerations towards the recent successes of BLLG and its outstanding developmental program seem to outweigh the disadvantages and offer a realistic expectation that the company will continue its upwards trajectory from current levels.

Blue Lagoon has managed its finances flawlessly, maintaining zero debt to compliment current treasury funds of $4 million along with the potential to exercise $4.5 million warrants at $0.50, allowing the company to relentlessly pursue extensive drilling at its Dome Mountain project and increase its valuation drastically. Recently, the company added additional funds to its treasury through shipments of gold and silver concentrates made from 5,000 tonnes of high-grade mineralized material from the Dome Mountain mine. Speculation remains that Blue Lagoon could easily eclipse the 100 million market cap in the near future as its drill program continues to portray positive mineralization results.

With 2022 in its infancy, shareholders will eagerly be awaiting further announcement of what lies ahead for Blue Lagoon and its ongoing drilling and mining endeavors. With the assumptions of a robust 2022 on the horizon, BLLG appears dedicated to providing intrinsic value to all who place confidence in its efforts. As investors we typically fantasize of uncovering such valuable acquisitions, amassing multitudes of shares on said speculations before patiently awaiting generational profits, of which Blue Lagoon seems to have the realistic potential of fulfilling. While the current $50 million market cap seems underwhelming when considering the hidden gem that is Blue Lagoon, the question remains for how long?

FULL DISCLOSURE: Assume that Breakaway Investors author (Ryan Krikke) owns shares in the company featured and has a conflict of interest. The content of this article is for information only. Readers must fully understand and agree that the contents of this article are not a recommendation or solicitation to buy or sell any security. The author assumes no responsibility for the investment actions executed by the reader. Always do additional research and always consult a professional before purchasing any security. Disclaimer found at https://www.breakawayinvestors.ca/disclaimer

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of one thousand nine hundred dollars for Blue Lagoon Resources advertising from Castle Rising Media. There may be 3rd parties who may have shares of Blue Lagoon Resources and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.